Understanding Real Estate Net Present Value (NPV)

Share

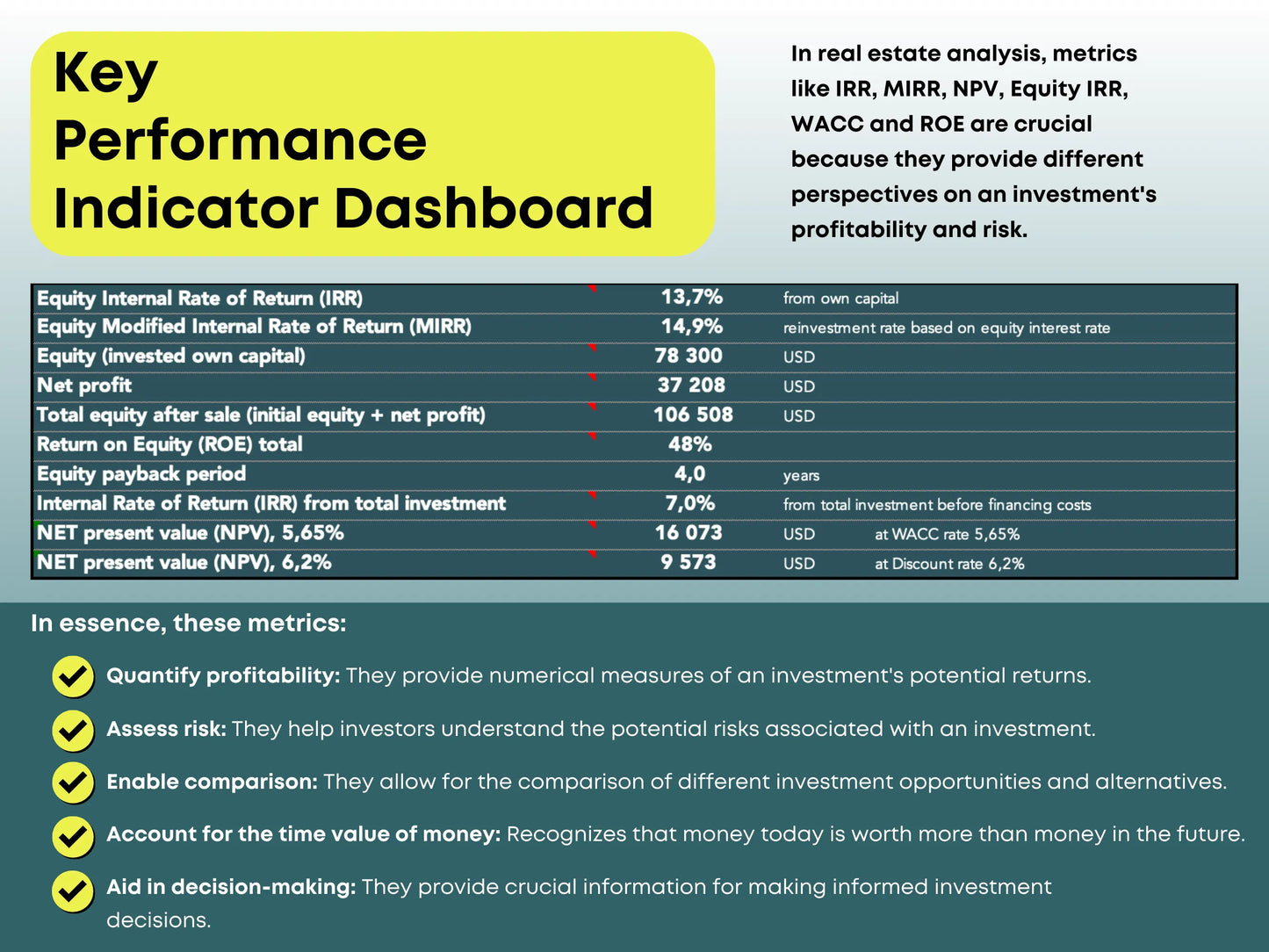

Why Is NPV So Important in Real Estate?

• Accounts for Time Value of Money:

Not all money is created equal. $10,000 today is worth more than $10,000 in five years. NPV adjusts future returns to reflect their value in today’s terms, helping you compare dollars today vs. dollars tomorrow.

• Evaluates the Viability of the Investment:

A positive NPV means the investment is expected to generate a return greater than the required rate of return (your cost of Capital or in case of bank financing your Weighted Average Cost of Capital WACC).

A negative NPV means the deal won’t meet your target returns, and you might need to reconsider.

• Helps You Make Smart Financing Decisions:

NPV can help you assess if the cost of financing the project (e.g., through debt or equity) will be worth the returns. If NPV is positive, it indicates the project can cover its costs and leave you with additional profit. If you have a WACC of 8% and NPV is positive 5 000 $, it means you will earn your desired 8% in return and on top of that the 5 000 $.

A negative NPV means the deal is expected to lose value when considering your cost of capital. While you might still earn cash flow from the property, it’s not enough to meet your target return. In this scenario, you might reconsider the deal or adjust the terms (e.g., negotiate a better purchase price or increase the expected sale value) to improve the investment’s attractiveness. First of all in case of negative NPV your equity return rate will suffer, because bank mortgage rate is fixed and has priority.

How to Use NPV in Practice

• Evaluate Multiple Deals:

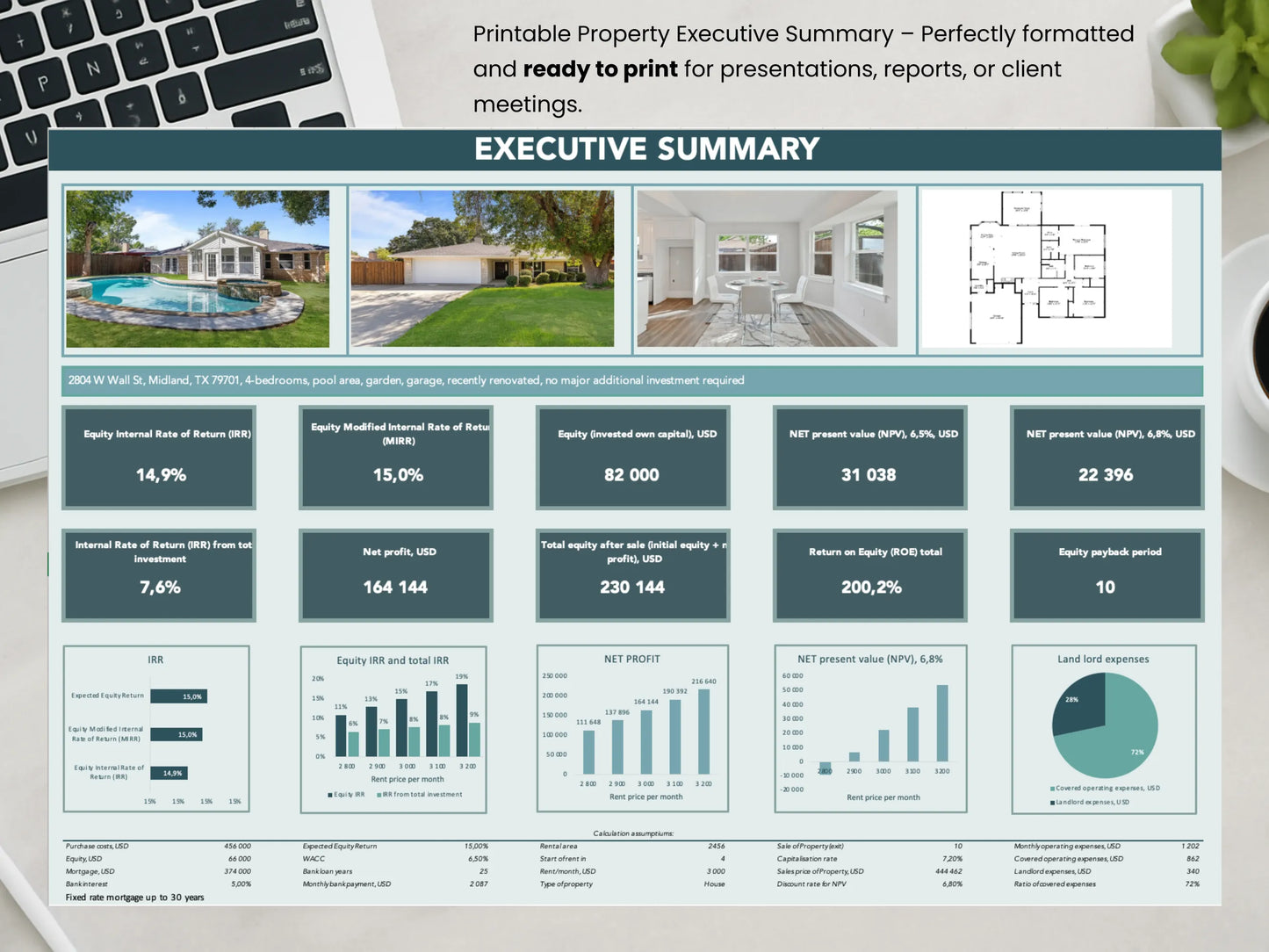

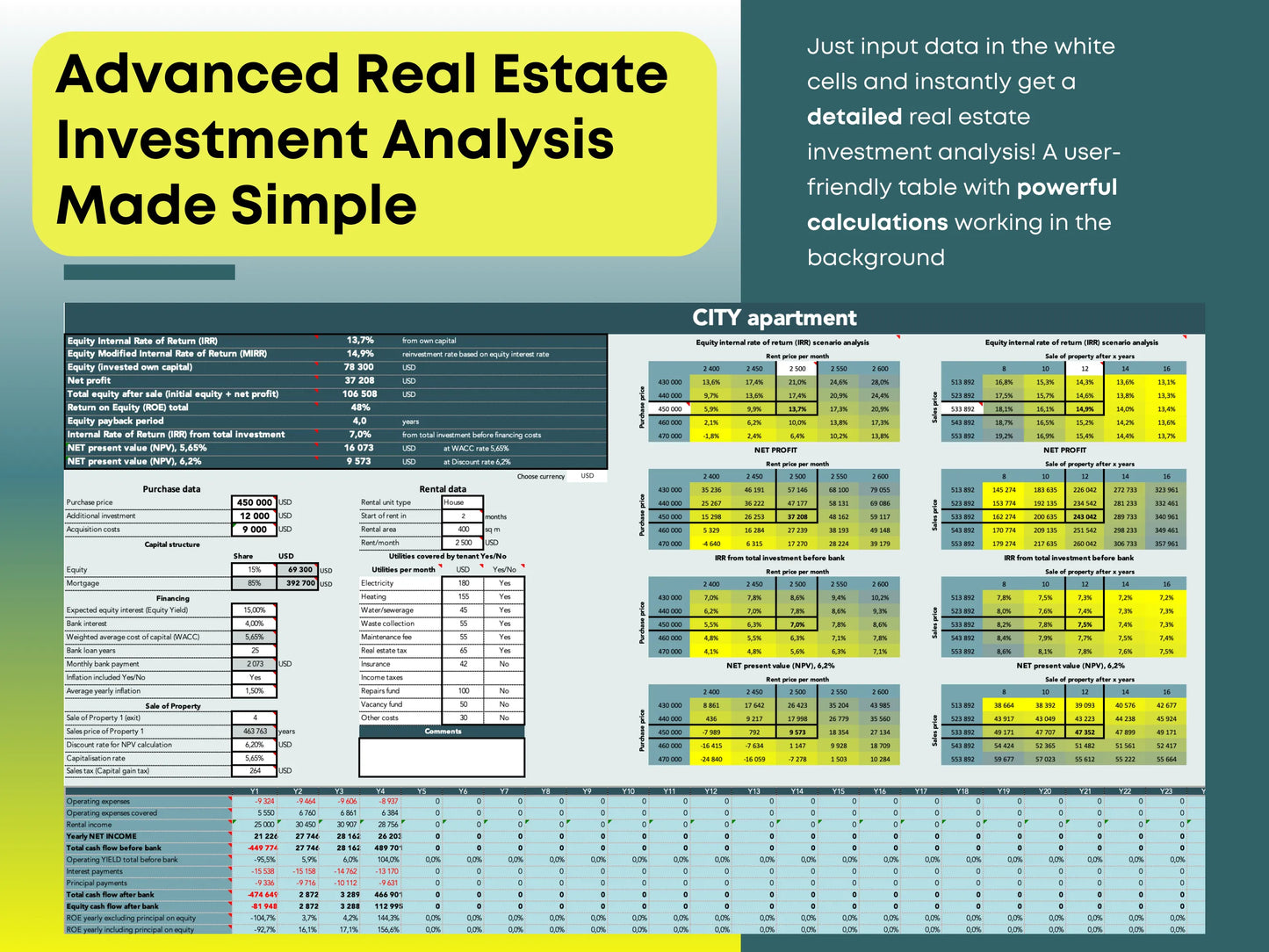

NPV is great for comparing multiple investment opportunities. If you have two, three or more properties to choose from, calculate the NPV for each one. The property with the highest positive NPV is likely the best option, assuming other factors like risk are similar.

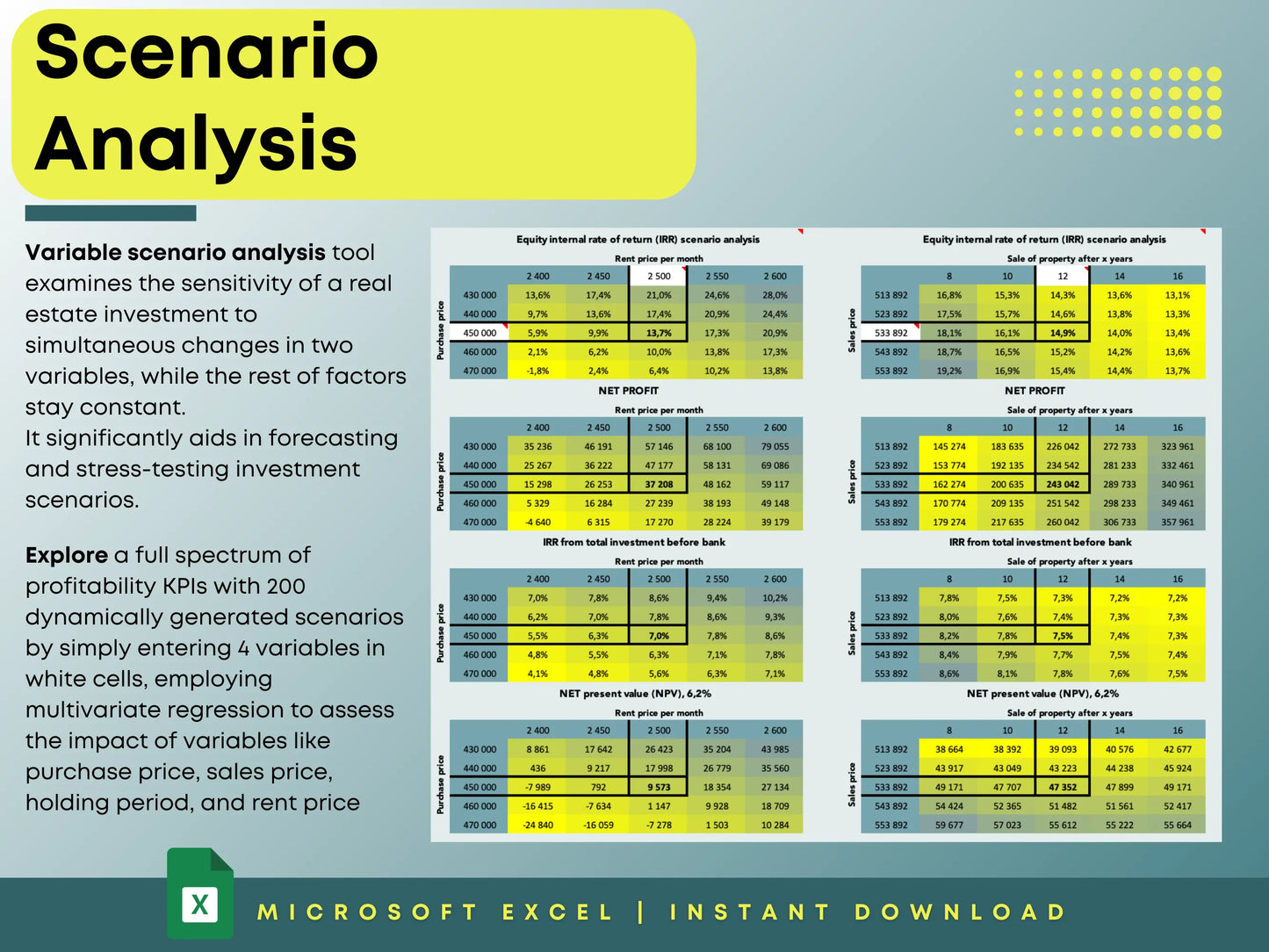

• Sensitivity Analysis:

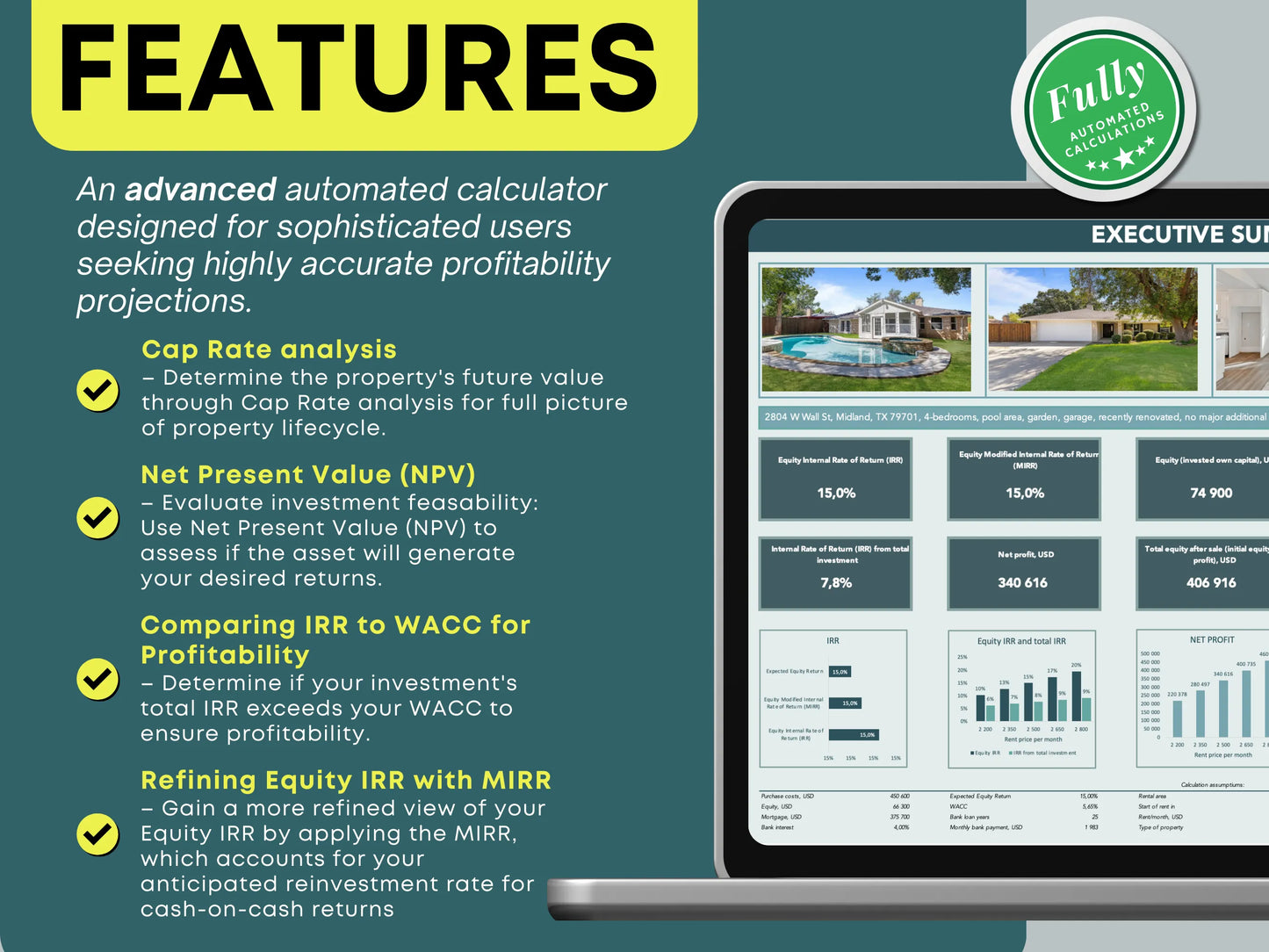

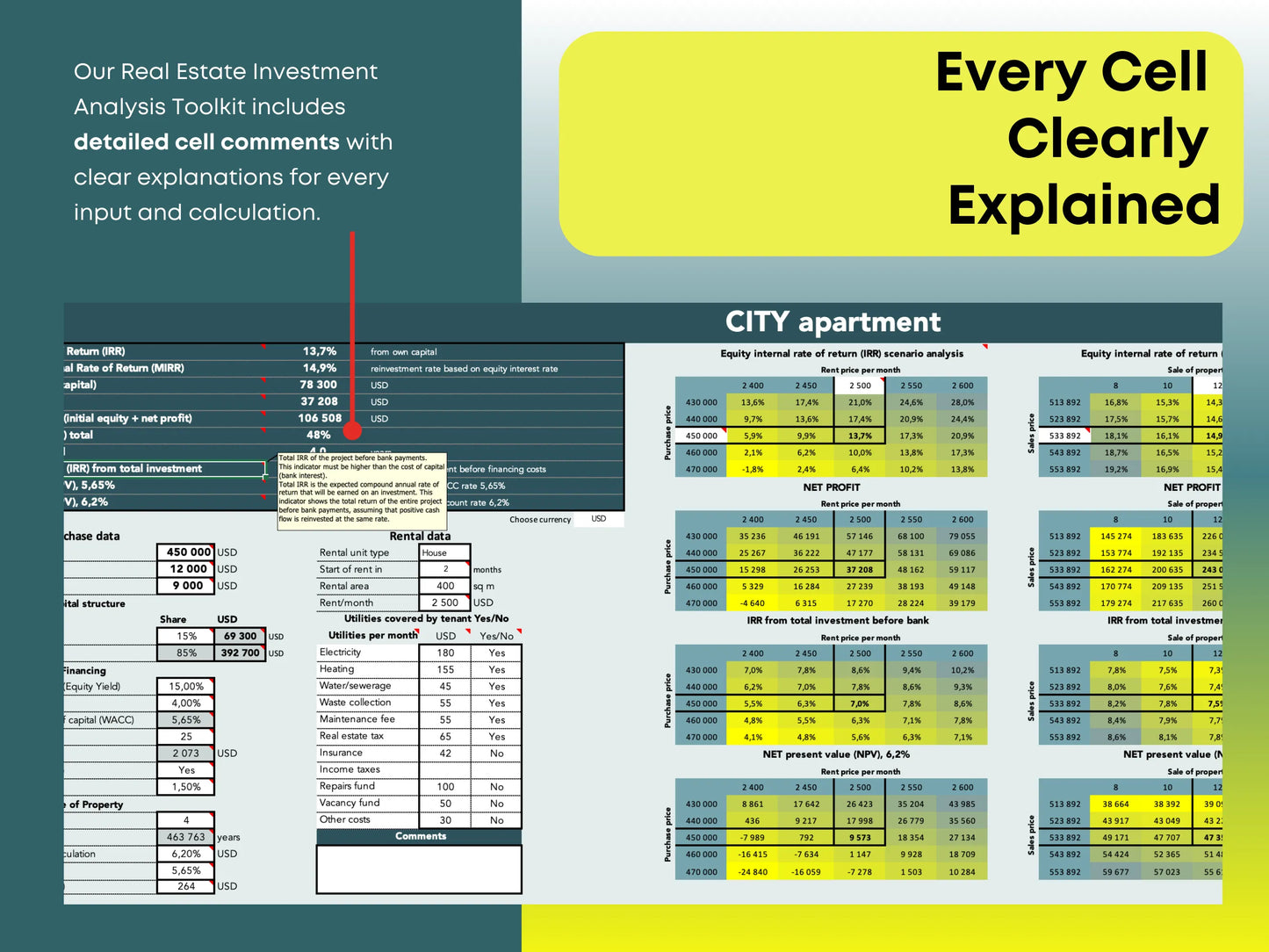

Use NPV to test what-if scenarios. For example, what happens if your rental income increases by 5%? Or if the property appreciates at a different rate? Sensitivity analysis helps you understand the potential range of outcomes and risks. Sensitivity analysis is included in all of our Real Estate tools.

• Determine Your Exit Strategy:

NPV can help you figure out if your exit strategy (selling the property after a certain number of years) will be profitable. A positive NPV means your exit strategy is on track, while a negative NPV suggests you may need to adjust your timeline or pricing expectations.

• Assess the Impact of Financing:

When you use leverage (e.g., loans) to finance a real estate purchase, NPV helps you determine if the debt load and interest costs are manageable. If the financing costs exceed the expected returns, the NPV will be negative, signaling a potentially risky investment.

Common Mistakes When Using NPV

• Using the Wrong Discount Rate:

Make sure to use your WACC (plus some risk factored in) or target IRR as the discount rate. A wrong rate can distort your NPV results, making the investment appear better or worse than it actually is.

• Ignoring Future Sale Proceeds:

Always include the sale price or exit proceeds when calculating NPV, as this often accounts for a large portion of the investment's return.

• Relying on Gross Income:

Always use net income (after expenses) when calculating cash flows. Gross income without considering maintenance costs, vacancy rates, taxes, or financing is misleading.

• Overlooking Market Changes:

Real estate markets evolve over time. Always recalculate NPV periodically, especially if market conditions or your assumptions change.

Final Thoughts: Why You Should Always Use NPV

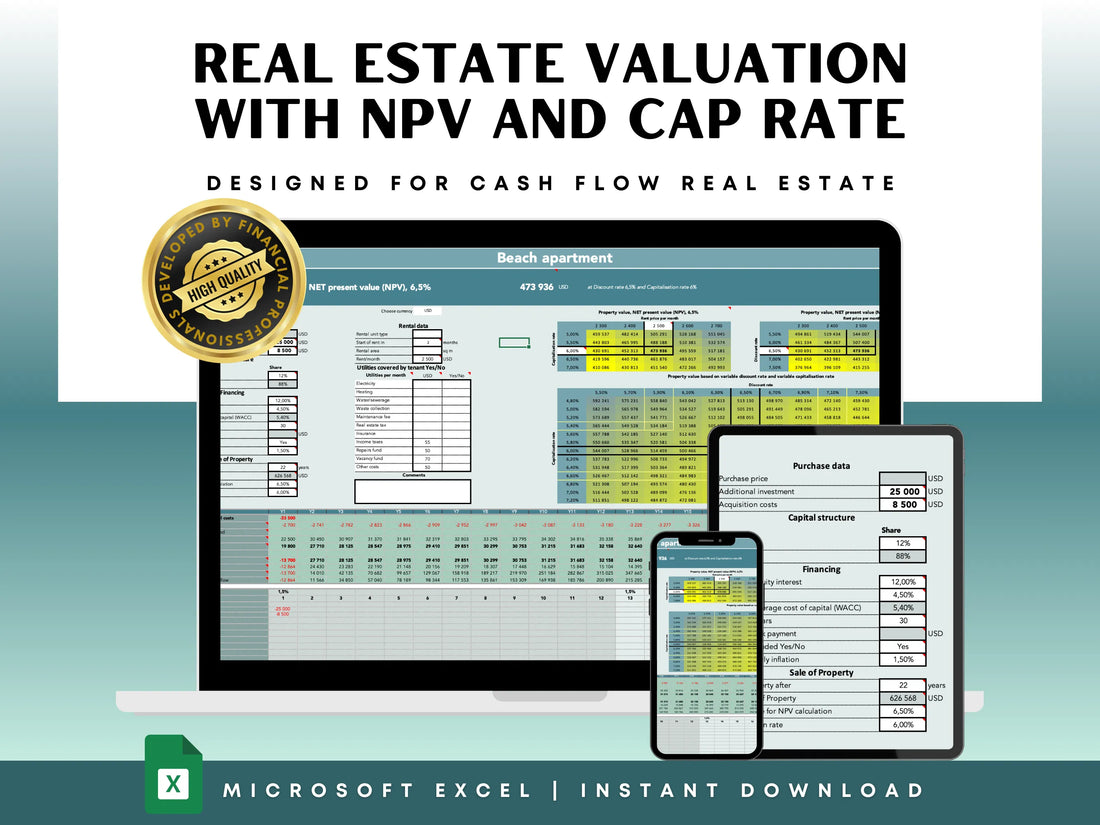

NPV is one of the most reliable ways to assess a real estate investment’s potential. It not only helps you understand how much value a deal will generate in today’s terms but also ensures you’re meeting your required return targets. By using NPV alongside other metrics like IRR and WACC, you can make more informed, data-driven decisions that improve the chances of your real estate investments succeeding.

Check out our Real Estate investment tools, which take into account all above mentioned key metrics.