Main KPIs in Real Estate investment analysis

Share

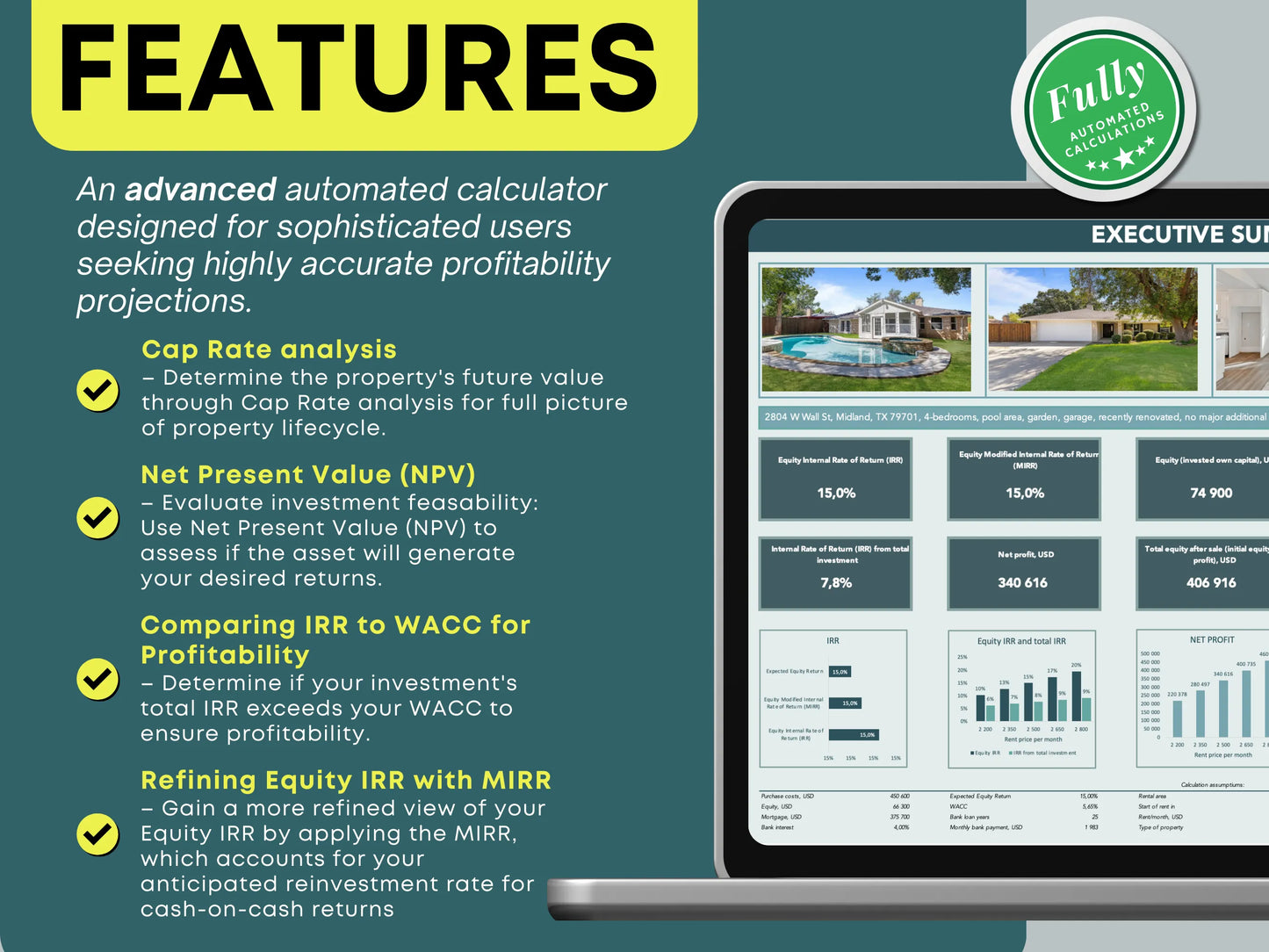

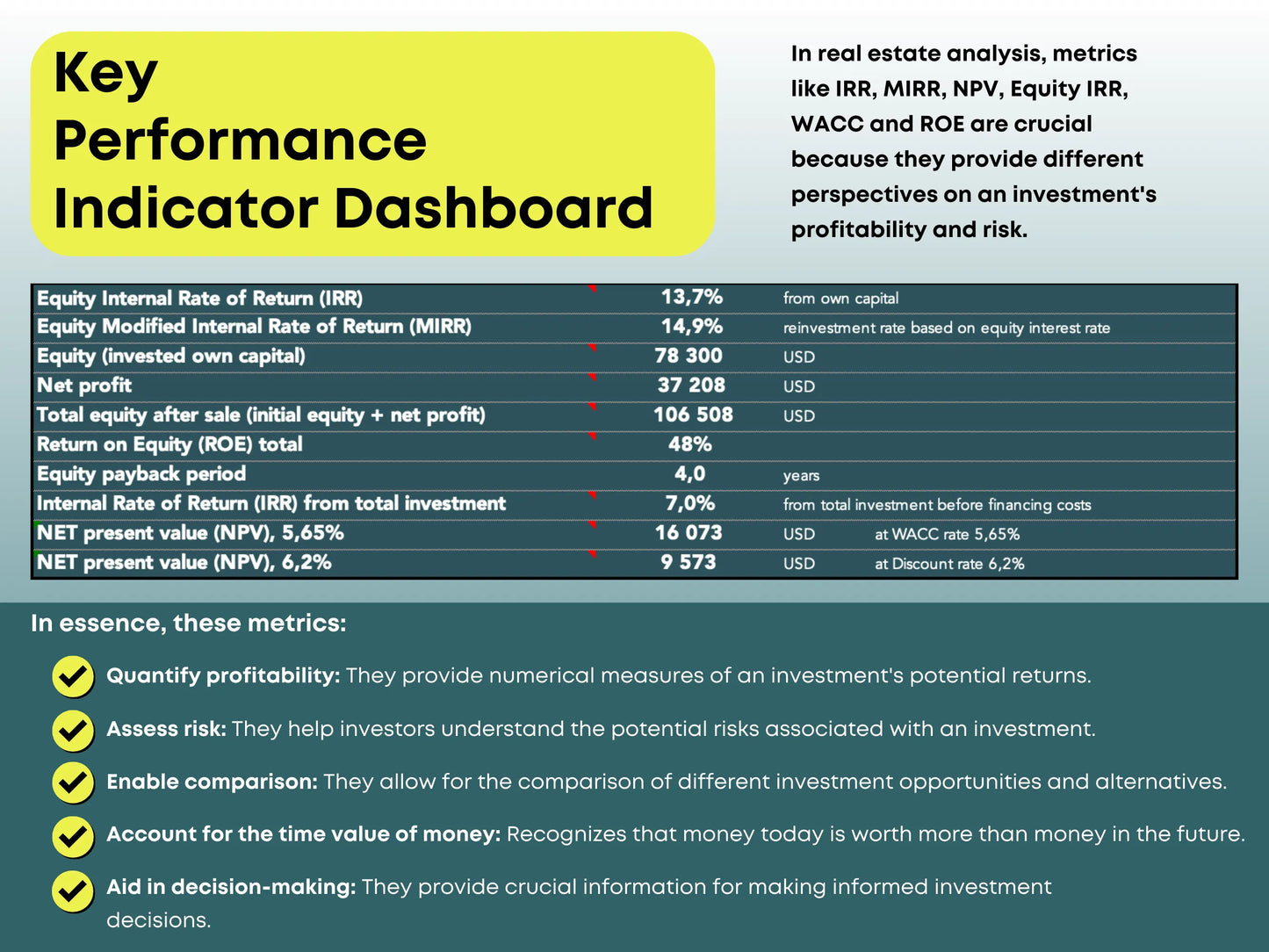

In real estate analysis, metrics like IRR, MIRR, NPV, Equity IRR, and ROE are crucial because they provide different perspectives on an investment's profitability and risk. Here's a breakdown, what is included in this tool and why:

- IRR (Internal Rate of Return):

- It essentially represents the annualized rate of return an investment is expected to yield.

- It's valuable for comparing different investment opportunities.

- It factors in the time value of money, which is crucial for long term investments.

- MIRR (Modified Internal Rate of Return):

- This is a variation of IRR that addresses some of IRR's limitations, particularly the assumption that cash flows are reinvested at the IRR itself.

- MIRR allows for different reinvestment rates, providing a more realistic view of potential returns.

- In this tool the reinvestment rate equals to Equity yield, that you can manually enter yourself and review, whether the planned investment can generate the desired yield.

- NPV (Net Present Value):

- This calculates the present value of all future cash flows from an investment, minus the initial investment cost.

- A positive NPV indicates that the investment is expected to generate expected equity yield and cover bank interest. Negative NPV indicates, that your expected equity yield and bank yield will not be achieved.

- It also factors in the time value of money.

- Equity IRR:

- This specifically measures the return on the investor's equity in a real estate deal, taking into account financing interest payments.

- It provides a more accurate picture of the investor's actual return on their invested capital.

- This is a cruacial indicator for comparing alternative investments (is it real estate, stocks, crypto or obligations)

- ROE (Return on Equity):

- This measures the profitability of an investment relative to the amount of equity invested.

- It indicates how effectively the investor's capital is being used to generate profits.

- This is very important to people who are using leverage, or borrowed funds, to increase their returns.

- Weighted Average Cost of Capital WACC:

The relationship between IRR (Internal Rate of Return) and WACC (Weighted Average Cost of Capital) is fundamental in investment analysis, particularly in real estate. Here's why the IRR should generally be higher than the WACC:

- WACC as a Hurdle Rate:

- WACC represents the average cost an investor pays to finance its assets (equity and mortgage interest rates combined). It's the "cost of capital."

- Think of WACC as a minimum acceptable return. To create value, an investment's return must exceed this cost. Therefore, WACC acts as a "hurdle rate."

- IRR as Investment Return:

- IRR is the rate of return an investment is expected to generate.

- It signifies the profitability of the investment.

- Value Creation:

- If the IRR is higher than the WACC, it means the investment is generating a return that exceeds the cost of financing it (equity and mortgage interest). This creates added value for the investor.

- Conversely, if the IRR is lower than the WACC, the investment is generating a return that's less than the cost of financing it, resulting in a loss of mainly equity return, because mortgage interest payments will always have priority, thus resulting in less equity returns.

- Decision-Making:

- In capital budgeting, a common rule is to accept projects with an IRR greater than the WACC and reject those with an IRR lower than the WACC.

- This ensures that investments contribute to increasing the investor's wealth faster.