Why Sensitivity Analysis is Essential in Real Estate Investment

Share

Why Sensitivity Analysis is Essential in Real Estate Investment?

When investing in real estate, decisions are often made based on projections—future rent income, property appreciation, mortgage rates, and operational costs. But what happens when reality deviates from your expectations? That’s where sensitivity analysis comes in.

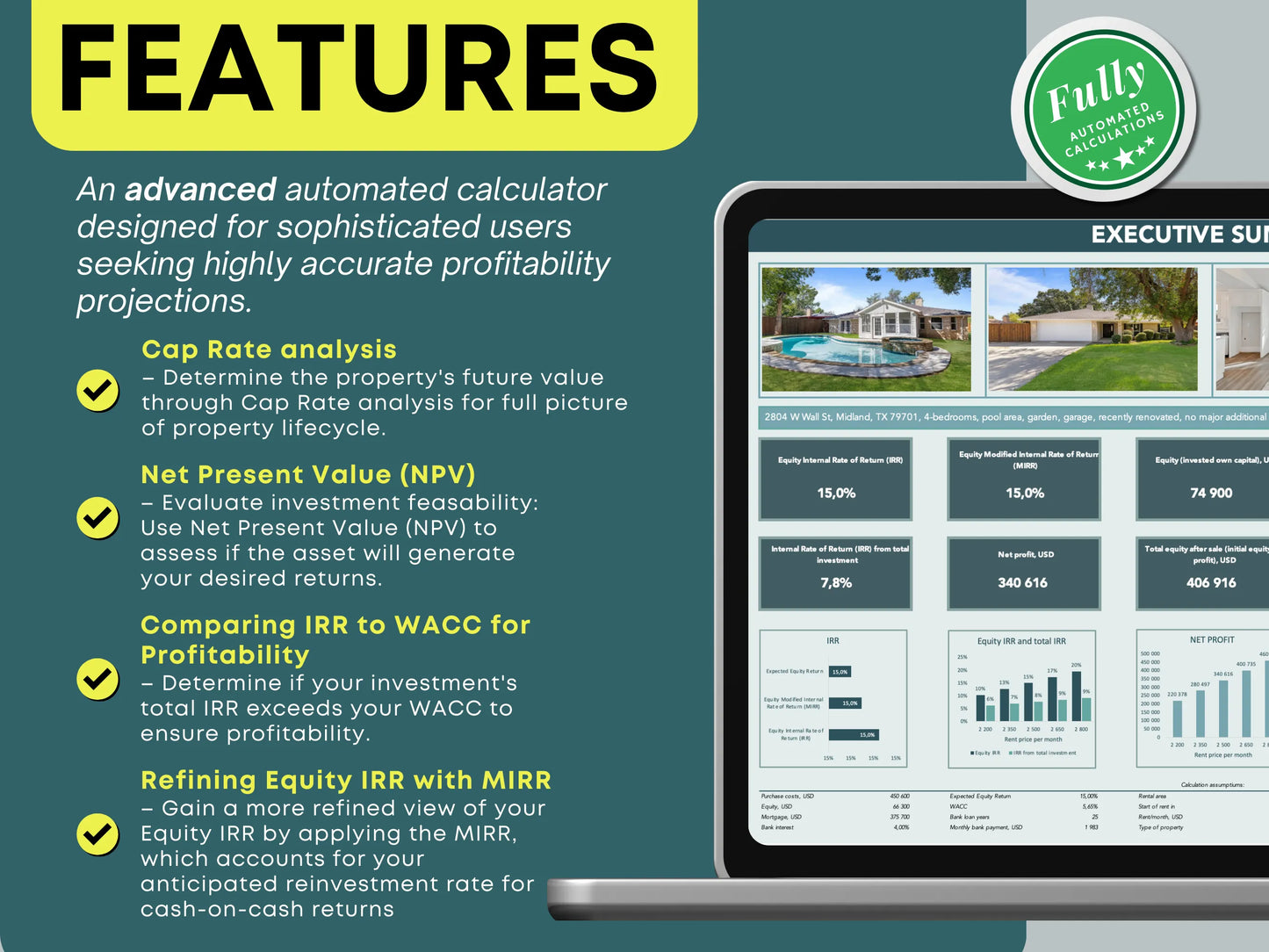

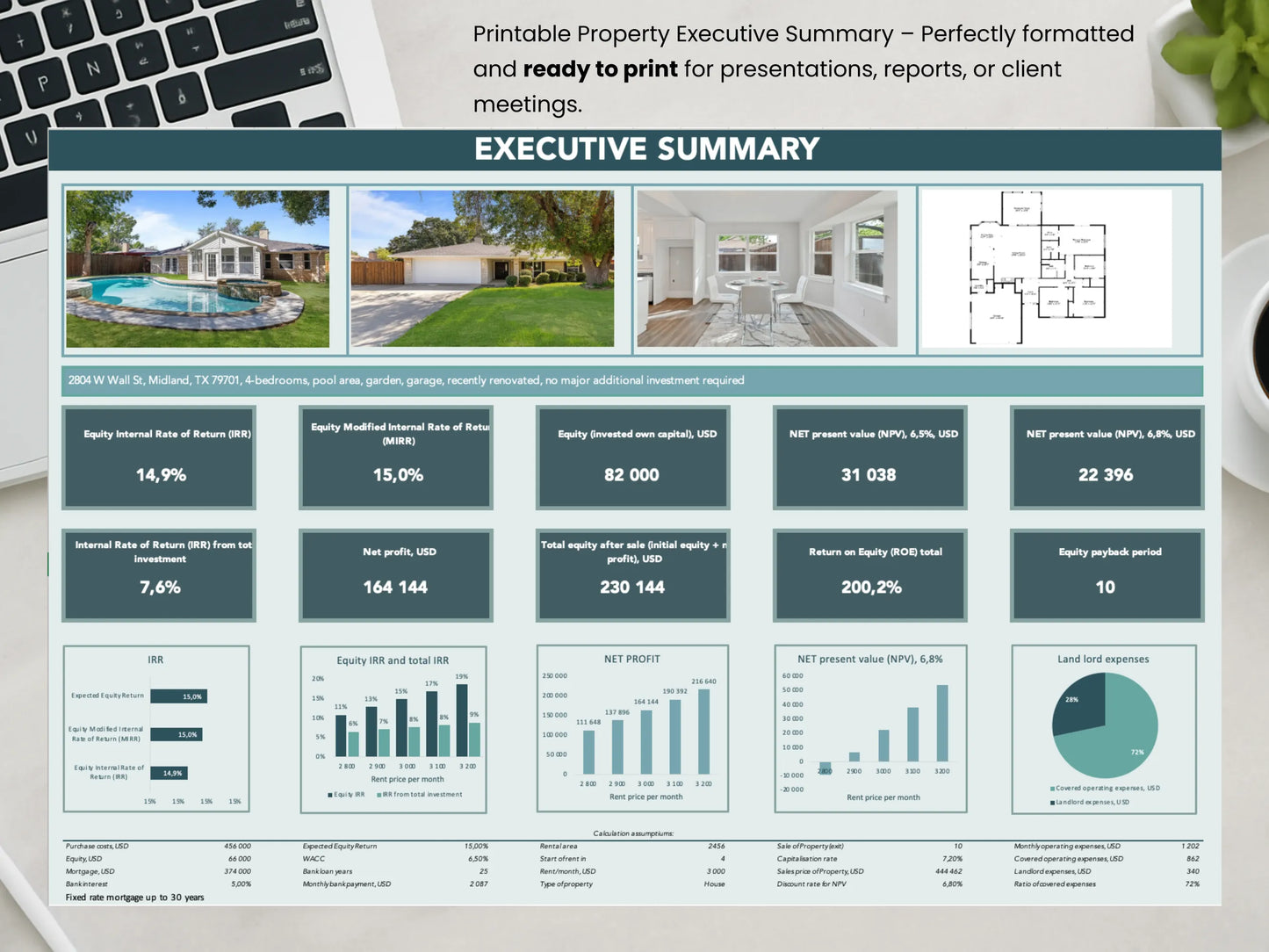

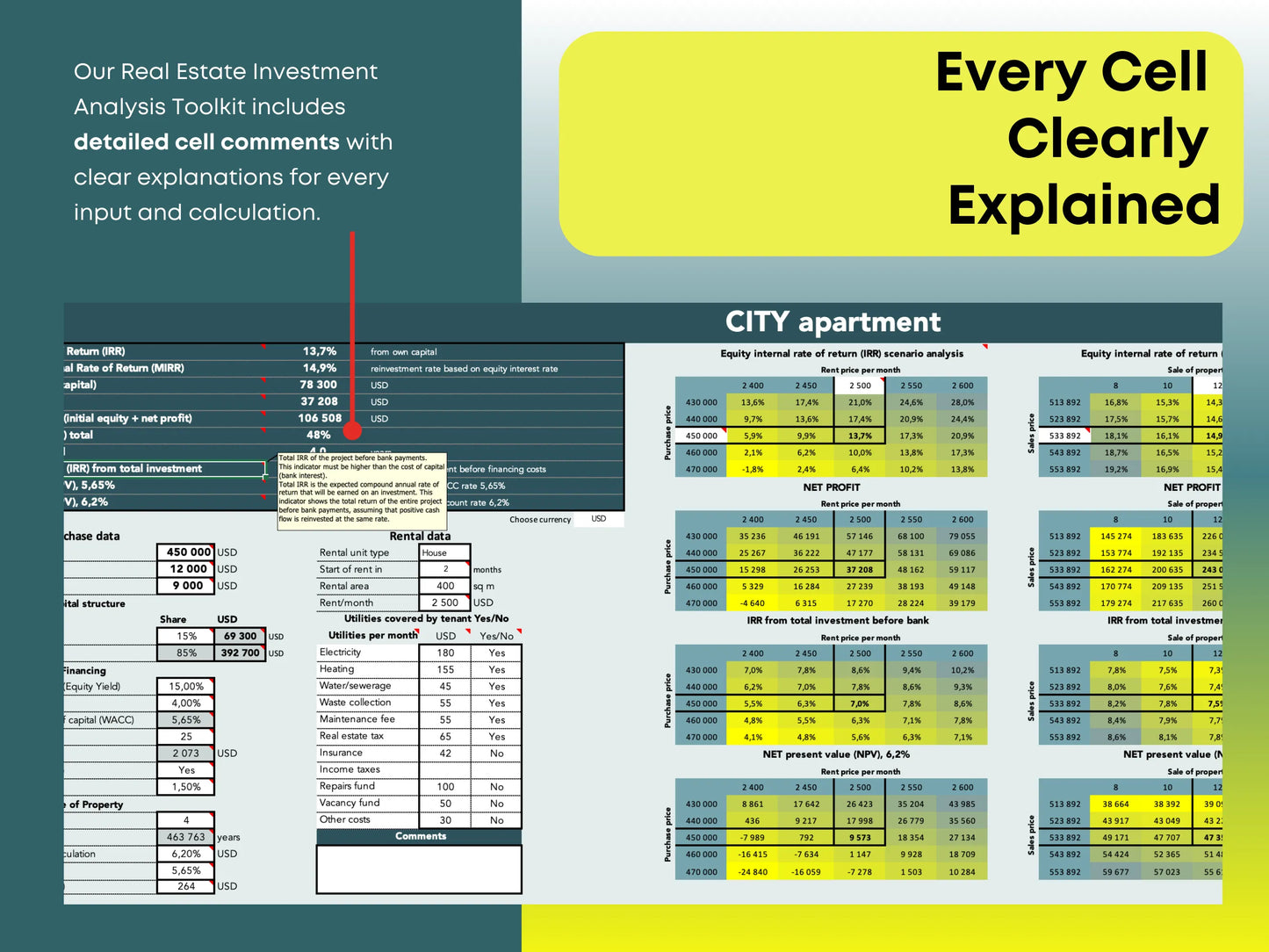

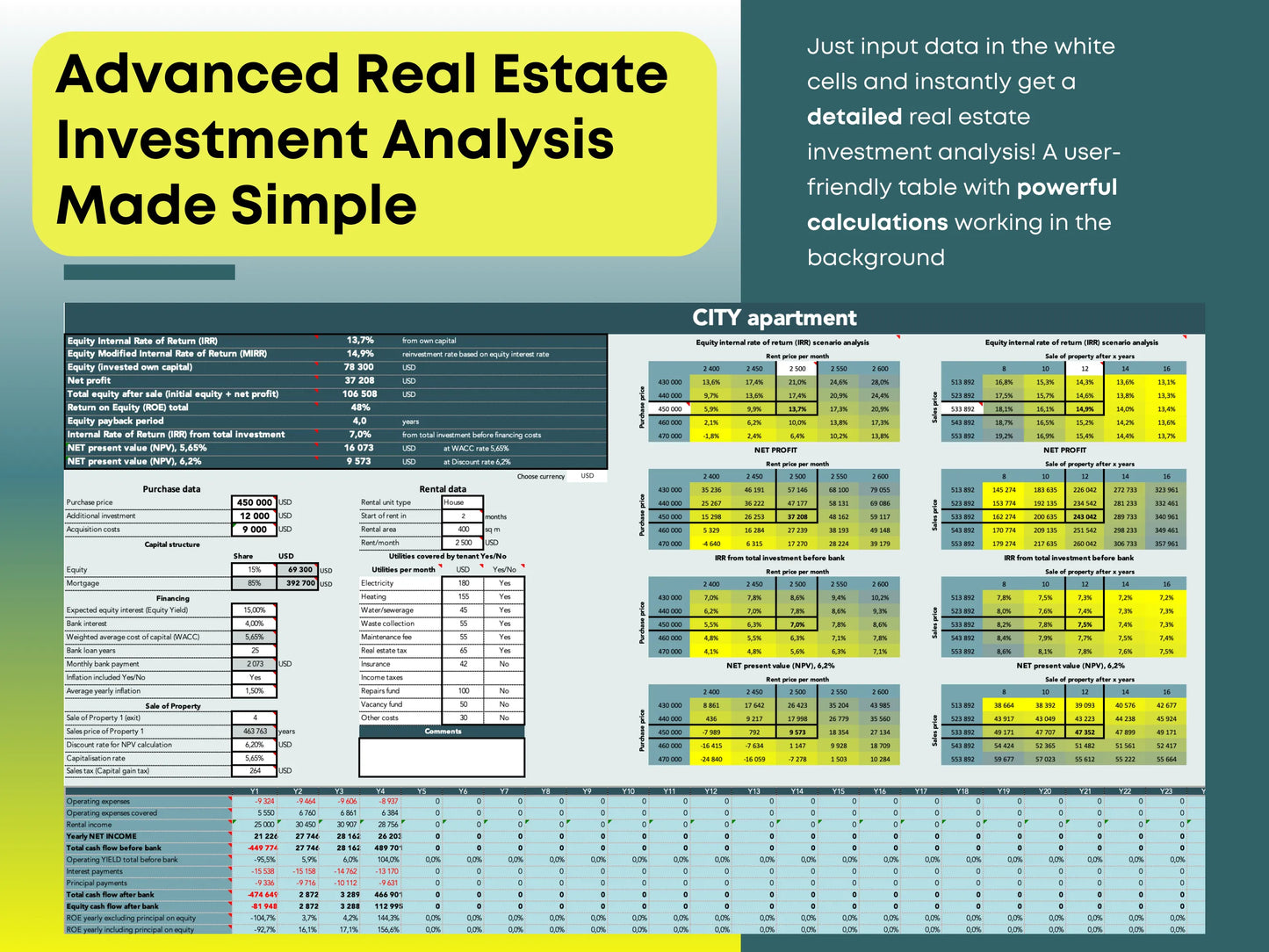

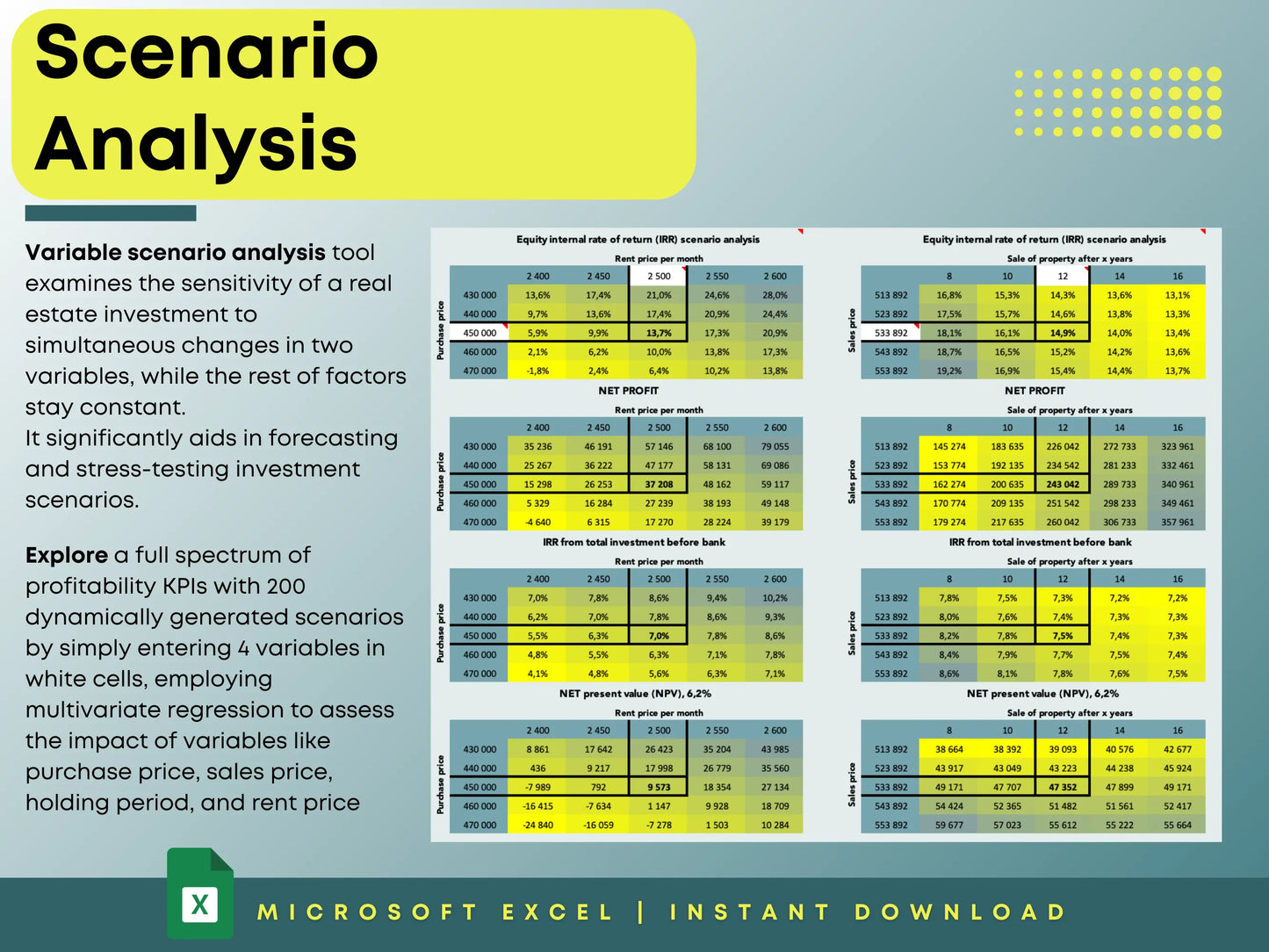

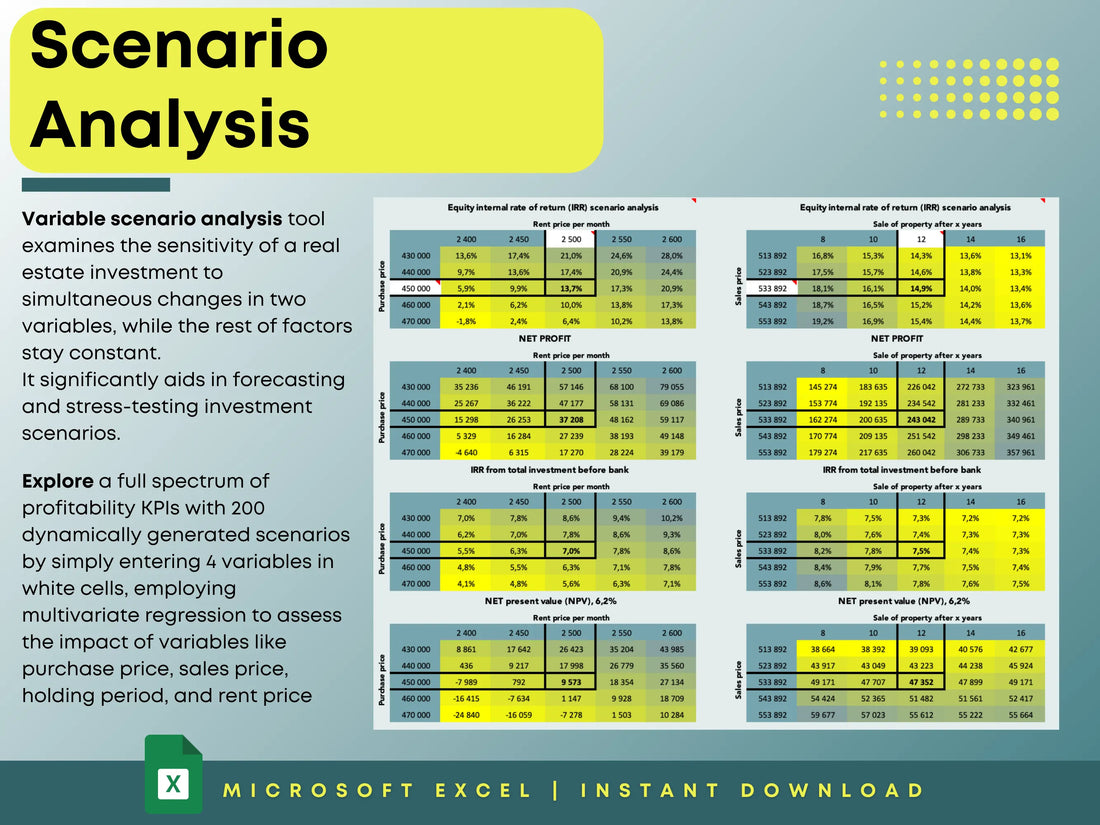

Sensitivity analysis involves running multiple scenarios to test how changes in key variables—like purchase price, rent income, or mortgage interest rate—impact your investment outcome. It's a tool that empowers investors to make informed, resilient decisions. It's a tool that is included in all of our Real Estate investment calculators.

The Key Variables That Matter

Let’s take a closer look at three critical inputs in real estate modeling:

• Purchase Price

This is your biggest upfront cost. Overpaying can reduce your return on investment, while finding a deal can multiply your gains. Running scenarios with a +/- 5-10% fluctuation in purchase price helps assess risk under different market conditions. In our tool you can define the scenarios for purchase price yourself.

• Rent Income

Rental income determines your cash flow. It can fluctuate due to market demand, tenant turnover, or economic conditions. Testing rent income under conservative (e.g., 10% below market) and optimistic (e.g., 10% above market) scenarios shows how stable your investment is. You can run a worst case, best case scenario for rent income to assess how the returns hold up.

• Mortgage Interest Rate

As rates rise or fall especially in recent times, so do your monthly payments. A 1% change in rate can significantly affect your debt service coverage ratio (DSCR) and net cash flow. Analyzing how interest rate variability affects your financials is crucial—especially in a volatile rate environment and in order to assess the optimal leverage.

Why Sensitivity Analysis Matters

• Better Risk Management: You’ll understand your break-even points—how far rents or interest rates can move before your investment becomes unprofitable.

• Improved Decision-Making: Rather than relying on a single "best guess," you’ll evaluate a range of outcomes to guide offers, financing terms, and exit strategies.

• Investor and Lender Confidence: When raising capital or seeking financing, demonstrating sensitivity-tested projections shows professionalism and due diligence.

•

How to Run a Sensitivity Analysis

• Build a Financial Model in a spreadsheet or software with inputs for your main variables.

• Choose Variable Ranges (e.g., rent from $1,200 to $1,500/month, interest rate from 5% to 7%).

• Test Multiple Scenarios: Create best-case, base-case, and worst-case outcomes.

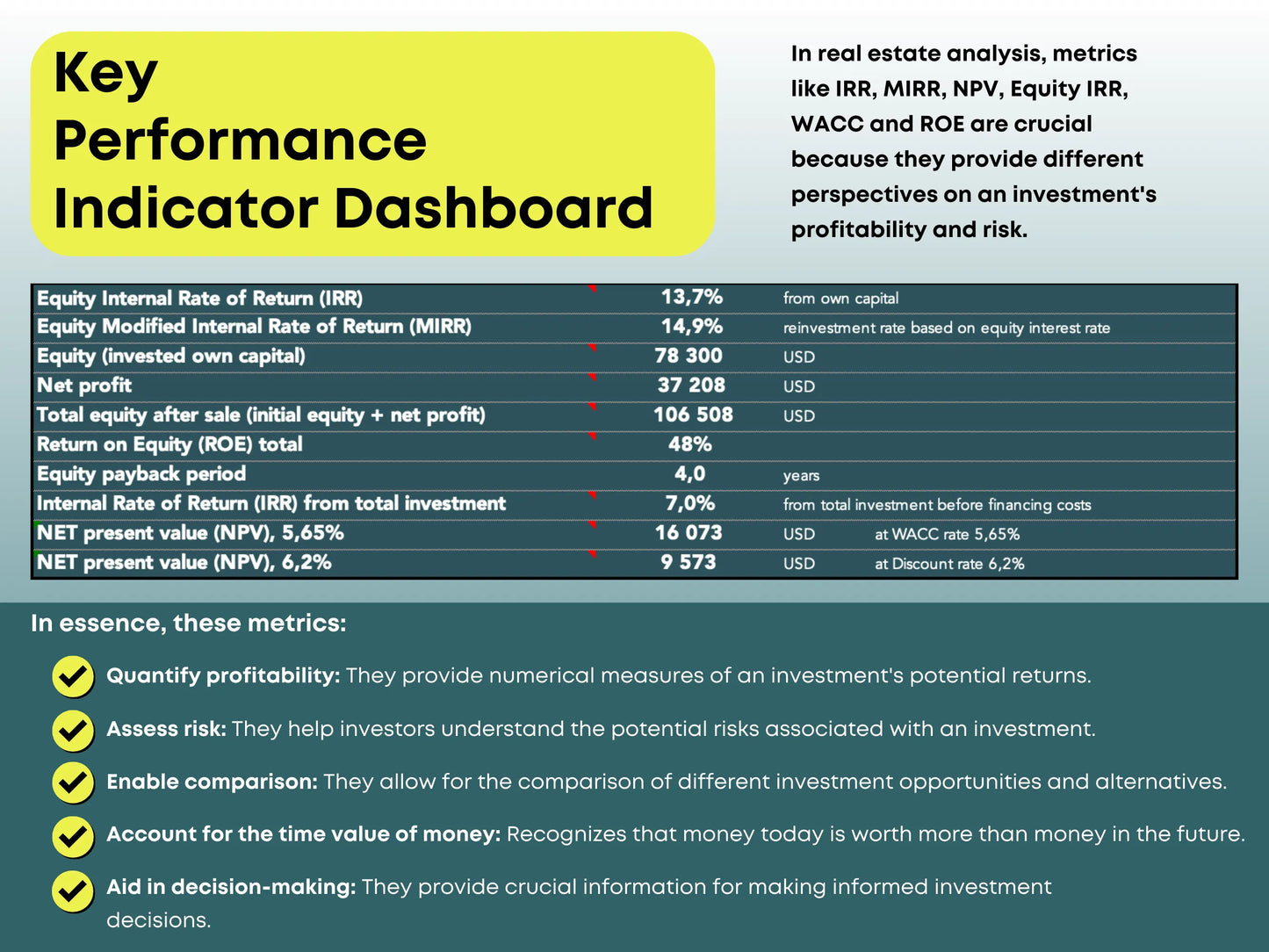

• Analyze Results: Look at cash flow, ROI, and internal rate of return (IRR) across scenarios.

•

Final Thoughts

In a market full of uncertainties, hope is not a strategy. Sensitivity analysis equips real estate investors with the foresight to prepare, adapt, and succeed—no matter how the numbers shift.

Don’t forget to check out our Real Estate investment tools, which have integrated automated scenario elasticity analysis in all of them.