Buying vs. Renting: Why Owning a Home is the Smart Financial Move

Share

When deciding where to live, one of the biggest questions is whether to buy or rent a home. While renting may seem convenient in the short term, buying a property often proves to be the smarter financial decision—especially when considering capital appreciation and wealth-building potential.

Unlike renting, where monthly payments go to a landlord with no financial return, homeownership allows you to build equity and long-term wealth. In this guide, we explore the financial advantages of buying a home, practical strategies to leverage equity, and how real estate investing can accelerate your financial growth.

1. Capital Appreciation: Your Home as an Investment

One of the biggest benefits of buying a home is capital gain. When you purchase a property, you’re investing in an asset that generally increases in value over time. Historically, real estate markets tend to appreciate in the long run, meaning the home you buy today is likely worth significantly more in the future.

Example:

Suppose you purchase a home for $300,000 and its value increases by an average of 4% per year over ten years. By the end of that period, the home could be worth approximately $444,000—a gain of $144,000 simply by holding the property.

This illustrates how homeownership isn’t just about having a place to live—it’s a long-term financial investment that grows your net worth.

2. Equity: Paying Yourself Instead of a Landlord

When you rent, monthly payments disappear into someone else’s pocket. When you buy a home, each mortgage payment builds equity, giving you ownership of a tangible asset.

Over time, as you pay down your mortgage, your ownership stake increases, boosting your net worth.

Long-term example:

After 20–30 years, a homeowner who has fully paid off a mortgage owns a valuable property free and clear, while a renter has nothing to show for decades of payments.

3. Inflation Protection: Locking in Housing Costs

Rent prices tend to rise over time due to inflation and increasing demand. Homeowners with a fixed-rate mortgage can lock in housing costs, protecting themselves from rising rent.

This provides financial predictability, making homeownership a smart long-term strategy compared to renting, where monthly costs may increase steadily.

4. Passive Wealth Growth

Unlike other investments requiring active management, owning a home allows you to grow wealth passively. You don’t need to constantly monitor the stock market or make complex financial decisions—the property naturally gains value over time as you live in it.

5. Tax Benefits and Financial Perks

Homeownership also offers potential tax advantages:

- Mortgage interest deductions

- Property tax deductions

- Capital gains exemptions (if selling after living in the home for at least 2 years)

These incentives enhance the financial benefits of owning versus renting.

6. Building Equity in Your Primary Home

As mortgage payments reduce your loan balance, the equity in your home increases. At the same time, if property values rise, your equity grows even faster.

Example:

- Home purchase price: $300,000

- Mortgage: $250,000

- After a few years, mortgage balance: $220,000

- Market value of home: $400,000

Equity = Home Value - Loan Balance

$400,000 - $220,000 = $180,000 in equity

This equity can serve as the foundation for further investment opportunities.

7. Refinancing to Unlock Cash for Investment

Many banks allow homeowners to borrow against a percentage (commonly 80%) of their home’s value. This means you could refinance a property to access funds for other investments.

Example:

- Home value: $400,000

- Borrow 80% of value: $320,000

- Pay off remaining mortgage: $220,000

- Extra cash available: $100,000

This cash can be used as a down payment on a second property, enabling strategic growth of your real estate portfolio.

8. Using Equity to Acquire Investment Properties

With the $100,000 cash from refinancing, you could purchase a rental property worth $500,000, using the full amount as a 20% down payment. Rental income can cover mortgage payments, while the property continues to appreciate over time—creating passive income and building additional wealth.

9. The Wealth-Building Cycle: Repeat and Grow

The process doesn’t stop with one property. As both properties appreciate, you can refinance again, extract equity, and purchase additional investment properties.

This creates a compounding effect:

- Properties increase in value

- Equity grows

- Cash is reinvested into new assets

Over time, this strategy allows you to build a diversified portfolio of income-generating real estate without waiting decades to save.

Key Benefits of Using Home Equity to Build Wealth

- Accelerated Wealth Growth: Use existing assets to expand your portfolio faster than saving cash alone.

- Passive Income: Rental properties provide monthly income to supplement earnings or pay off mortgages.

- Long-Term Appreciation: Real estate value growth continues to build wealth.

- Tax Advantages: Mortgage interest and depreciation can reduce taxable income on investment properties.

Practical Tips for Homeowners Looking to Invest

- Plan Your Finances Carefully: Ensure you have a stable income and positive cash flow.

- Research Market Trends: Choose locations with strong appreciation potential.

- Manage Leverage Responsibly: Avoid overborrowing and account for vacancies.

- Monitor Property Performance: Keep track of rental income, expenses, and equity growth.

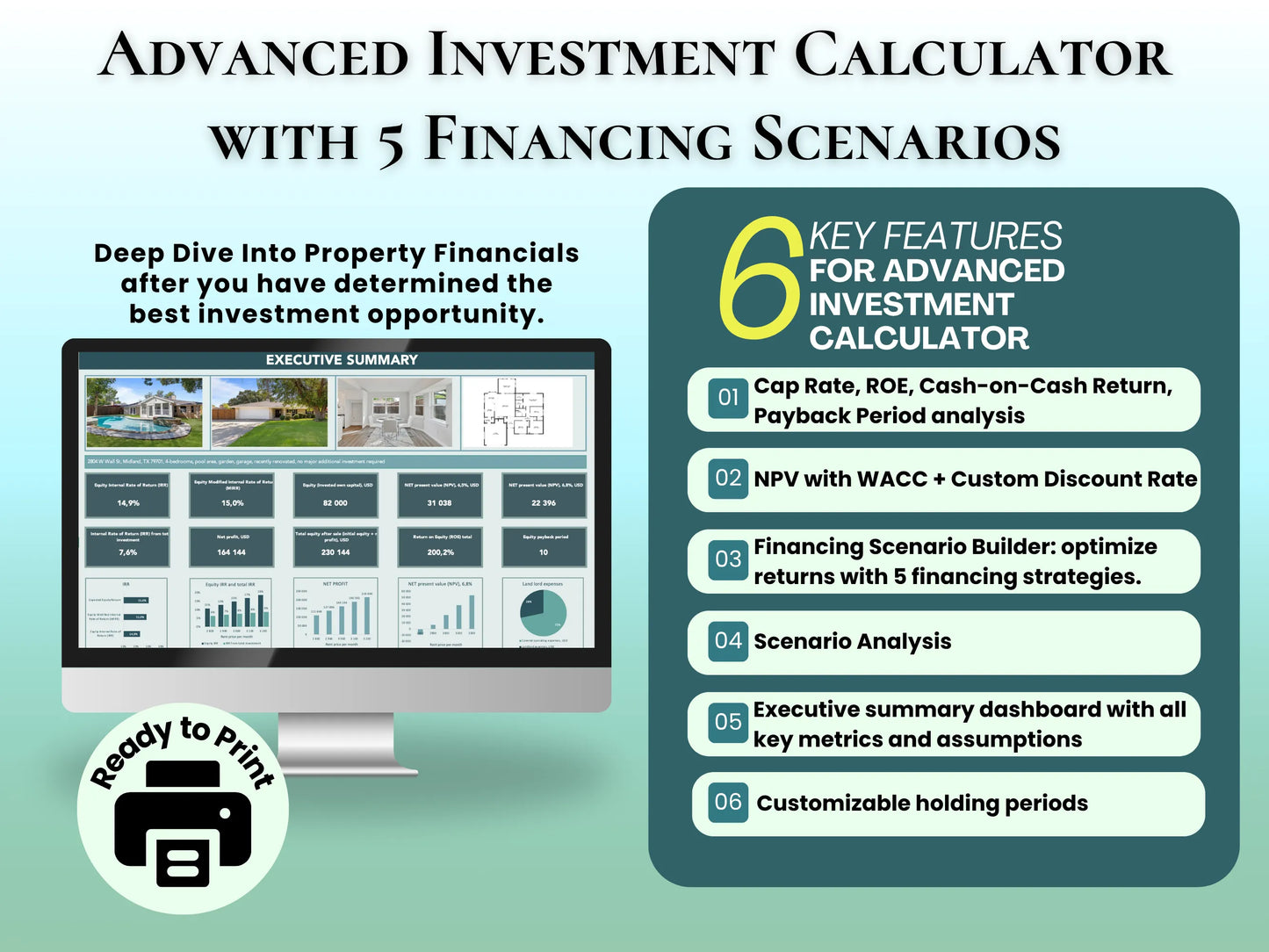

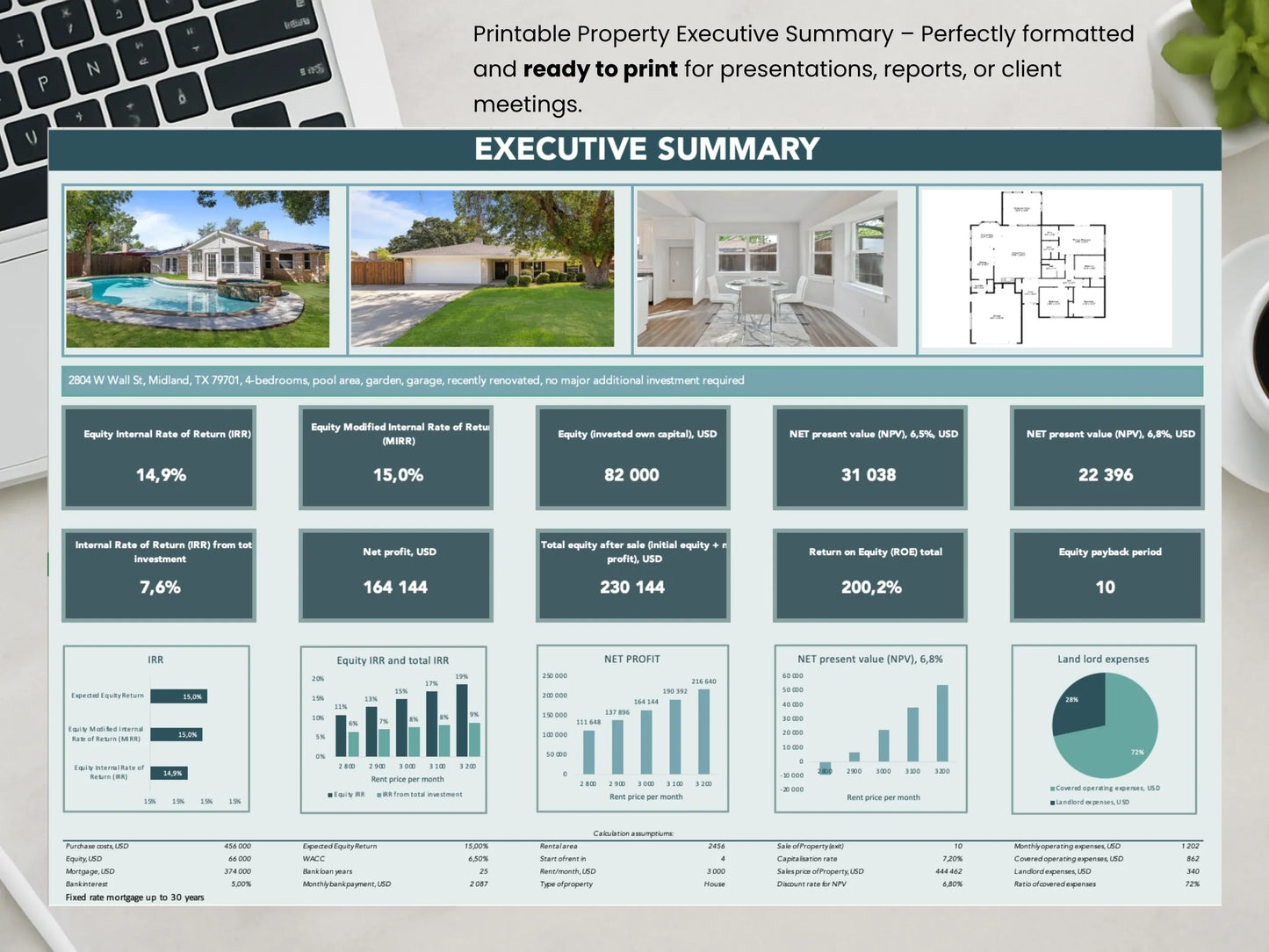

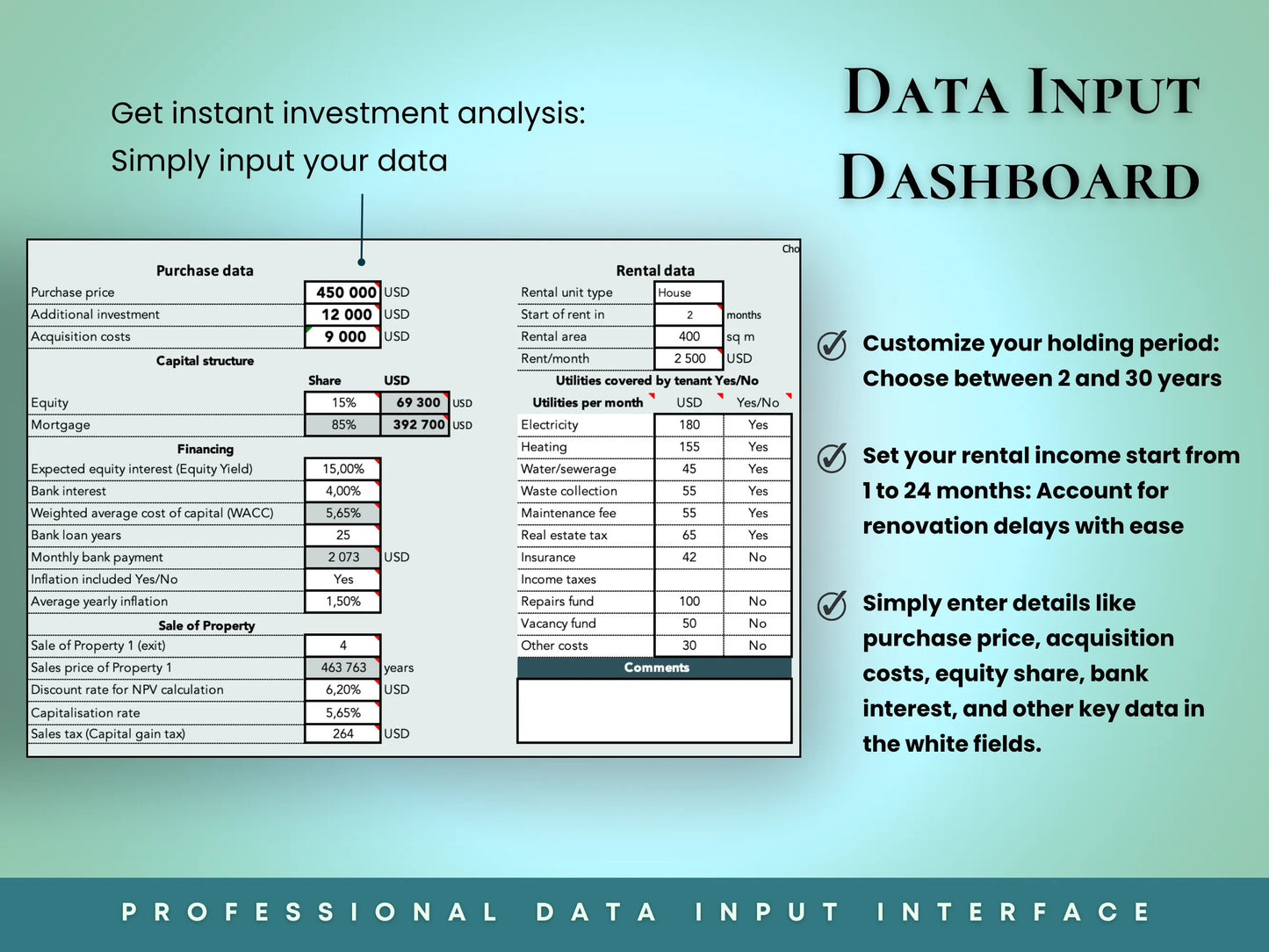

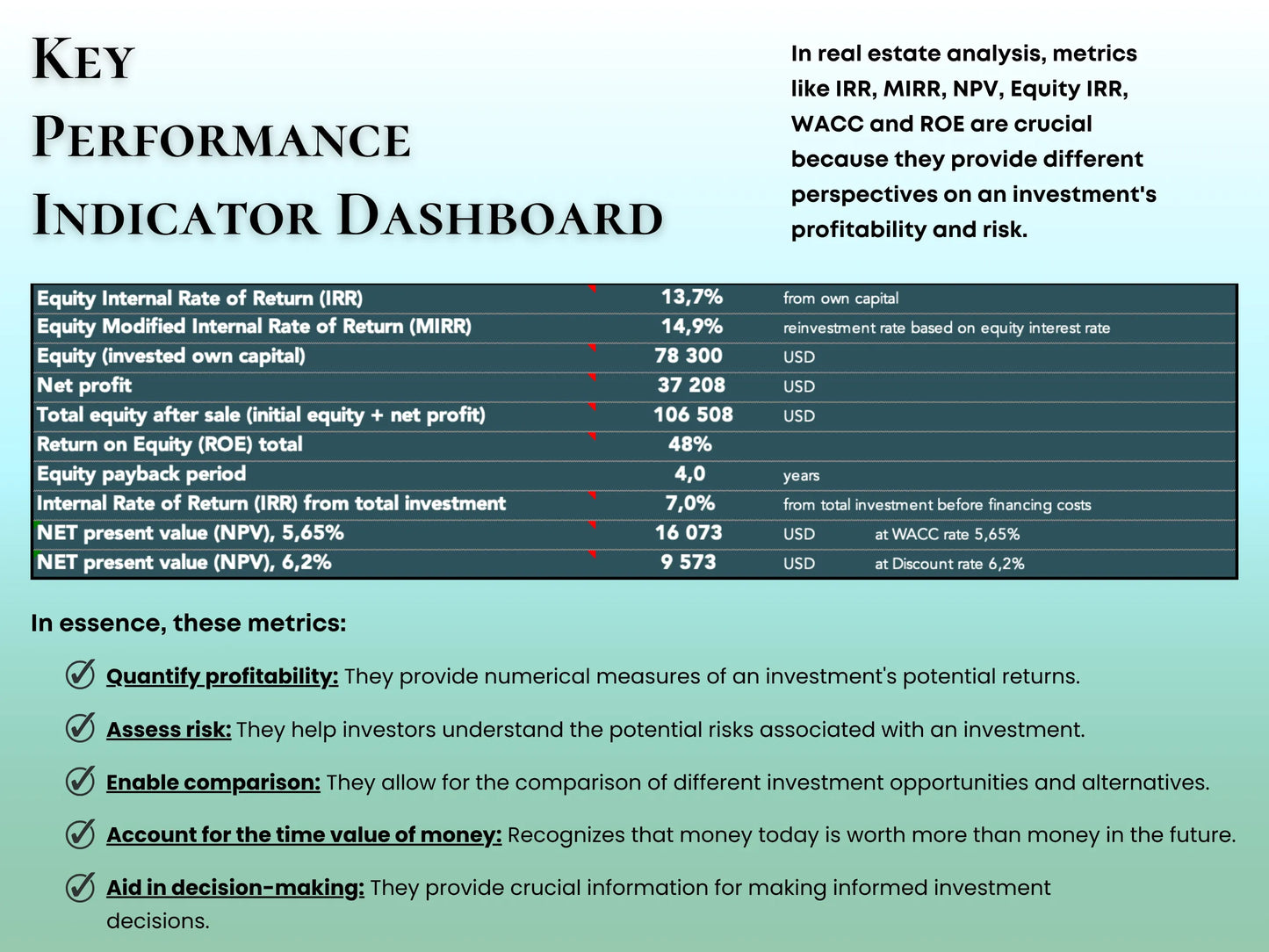

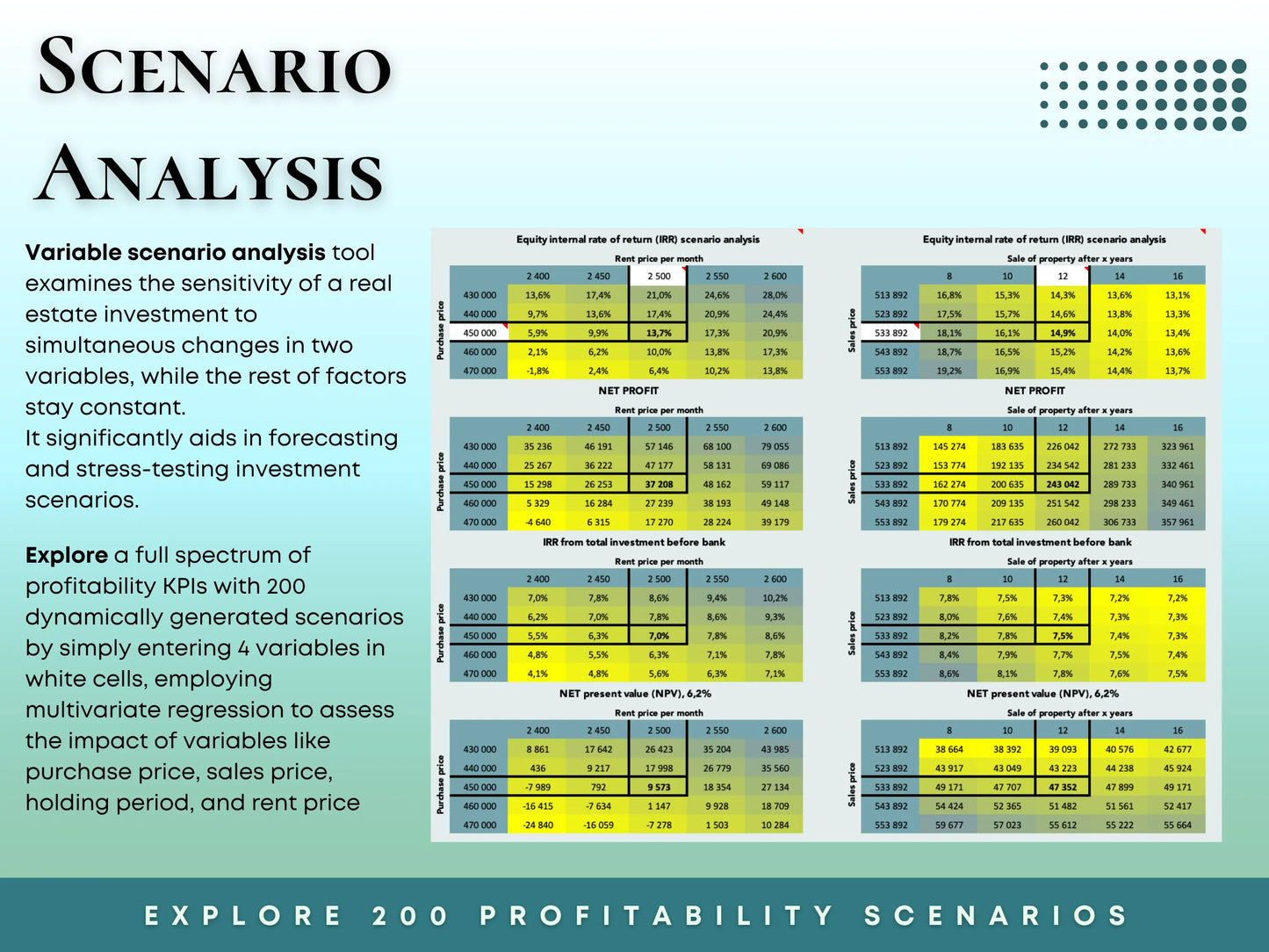

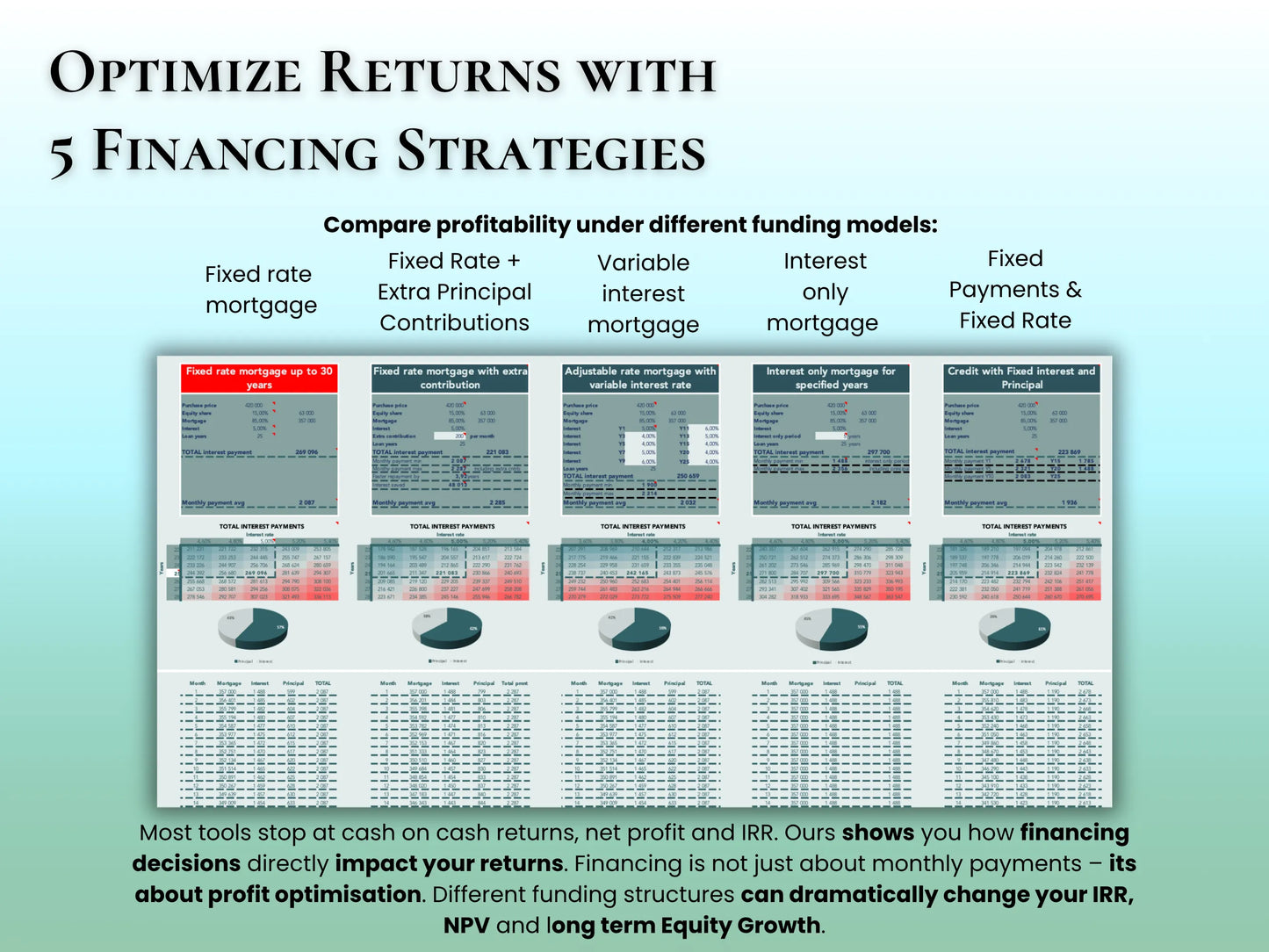

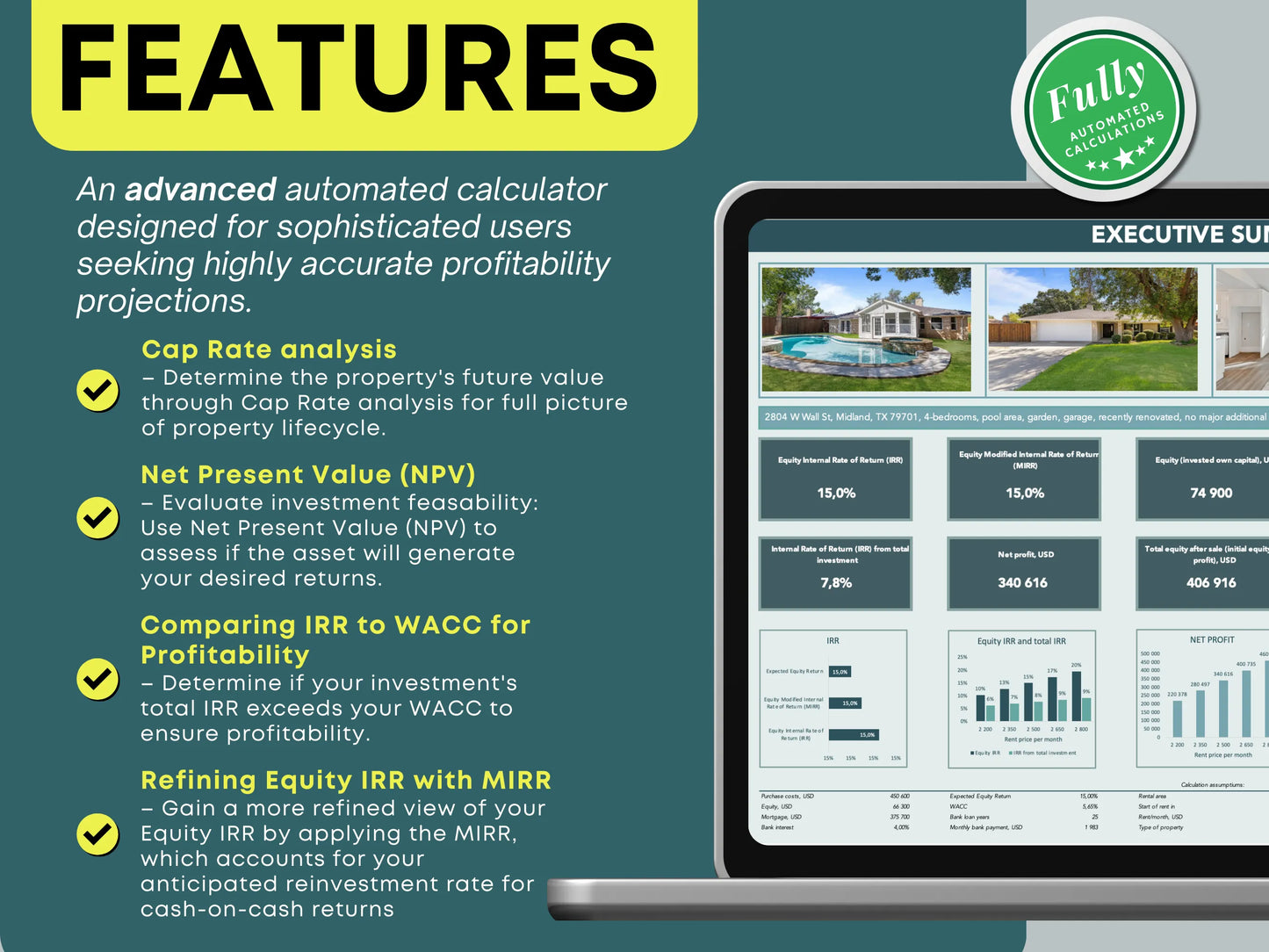

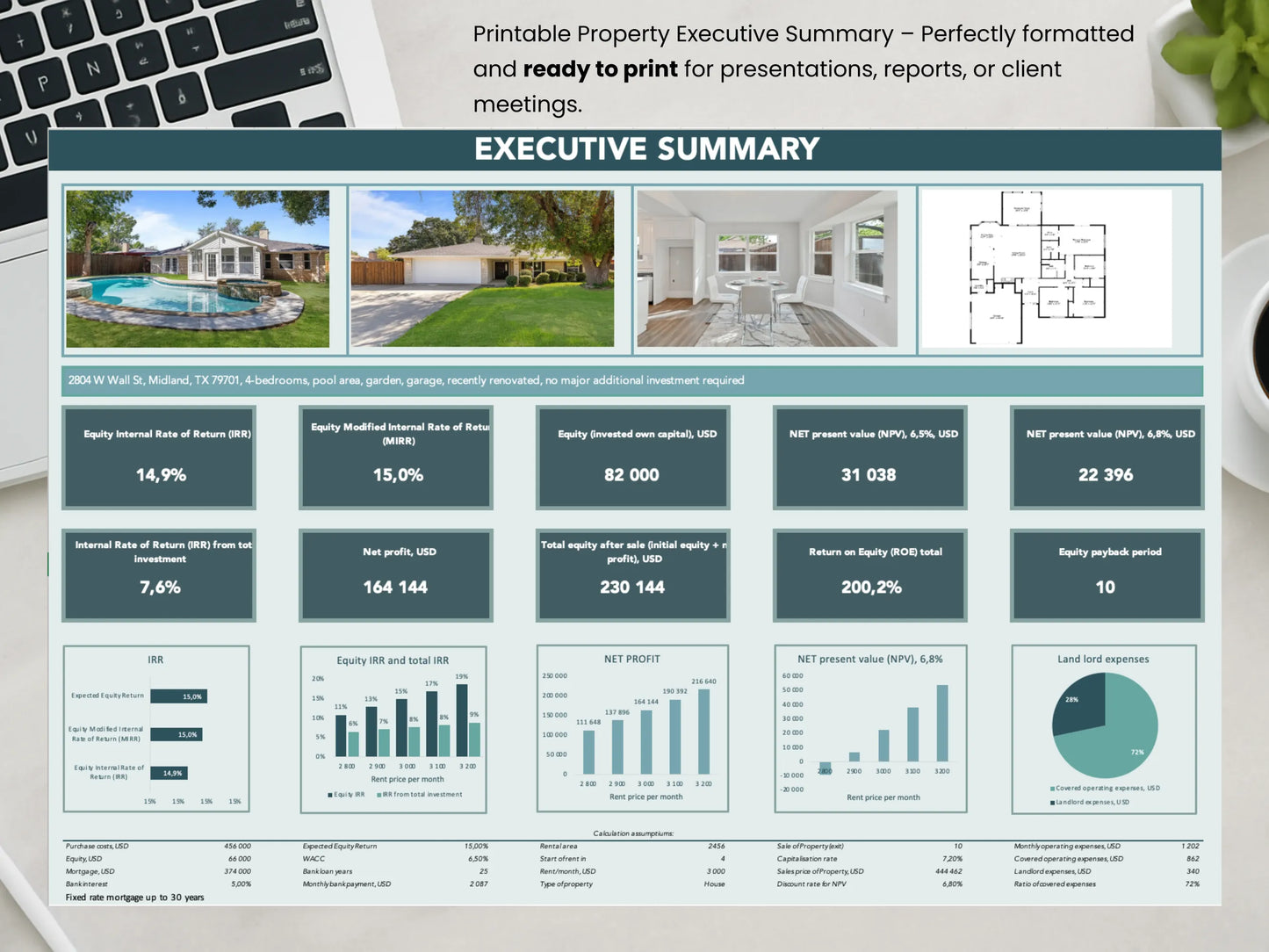

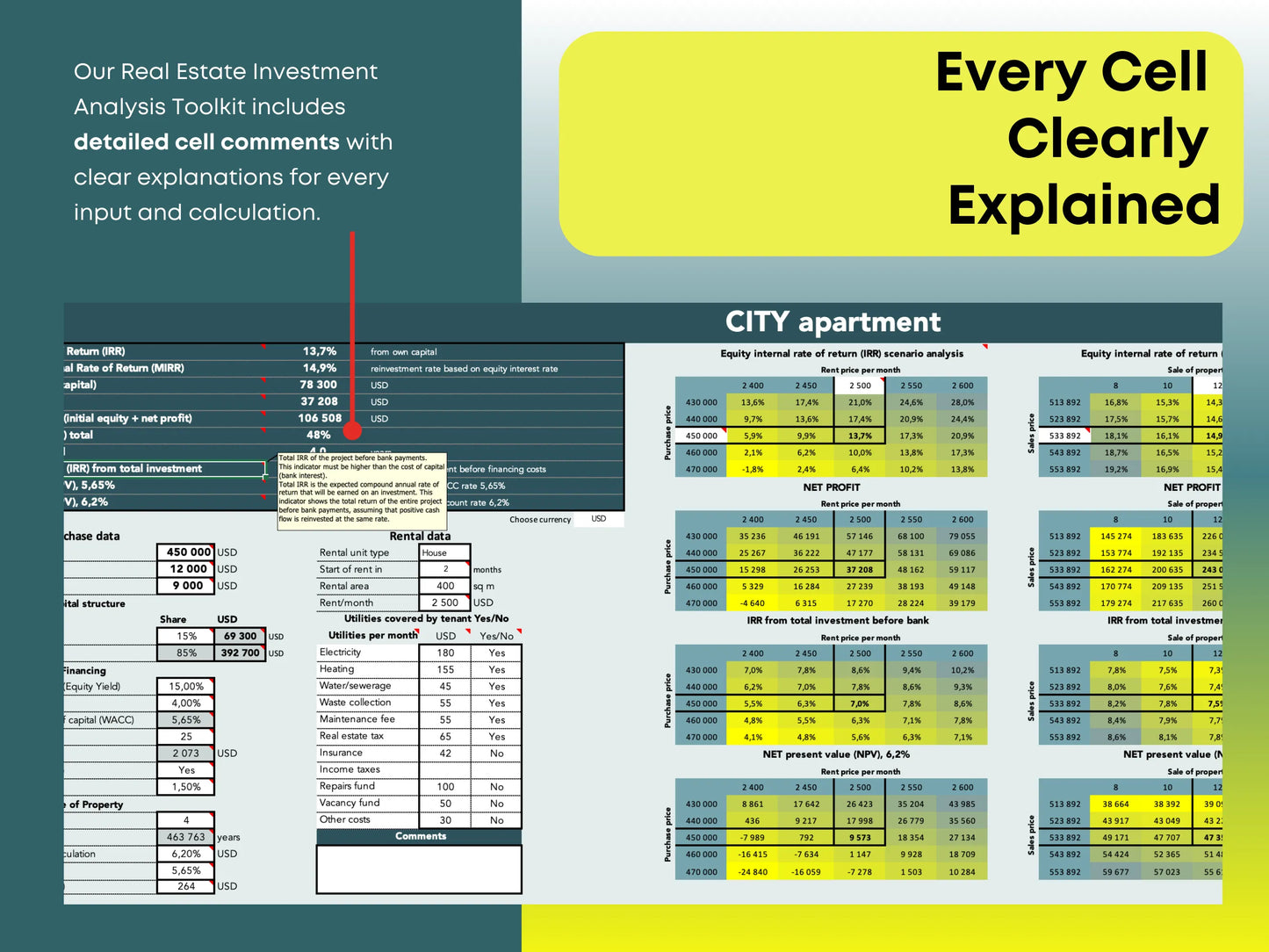

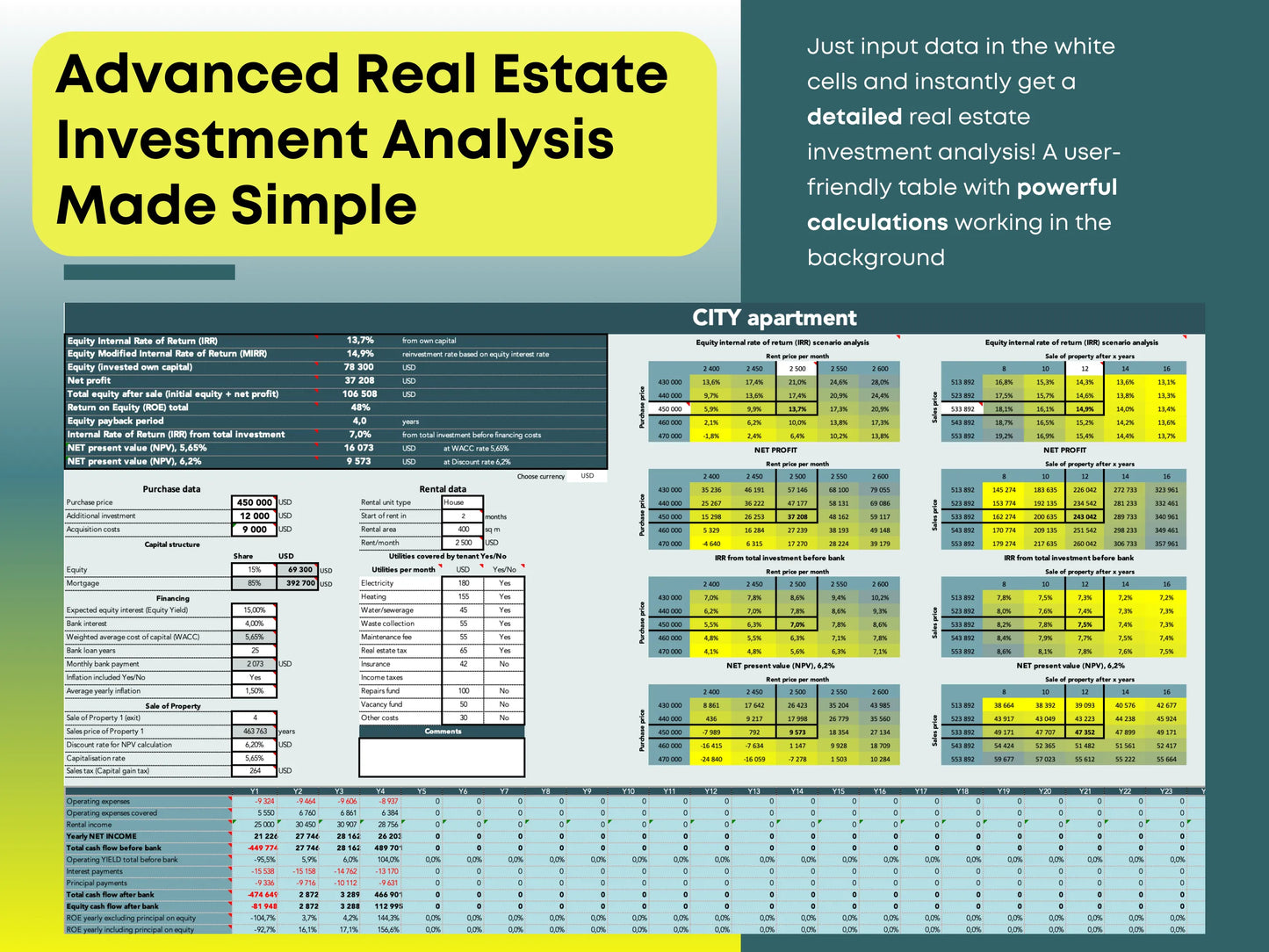

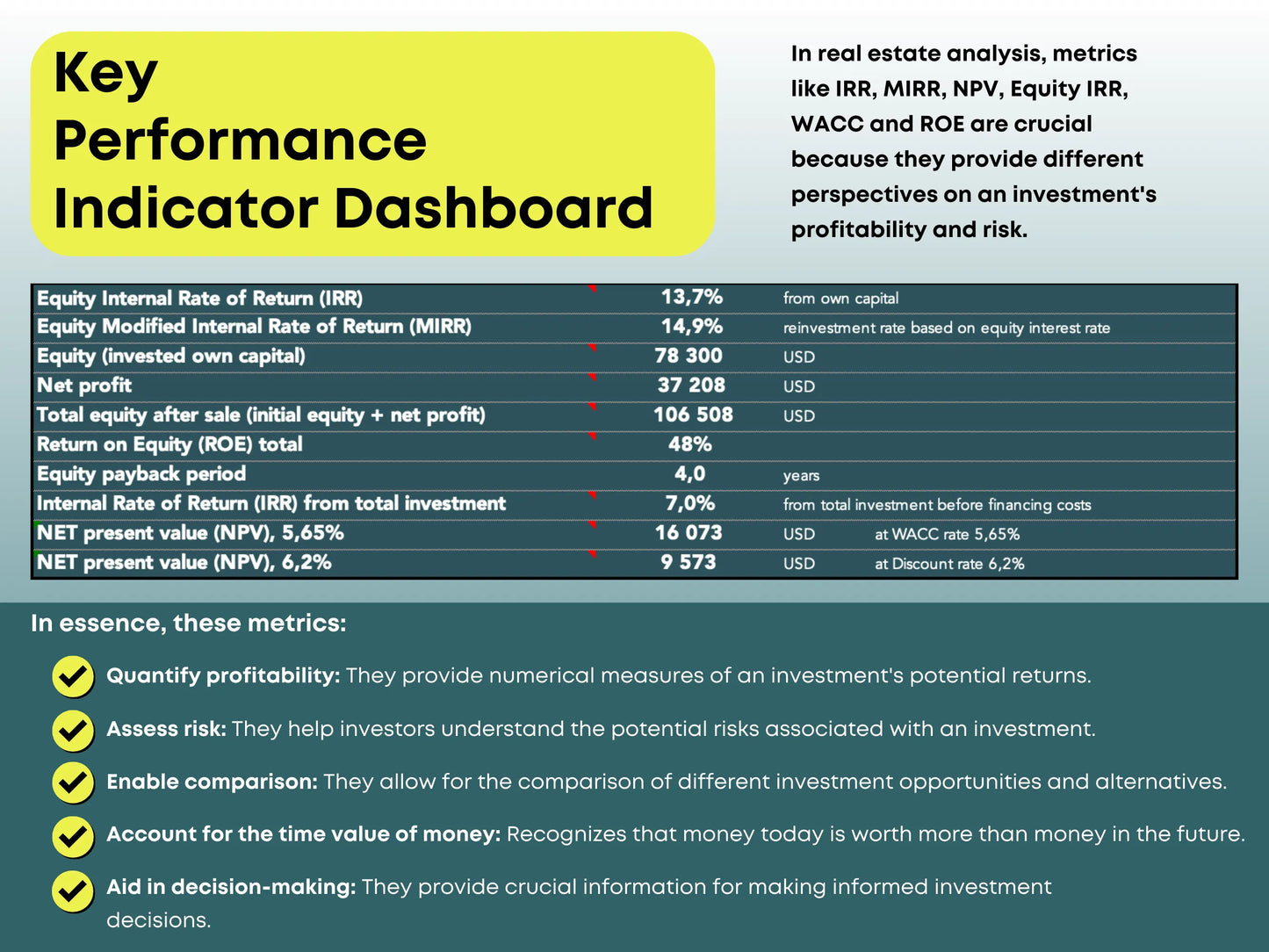

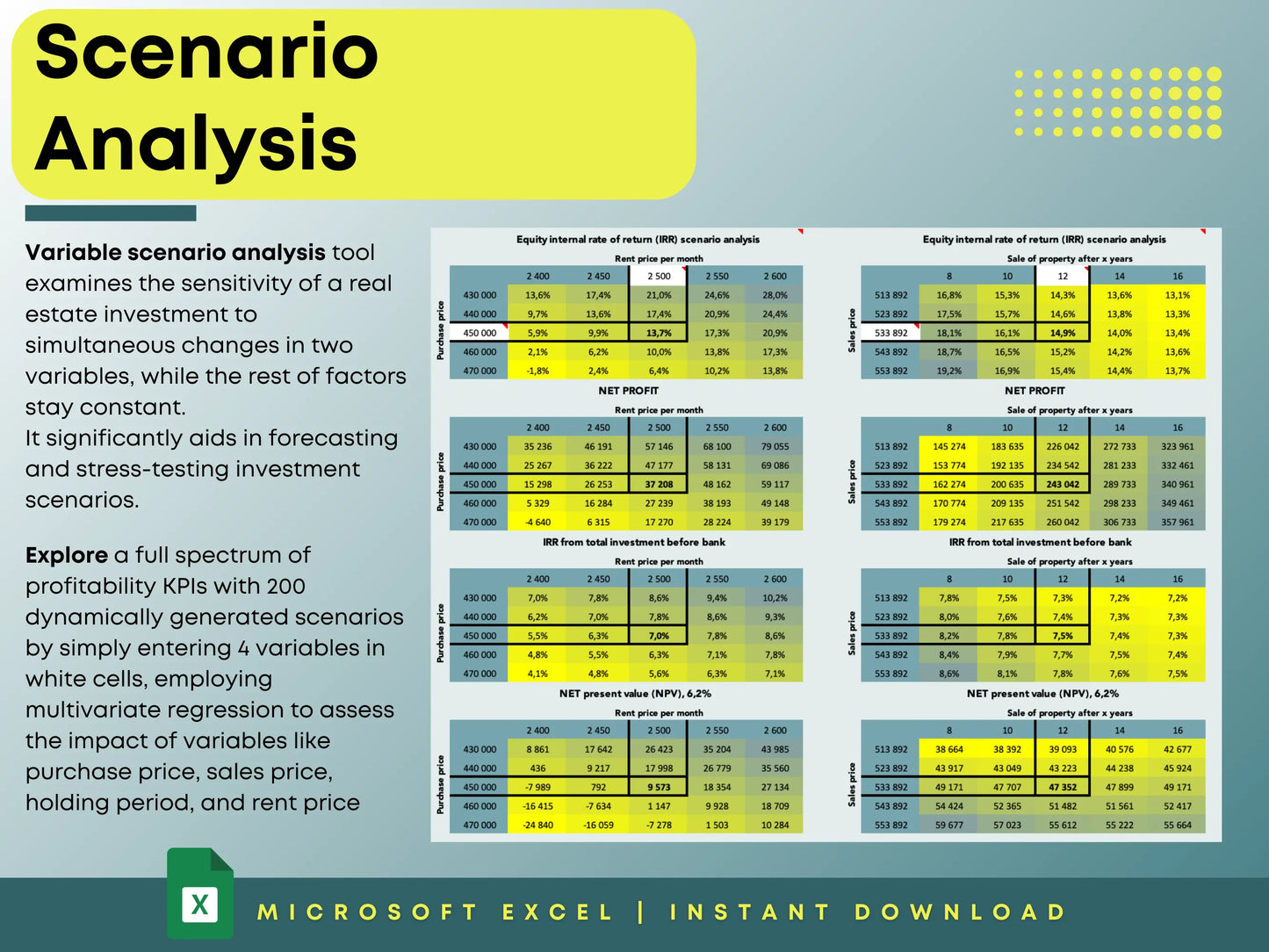

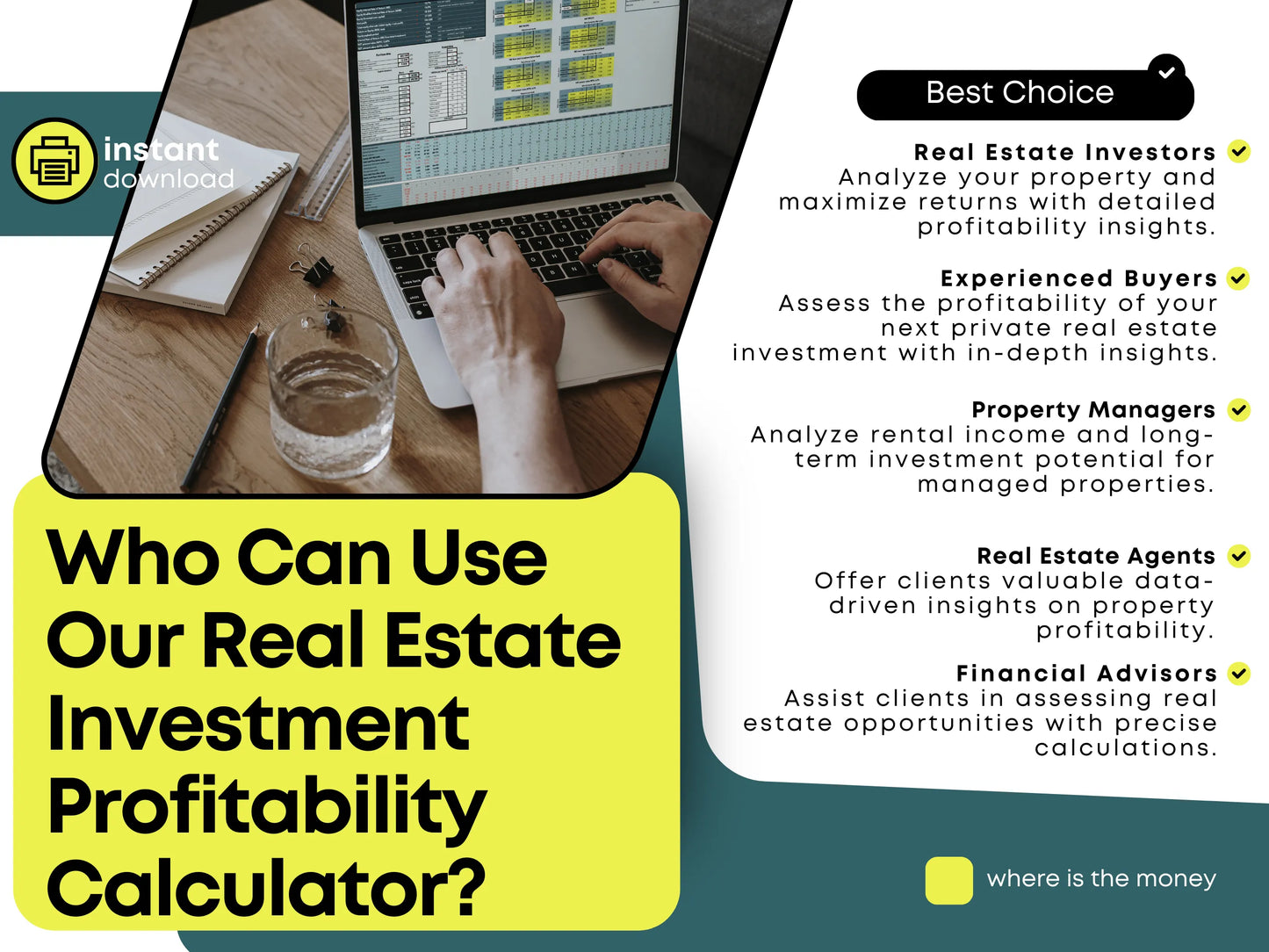

- Use Tools and Templates: Financial planning templates help calculate mortgage payments, equity growth, and investment potential.

Final Thoughts

Using homeownership as a springboard to real estate investing is a proven wealth-building strategy. By leveraging equity, refinancing, and reinvesting in rental properties, homeowners can scale portfolios and generate passive income over time.

This approach requires careful financial planning, market research, and responsible borrowing, but when executed correctly, it allows individuals to grow wealth faster and more efficiently than relying on savings alone.

Would you consider using this strategy to grow your real estate investments? Check out our financial planning templates to evaluate opportunities, manage equity, and start building your real estate portfolio today.