Why Sensitivity Analysis is Essential in Real Estate Investment

Share

Investing in real estate can be one of the smartest ways to build long-term wealth—but it’s also filled with variables. Every property decision involves analyzing dozens of numbers: purchase price, rental income, mortgage rates, operating costs, and expected appreciation.

These figures guide your investment choices—but what happens when reality shifts? Market conditions change, interest rates rise, or your property stays vacant longer than expected. That’s where sensitivity analysis in real estate investment becomes invaluable.

What Is Sensitivity Analysis in Real Estate?

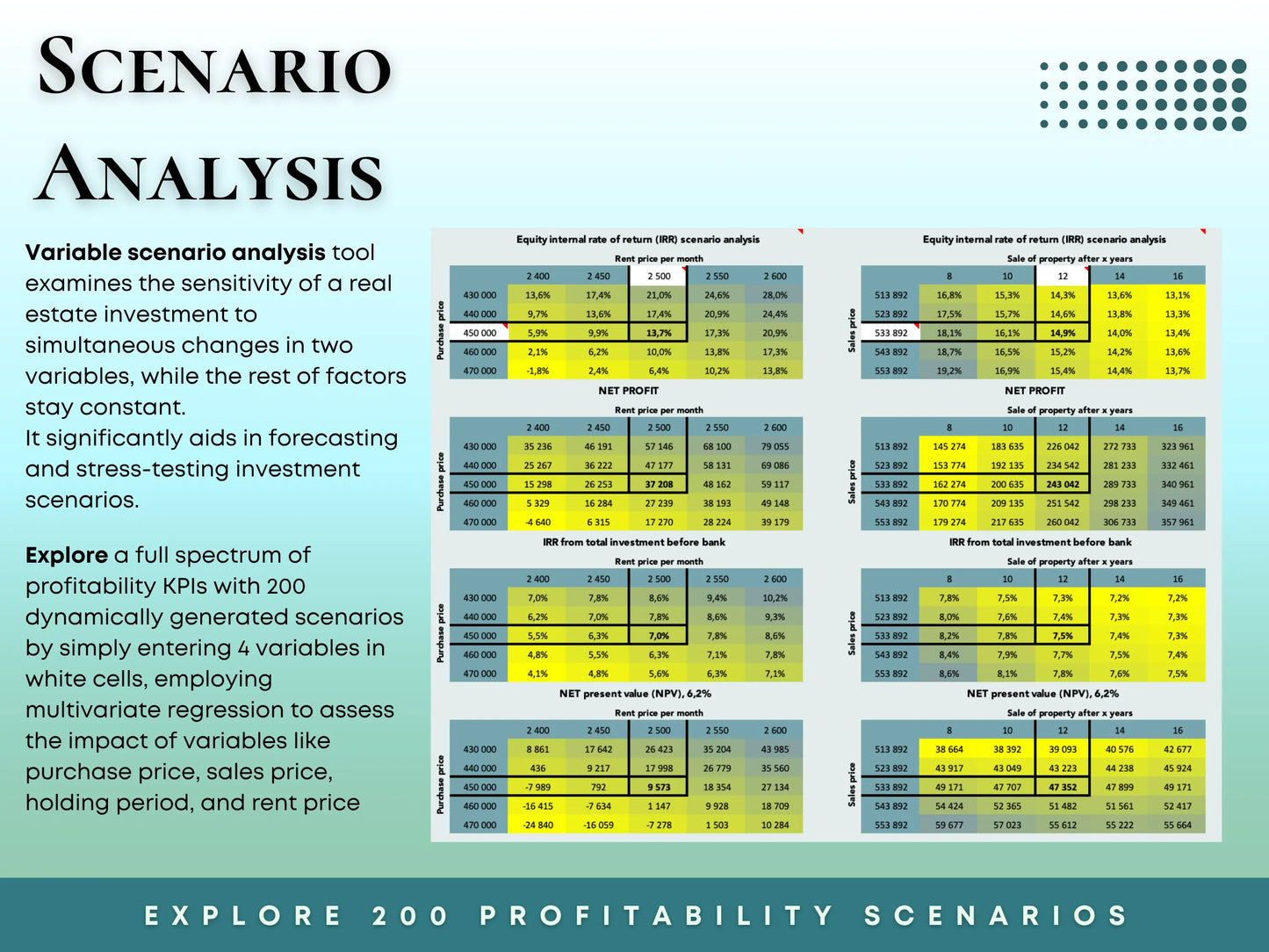

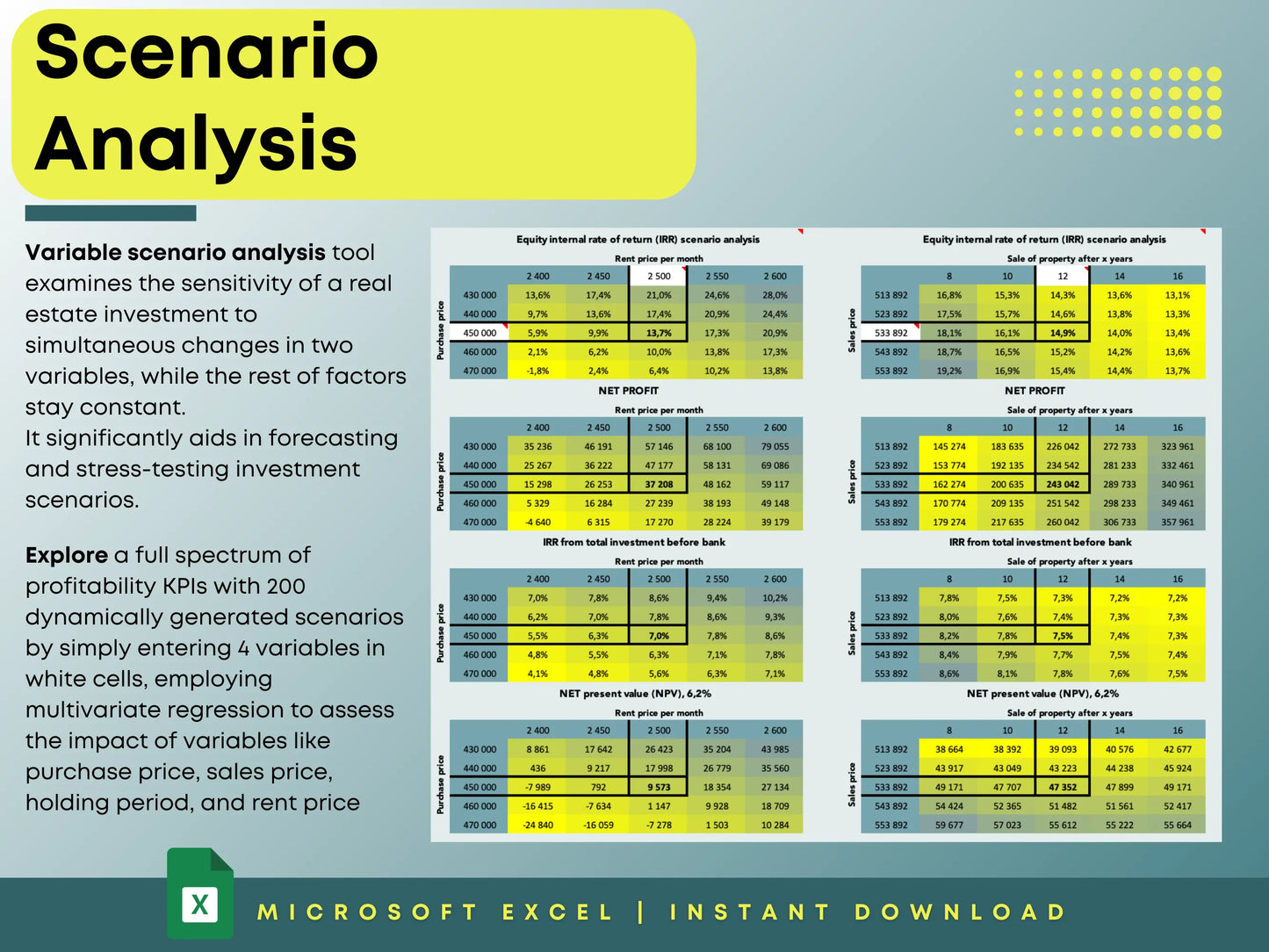

Sensitivity analysis, also known as what-if or scenario analysis, is a financial modeling technique used to test how different assumptions affect your investment results.

It helps you answer key questions like:

- What happens to cash flow if rental income drops by 10%?

- How does a 1% increase in mortgage interest rate affect your ROI?

- What if the purchase price ends up 5–10% higher than expected?

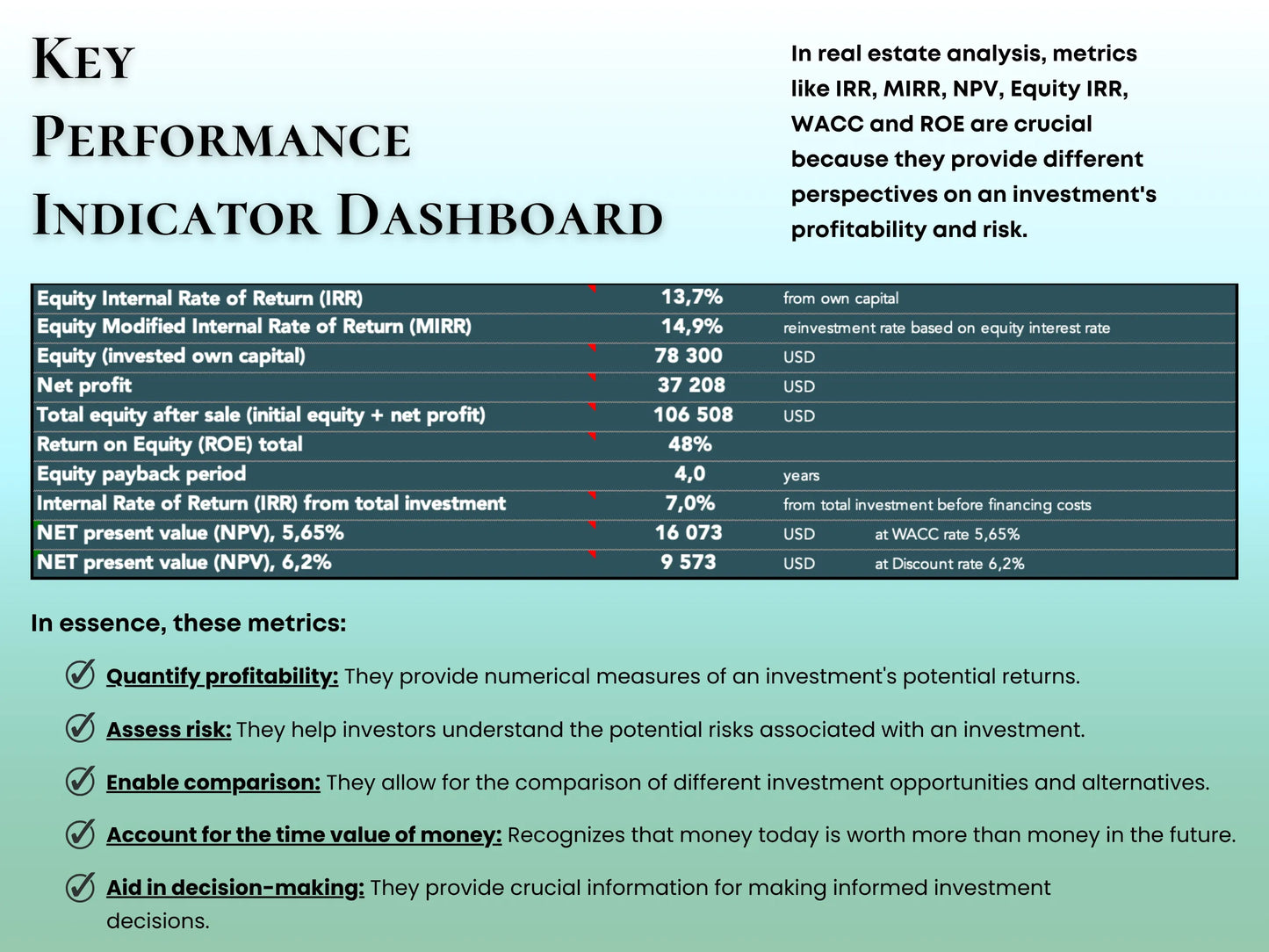

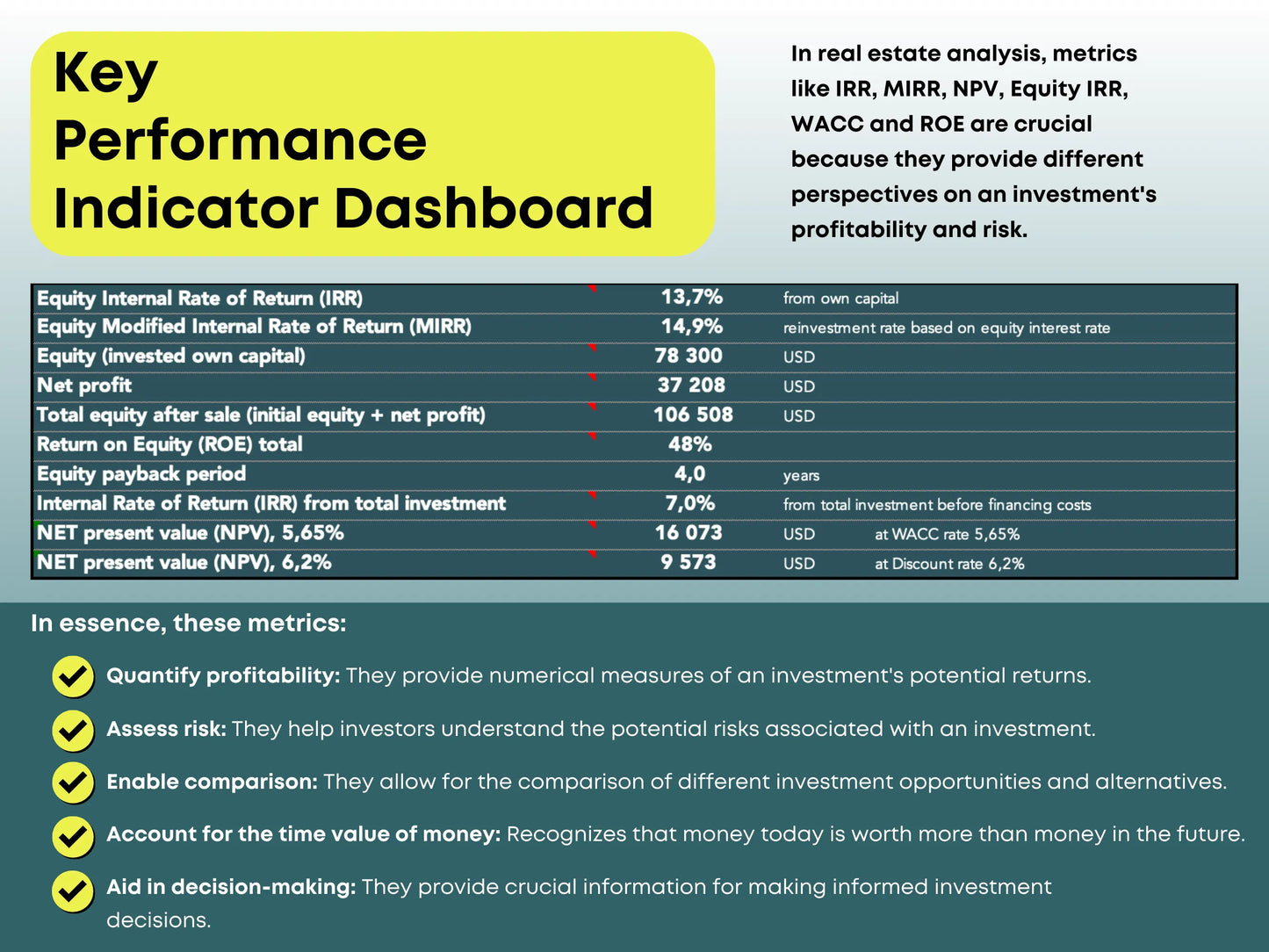

By running these simulations, investors can measure risk exposure, identify break-even points, and make data-driven decisions.

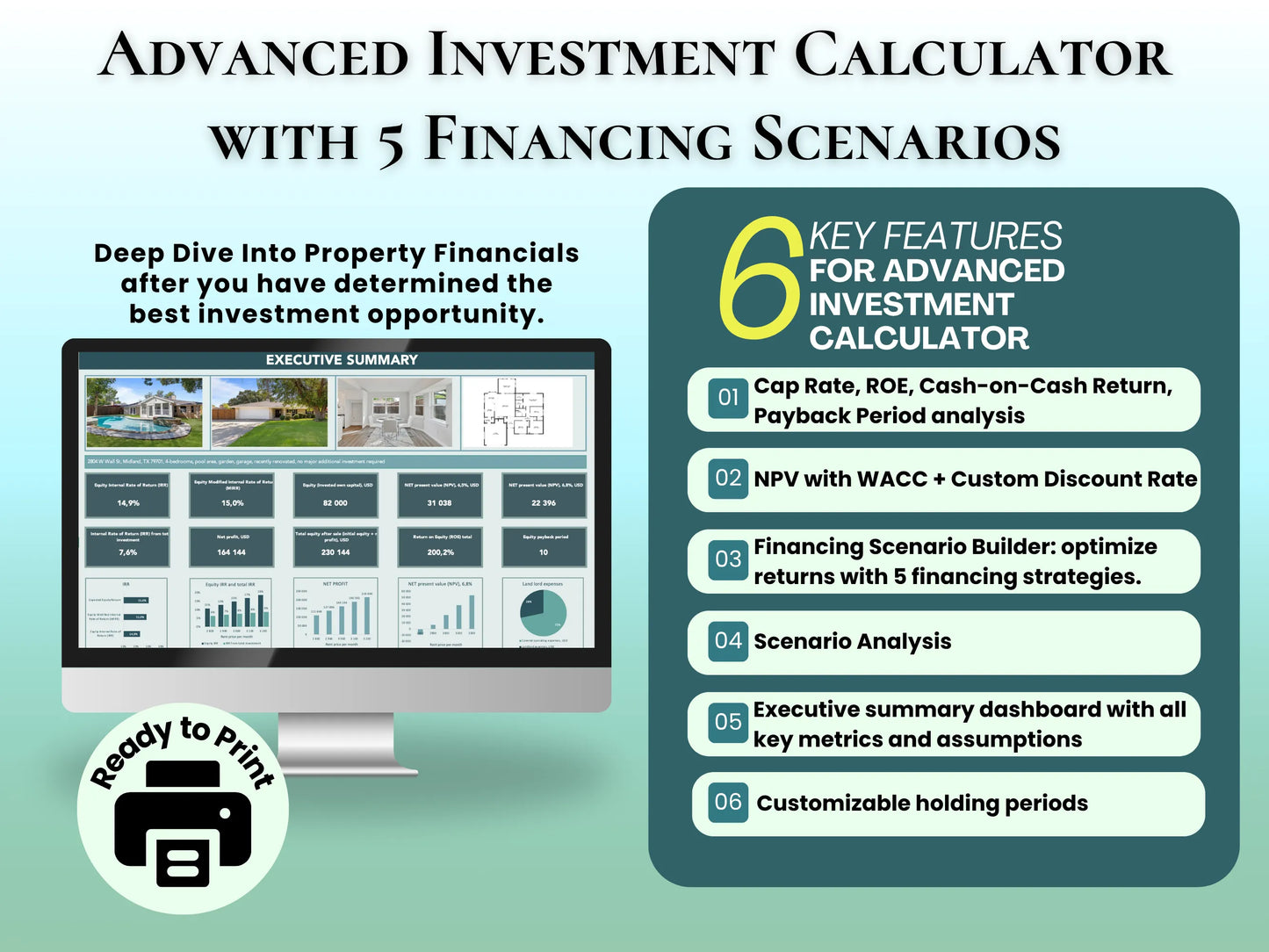

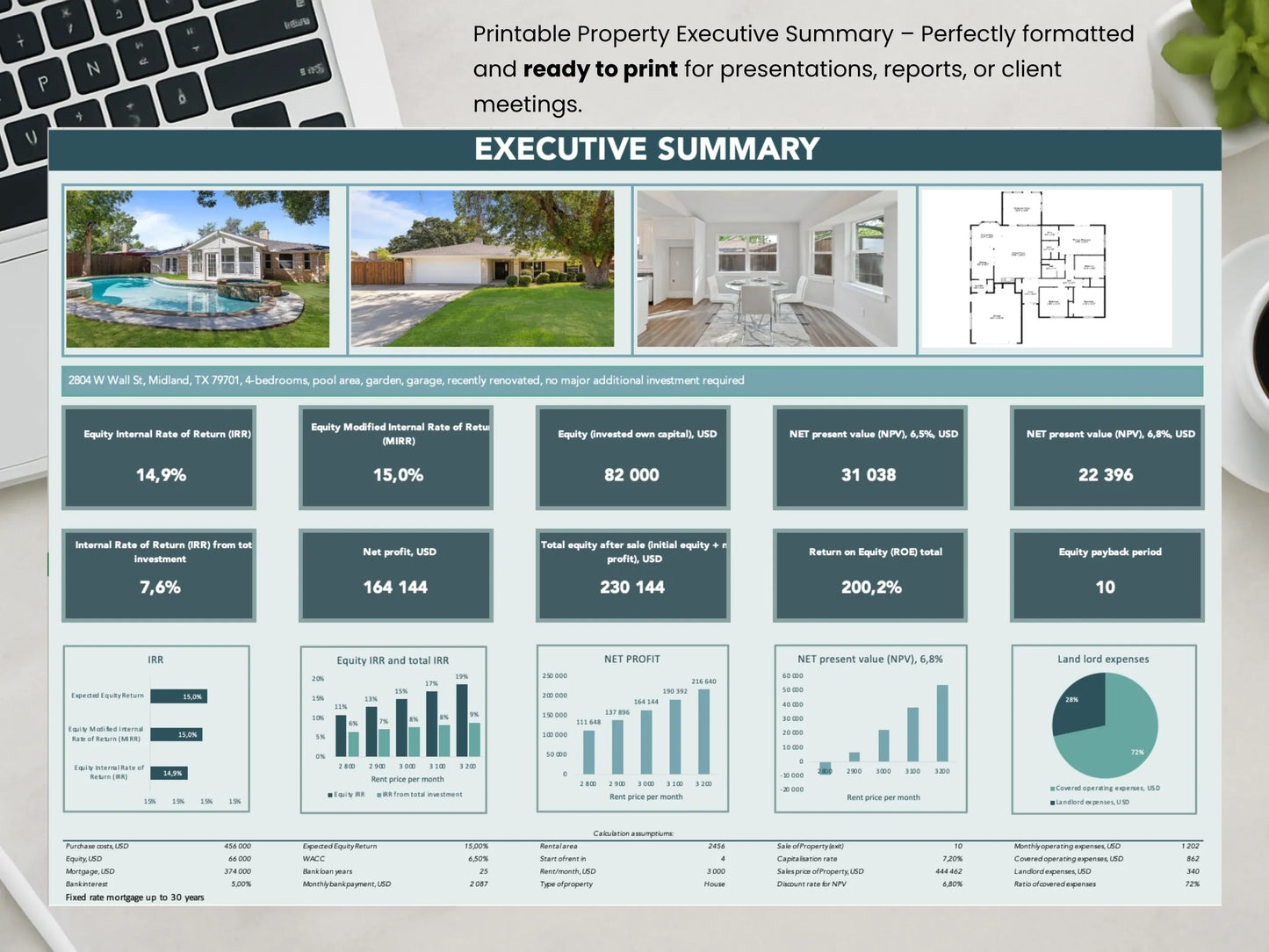

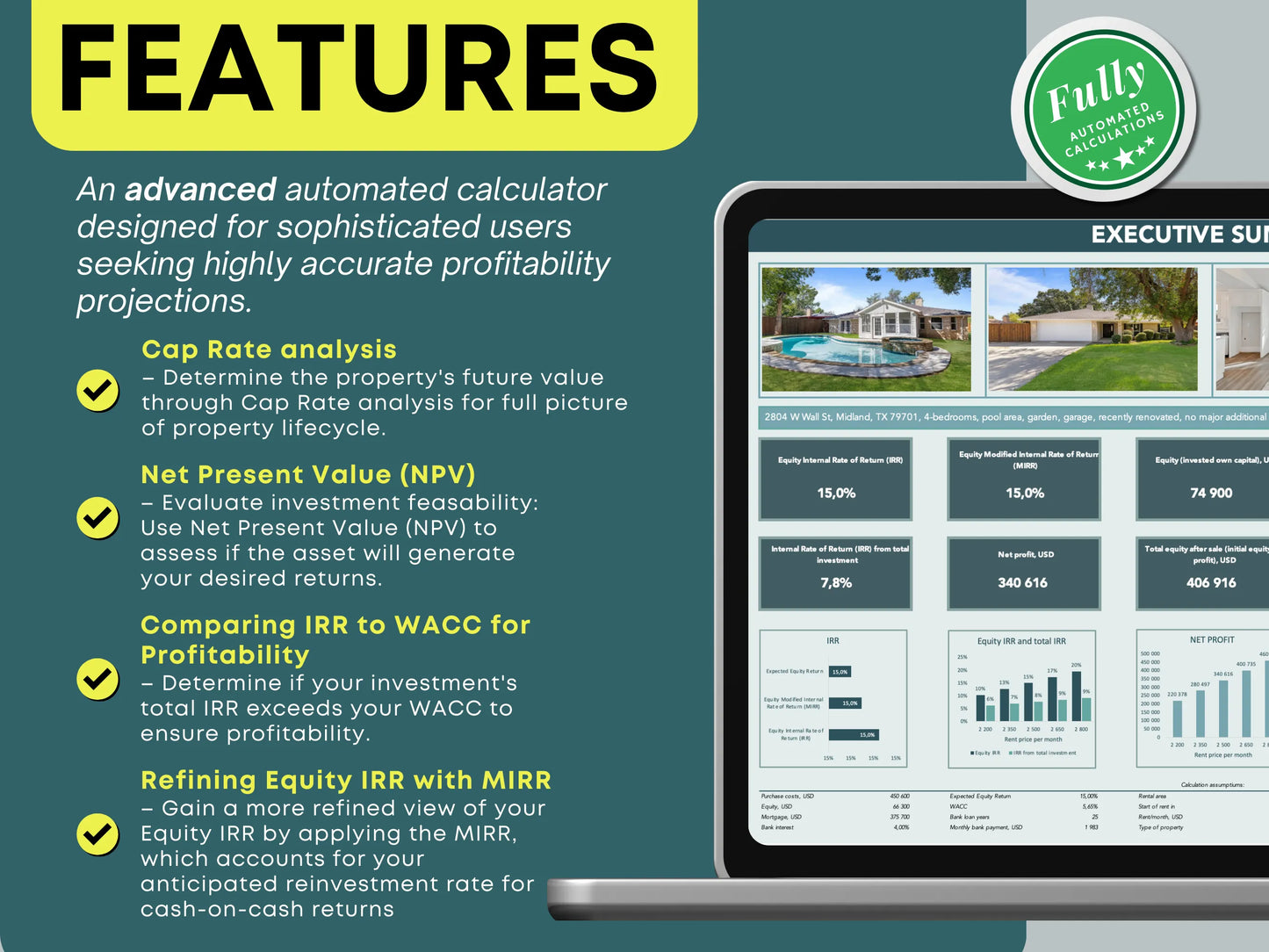

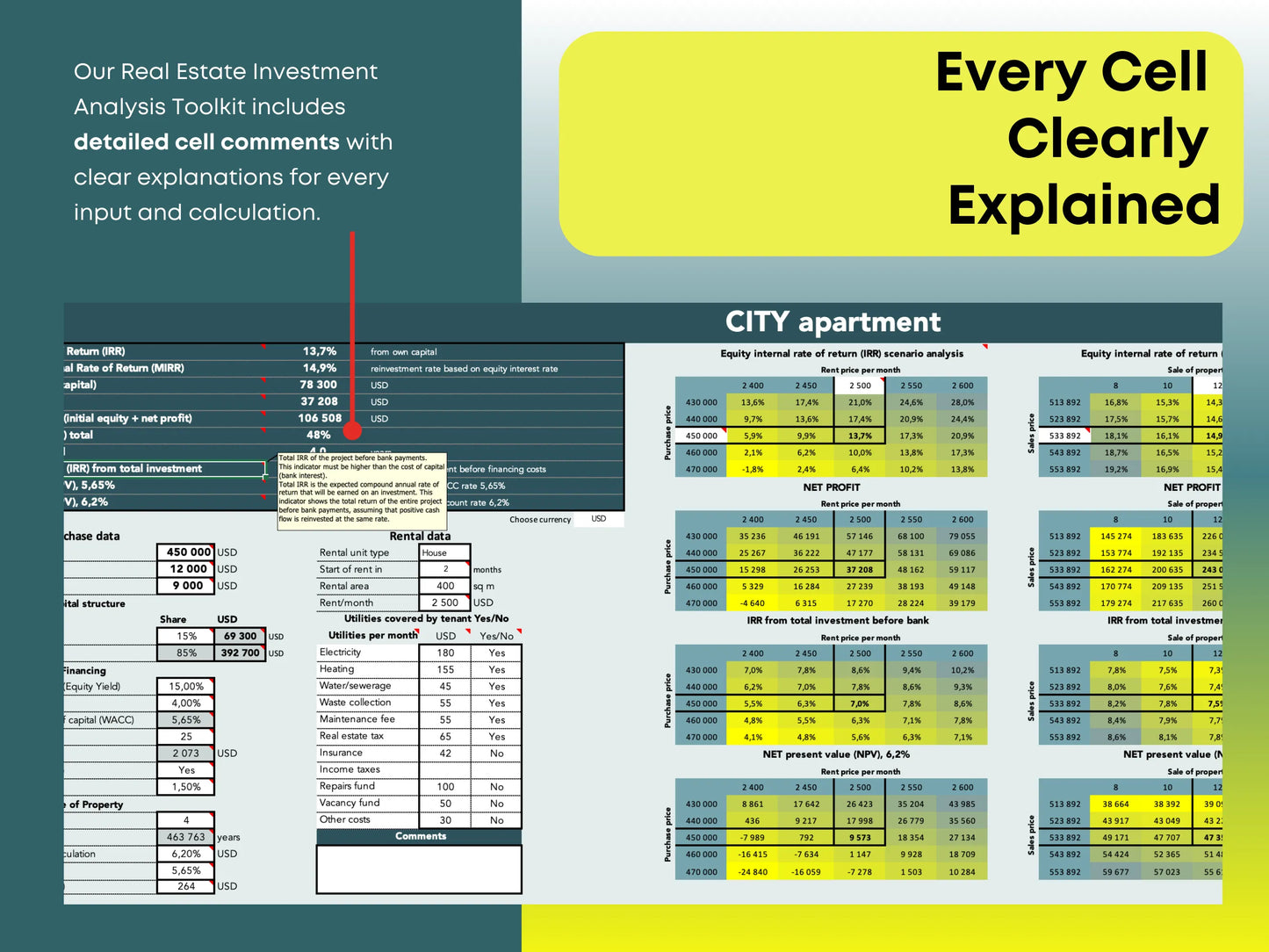

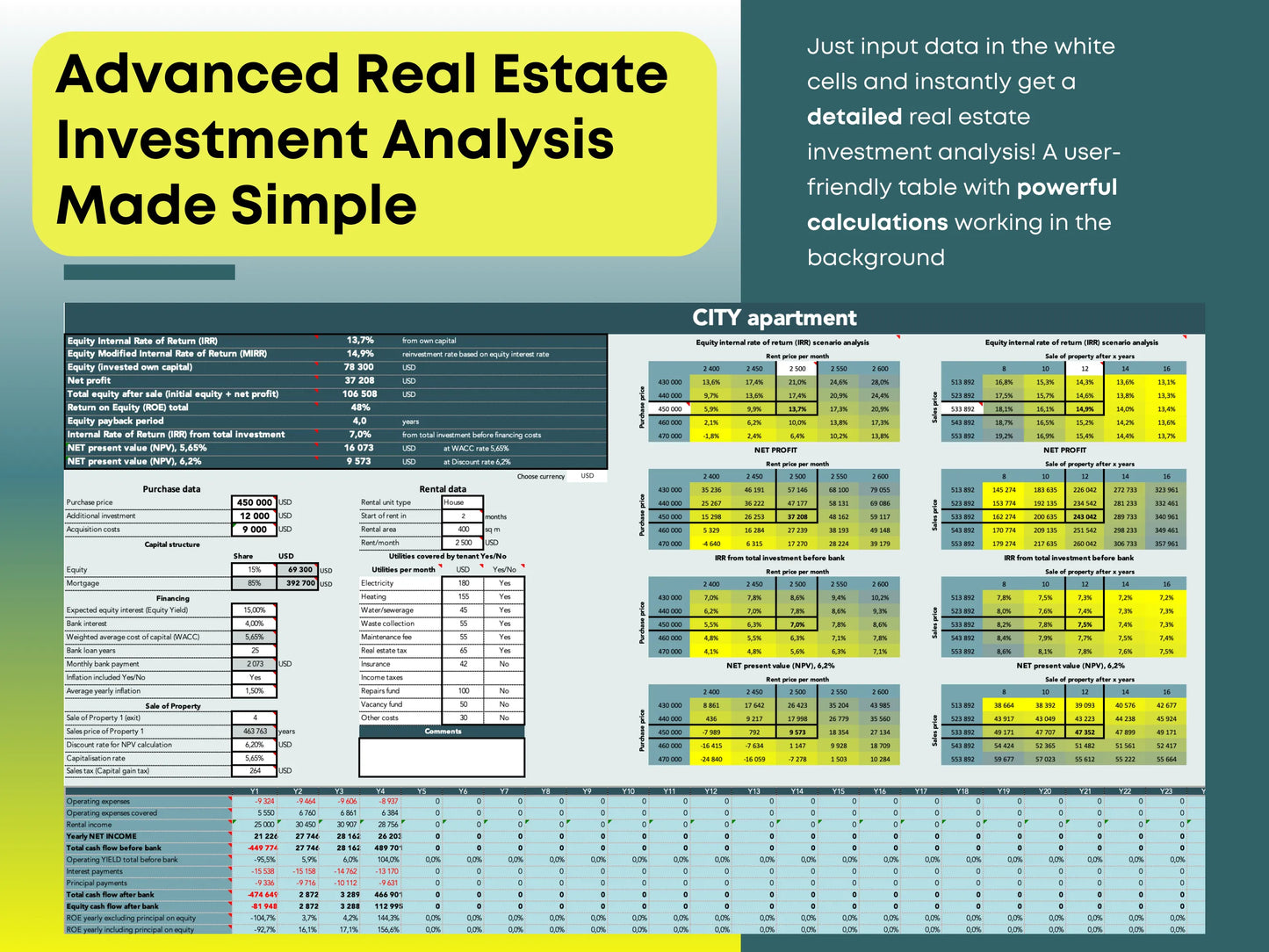

Our real estate investment calculators include built-in sensitivity analysis tools—so you can test multiple scenarios instantly without manual recalculations.

Why Sensitivity Analysis Matters in Real Estate Investment

1. It Protects You from Risk

Every property investment involves uncertainty. Sensitivity analysis helps you quantify those risks and see how sensitive your deal is to changes in key factors like rent, expenses, and financing rates.

For example, you might discover that your investment stays profitable even if rent drops 15%. Or you may find that a small increase in interest rates could push cash flow negative—vital information before signing a mortgage.

2. It Improves Decision-Making

Relying on one “best guess” scenario can lead to mistakes. Sensitivity analysis allows you to explore multiple outcomes—helping you set realistic expectations and safer financing terms.

This approach ensures you make informed decisions instead of hoping everything goes perfectly.

3. It Builds Credibility with Lenders and Investors

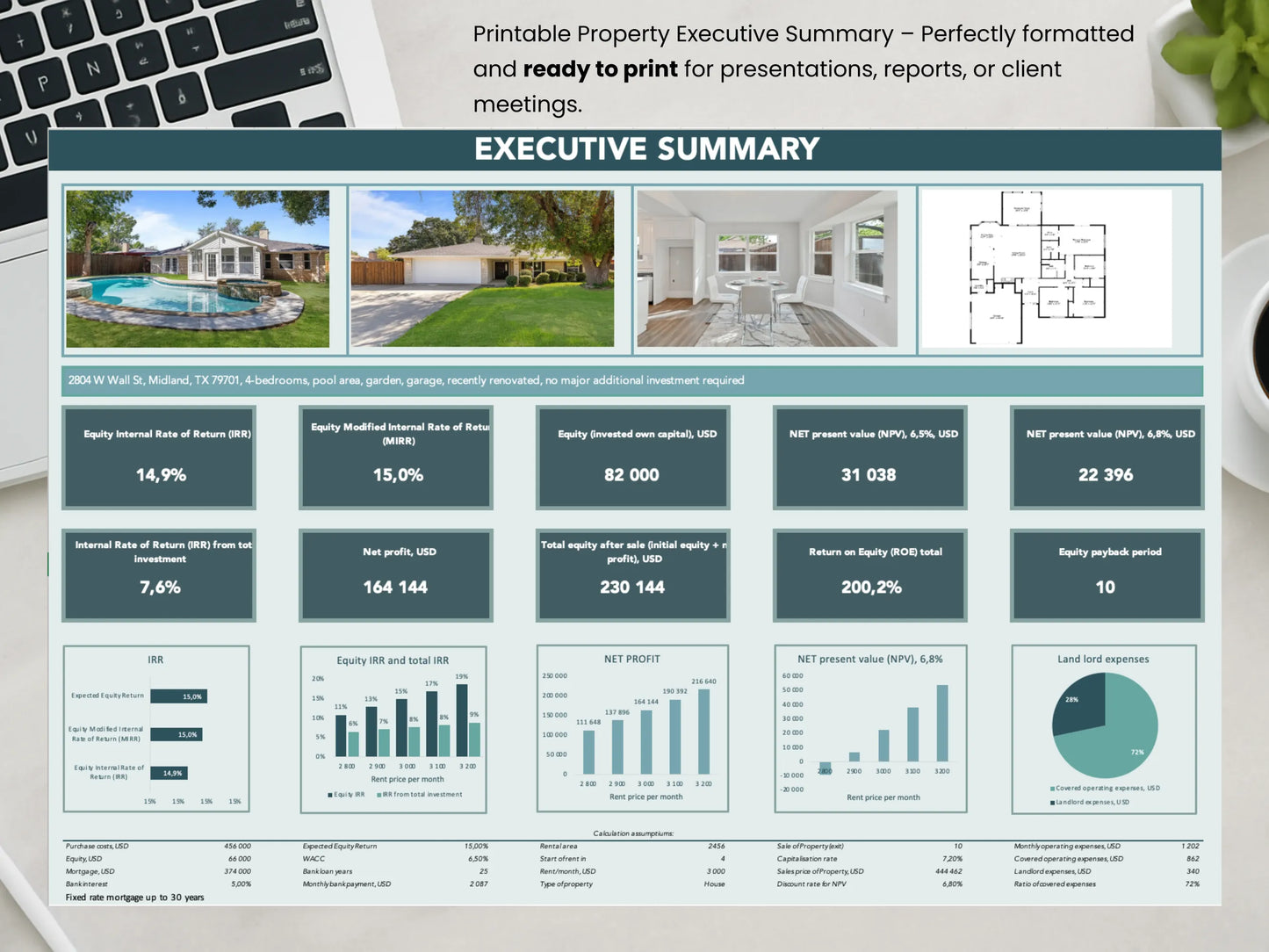

Presenting scenario-tested financial models shows professionalism and due diligence. Lenders and investors trust you more when they see that your cash flow, ROI, and debt service coverage ratio (DSCR) have been tested against multiple conditions.

Key Variables to Include in Your Sensitivity Analysis

1. Purchase Price

The purchase price has the biggest impact on your returns. A higher purchase price reduces your ROI, while getting a discount increases potential profit.

Test how your numbers change if the property costs 5–10% more or less than expected. For instance:

- Base case: $300,000

- Low scenario: $270,000

- High scenario: $330,000

You’ll instantly see how your NPV, ROI, and IRR shift across scenarios—helping you set a maximum purchase price you can afford.

2. Rental Income

Your rental income is the foundation of your real estate returns. But it can fluctuate due to tenant turnover, market conditions, or local competition.

Use sensitivity analysis to model three scenarios:

- Optimistic: Rent +10% higher than expected

- Base case: Rent meets your projections

- Conservative: Rent –10% lower than expected

This analysis helps identify your break-even rent—the minimum amount needed to cover all expenses and debt payments.

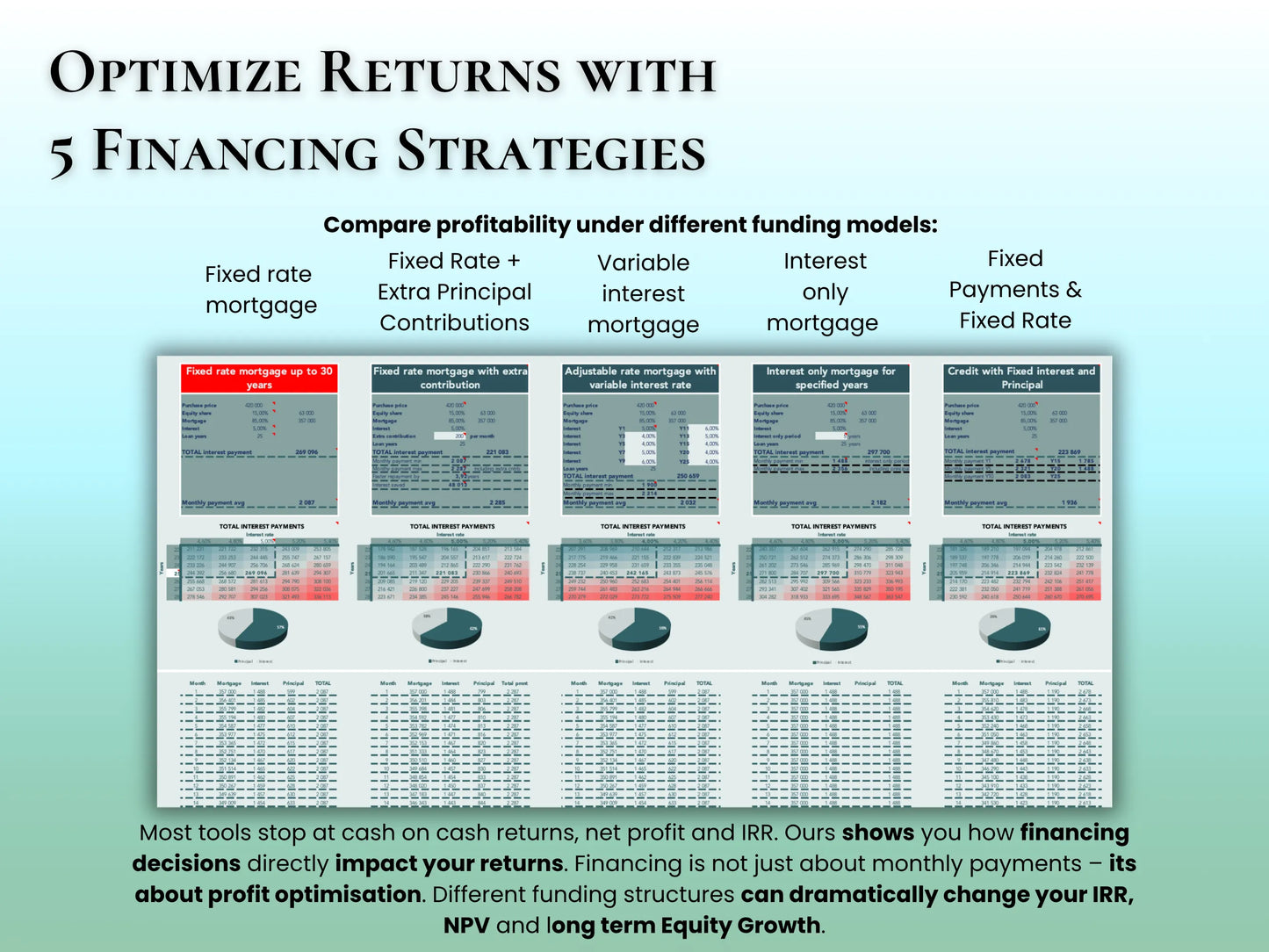

3. Mortgage Interest Rate

Interest rates can dramatically change your profitability. Even a 1% difference in mortgage rate can alter your monthly payments and cash flow.

By testing rate changes (e.g., from 5% to 7%), you can identify:

- The maximum rate your investment can handle

- The cash flow impact of rising rates

- The best leverage ratio for your financing

This is especially important in today’s unpredictable rate environment.

How to Perform a Sensitivity Analysis (Step-by-Step)

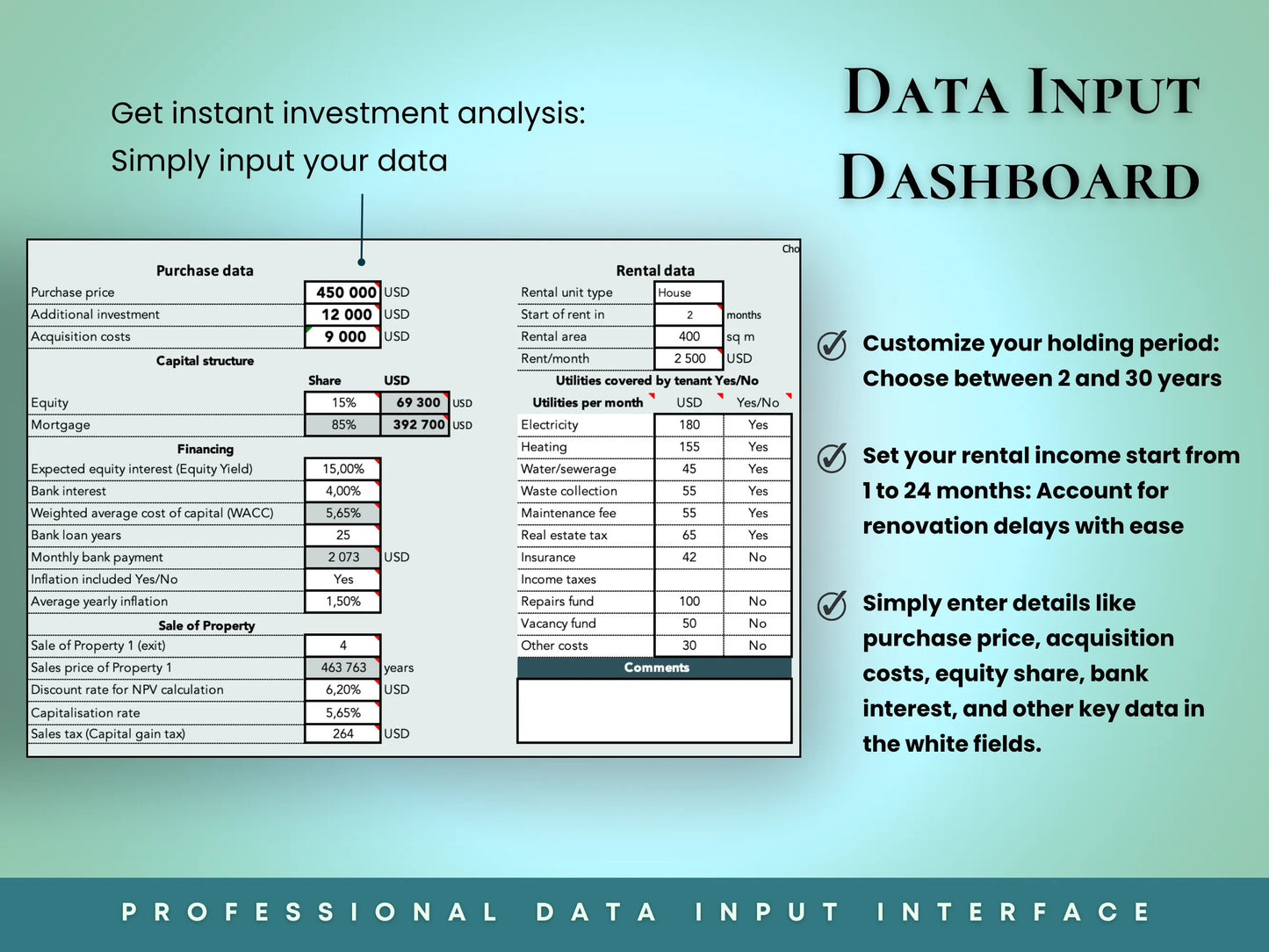

Step 1: Build Your Financial Model

Start with a spreadsheet or a real estate calculator that includes:

- Purchase price

- Rent income

- Operating expenses

- Mortgage terms

- Property appreciation

You can use Excel, Google Sheets, or specialized tools with built-in automation.

Step 2: Define Your Variable Ranges

Set realistic ranges for your key inputs. For example:

- Rent: $1,200–$1,500

- Interest rate: 5–7%

- Purchase price: $270,000–$330,000

Step 3: Create Scenarios

Combine your ranges into best-case, base-case, and worst-case scenarios.

|

Scenario |

Purchase Price |

Rent Income |

Interest Rate |

|

Best Case |

$270,000 |

$1,500 |

5% |

|

Base Case |

$300,000 |

$1,350 |

5.5% |

|

Worst Case |

$330,000 |

$1,200 |

6% |

For each scenario, calculate cash flow, ROI, IRR, and NPV.

Step 4: Analyze the Results

Now, review how your results change. Ask yourself:

- Can the property stay profitable if rent decreases?

- Does paying a higher price drastically cut ROI?

- At what rate does cash flow become negative?

This gives you a clear, data-backed understanding of the strength and stability of your investment.

Advanced Tips for Accurate Sensitivity Analysis

- Test multiple variables at once. Real life doesn’t change one number at a time. Try adjusting rent, price, and interest rate together for realistic results.

- Incorporate macro factors. Include inflation, vacancy rates, or tax changes to see broader impacts.

- Use automated calculators. Tools with built-in scenario elasticity save time and eliminate formula errors.

Common Mistakes to Avoid

- Ignoring worst-case scenarios. Don’t just test small variations—include extreme cases to prepare for downturns.

- Overcomplicating your model. Too much detail can hide key insights. Focus on the top variables.

- Forgetting qualitative factors. Numbers matter, but so do tenant quality, location trends, and property condition.

Final Thoughts: Make Smarter Real Estate Decisions

Real estate investing will always carry uncertainty—but uncertainty doesn’t have to mean risk.

Sensitivity analysis gives investors a clear, structured way to forecast outcomes, prepare for volatility, and protect returns.

By testing variables like purchase price, rent income, and interest rates, you’ll know exactly how your investment performs under pressure. It’s one of the most practical ways to build confidence, manage risk, and increase profitability.

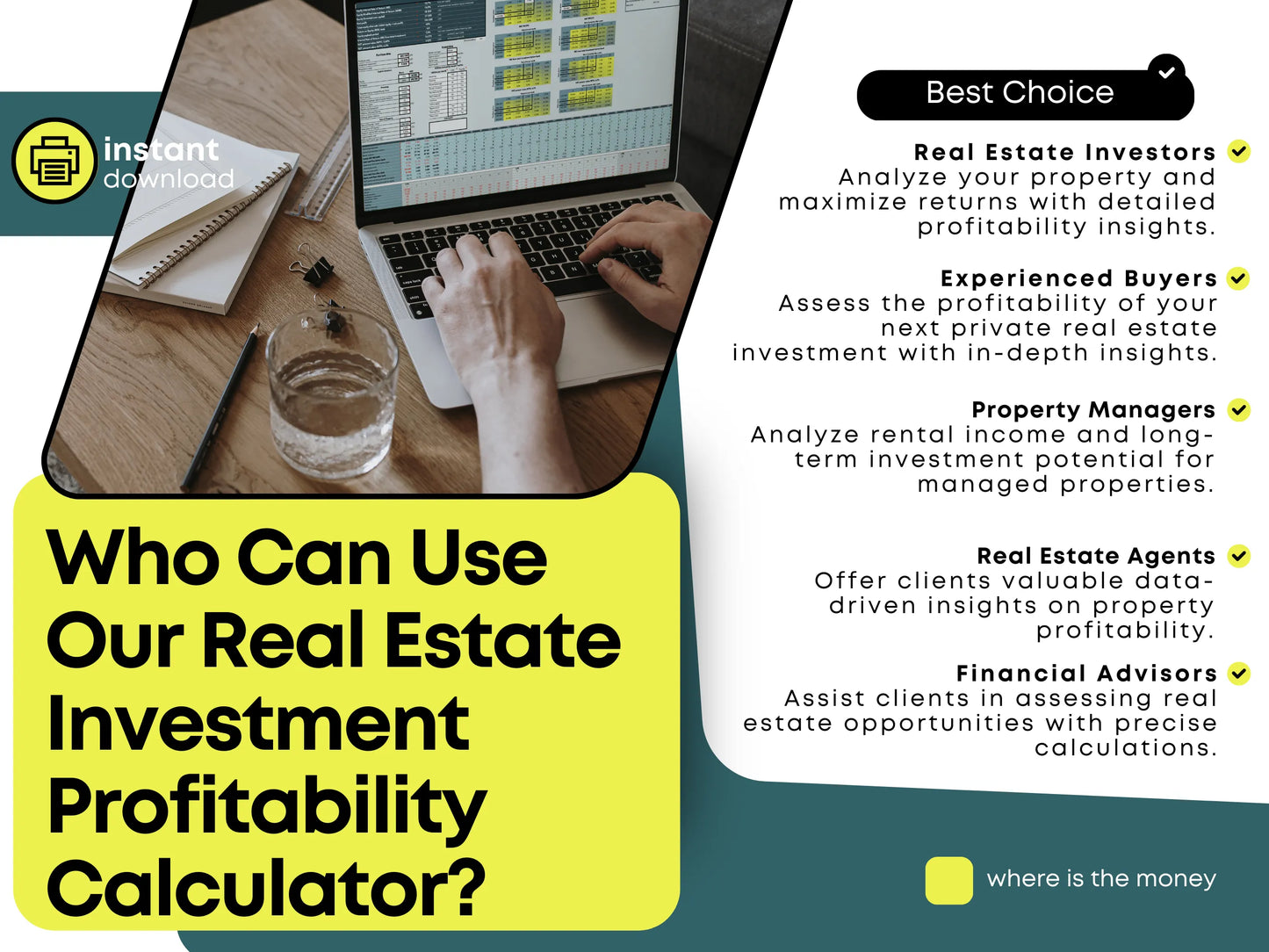

👉 Try our Real Estate Investment Calculators in Excel — featuring automated sensitivity and scenario analysis. Easily compare outcomes, adjust assumptions, and make smarter, data-driven investment decisions.