Understanding Real Estate Net Present Value (NPV): A Complete Guide for Investors

Share

When evaluating a property investment, one of the most important financial metrics to understand is Net Present Value (NPV). In real estate investment analysis, NPV determines whether a deal creates value after accounting for the time value of money, financing costs, and your exit strategy.

This comprehensive guide explains what NPV means in real estate, why it’s crucial, how to calculate it, common mistakes investors make, and strategies to improve your analysis. By the end, you’ll understand why experienced investors never make a decision without running an NPV calculation.

What Is Net Present Value (NPV) in Real Estate?

Net Present Value (NPV) measures how much an investment is worth in today’s dollars after considering a series of cash inflows and outflows.

Cash Inflows

These include:

- Rental income – steady monthly or annual payments from tenants

- Property appreciation – the increase in property value over time

- Sale proceeds – cash received from selling the property at the end of the holding period

Cash Outflows

These include:

- Operating expenses – maintenance, insurance, property taxes, utilities

- Financing costs – loan interest and principal repayment

- Other costs – vacancies, capital improvements, and transaction fees

The NPV formula discounts future cash flows into today’s value using your discount rate, which is your required rate of return or cost of capital.

- Positive NPV: The investment is expected to generate returns above your target.

- Negative NPV: The investment may destroy value relative to your cost of capital.

NPV allows you to compare properties of different sizes, locations, and financing structures by standardizing returns in today’s dollars. Whether you’re investing in residential rentals, commercial real estate, or mixed-use properties, NPV is a core part of your decision-making toolkit.

Why NPV Is Critical in Real Estate Investment Analysis

1. Accounts for the Time Value of Money

The principle is simple: a dollar today is worth more than a dollar tomorrow. Rental income, tax benefits, and eventual sale proceeds occur over time, and NPV converts these future cash flows into present value.

By doing so, you can answer key questions:

- Is the property generating enough value today to justify the purchase?

- How much will future cash flows contribute to overall profitability?

2. Evaluates Investment Opportunities

NPV acts as a go/no-go signal. For example, if your required rate of return is 8%:

- Positive NPV → The property is financially viable

- Negative NPV → You may need to renegotiate or look elsewhere

This helps investors avoid overpaying for properties or committing to projects that won’t create wealth over time.

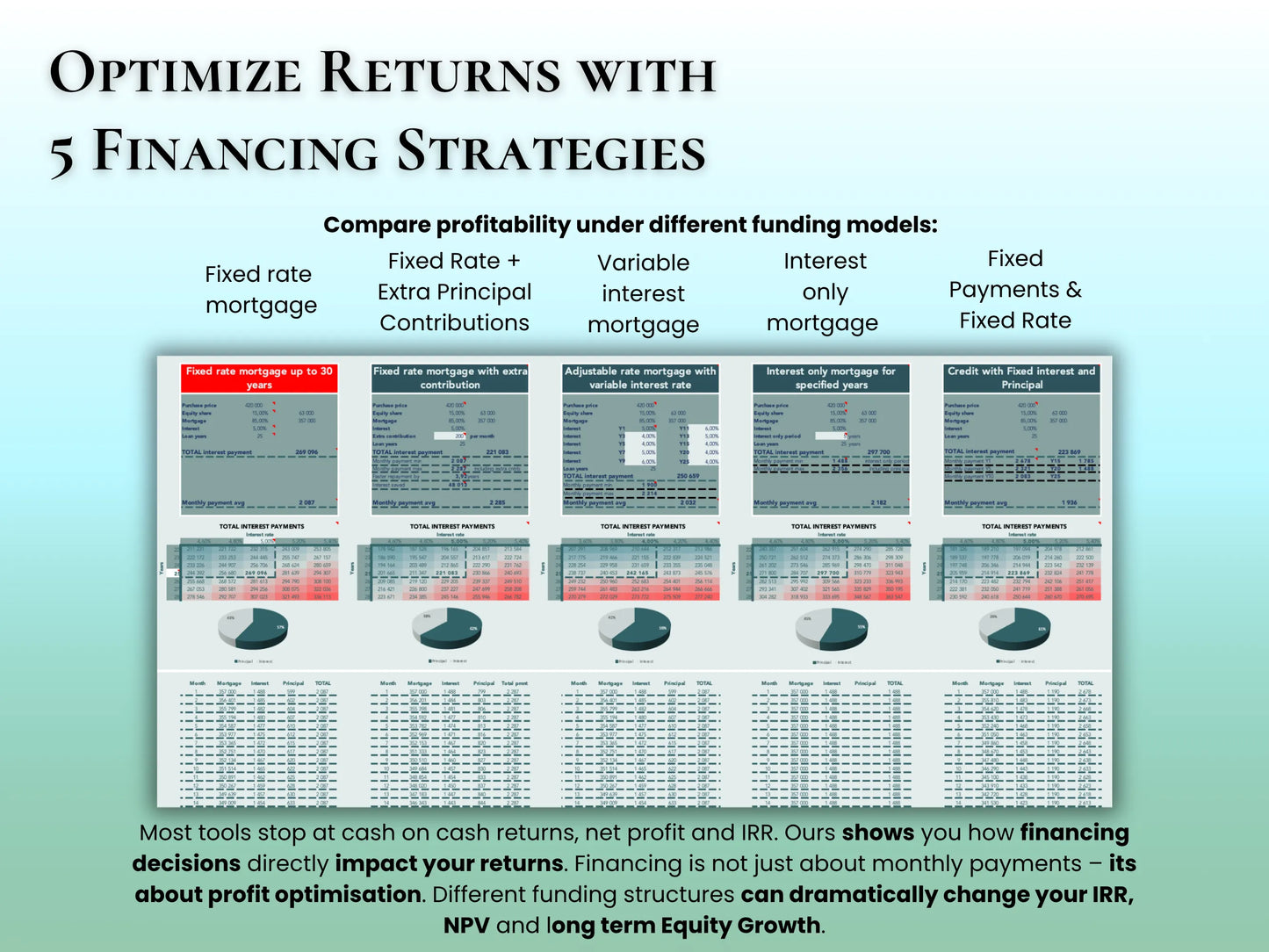

3. Improves Financing Decisions

Most real estate deals involve some form of debt. NPV allows you to analyze:

- Interest payments

- Loan amortization

- Equity contributions

If NPV stays positive after accounting for financing, you know the property still adds value even when leveraged.

4. Protects Equity Returns

In leveraged deals, debt holders are paid first. Negative NPV can shrink equity returns even if cash flow looks healthy. This makes NPV analysis critical for capital protection.

How to Use NPV in Real Estate Investment Analysis

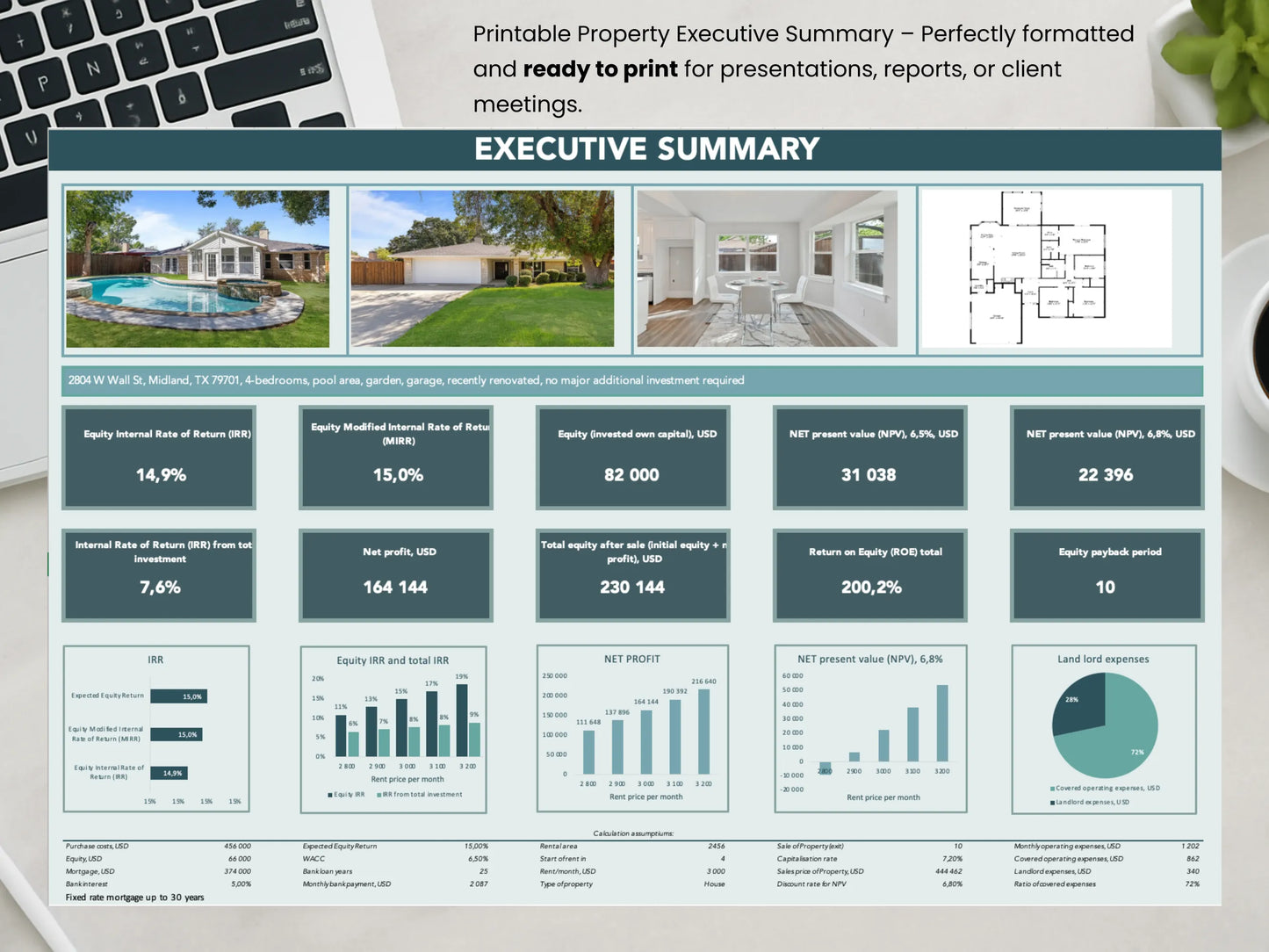

Compare Multiple Properties

Two properties may appear similar based on gross income or cap rate. But once you calculate NPV, the property with a higher positive NPV usually provides more value in real terms.

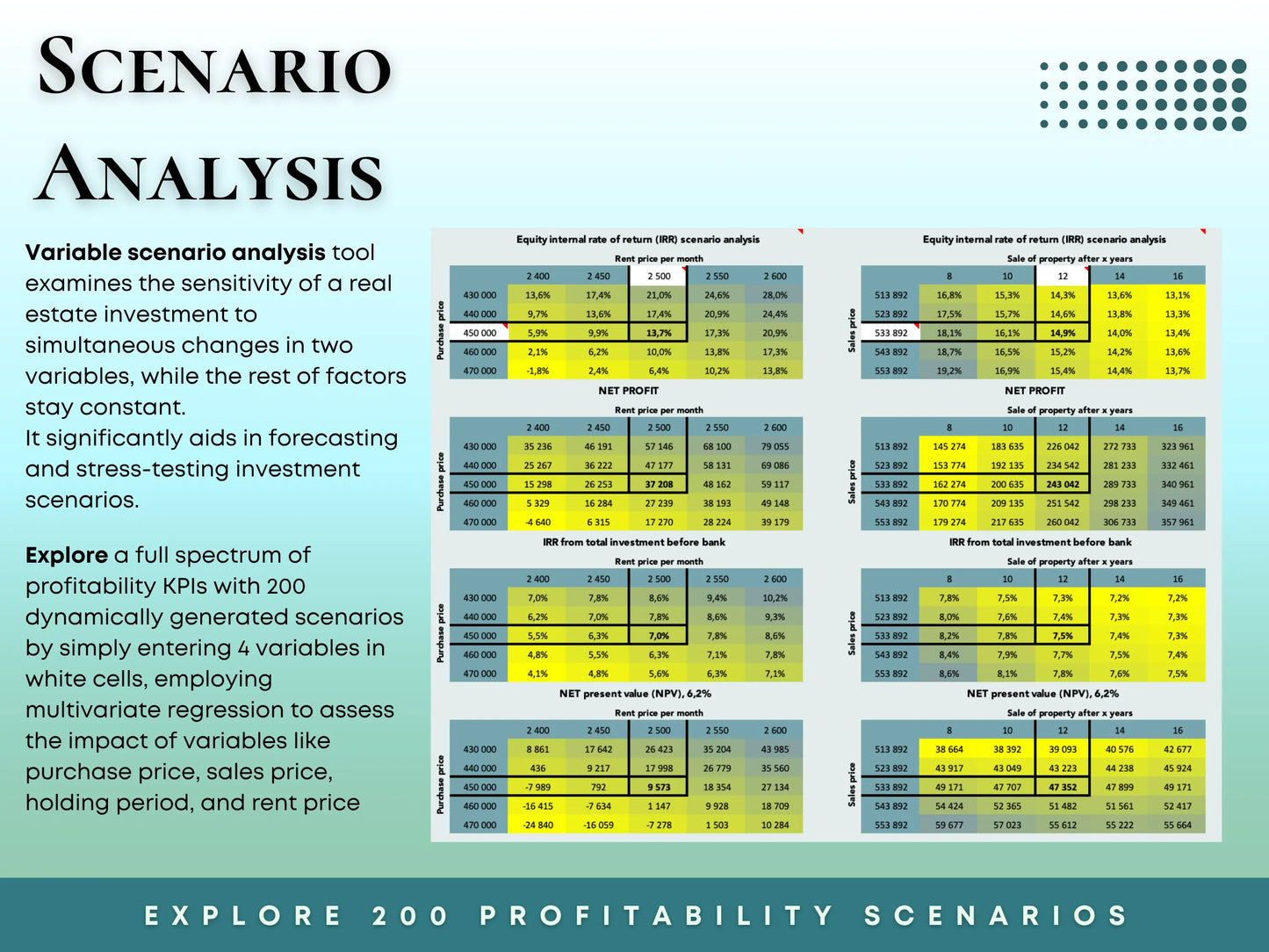

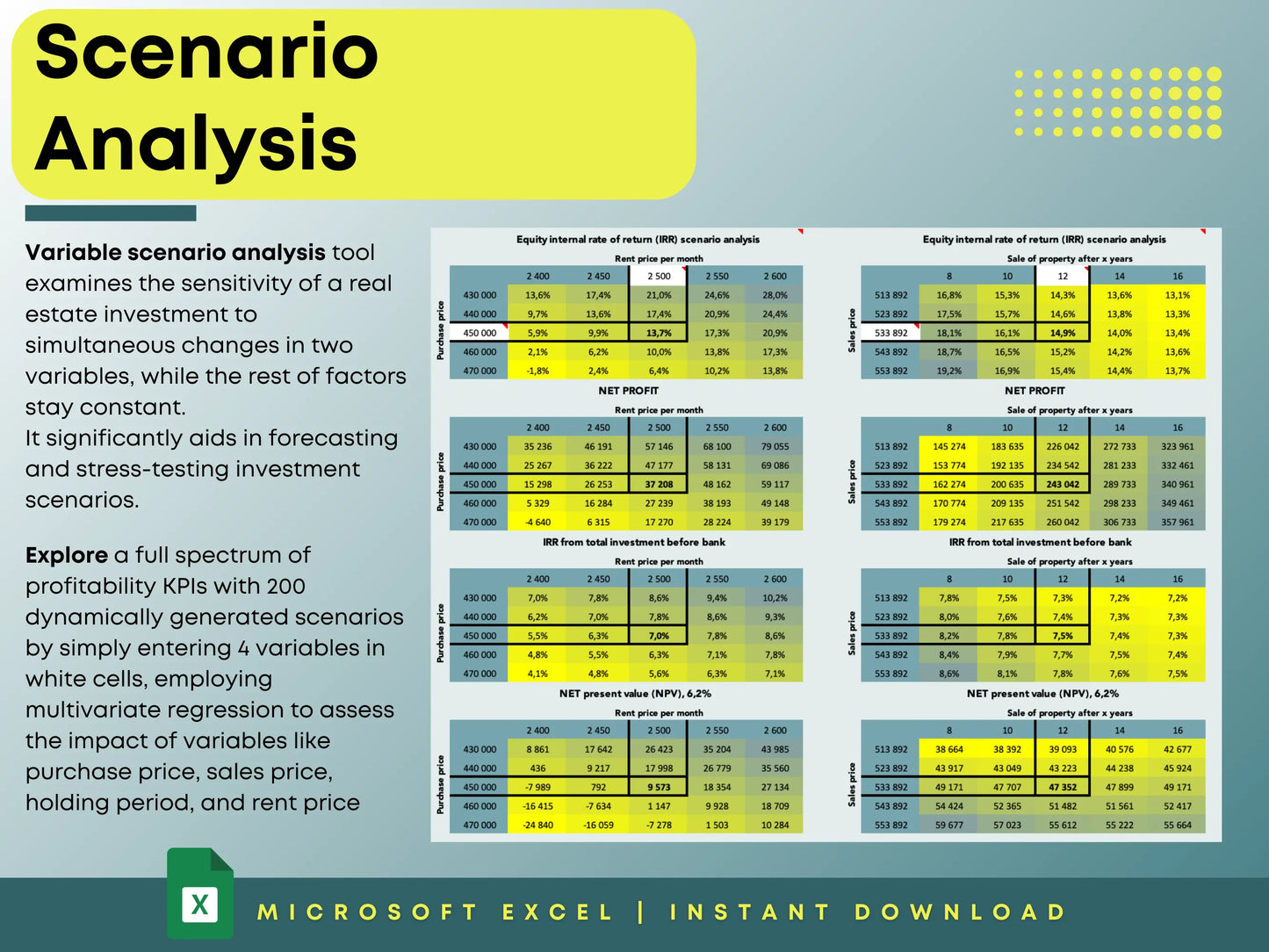

Run Sensitivity Analysis

Market assumptions rarely hold perfectly. Test “what-if” scenarios:

- What if rental income grows slower than expected?

- What if interest rates rise during the holding period?

- What if exit cap rates increase?

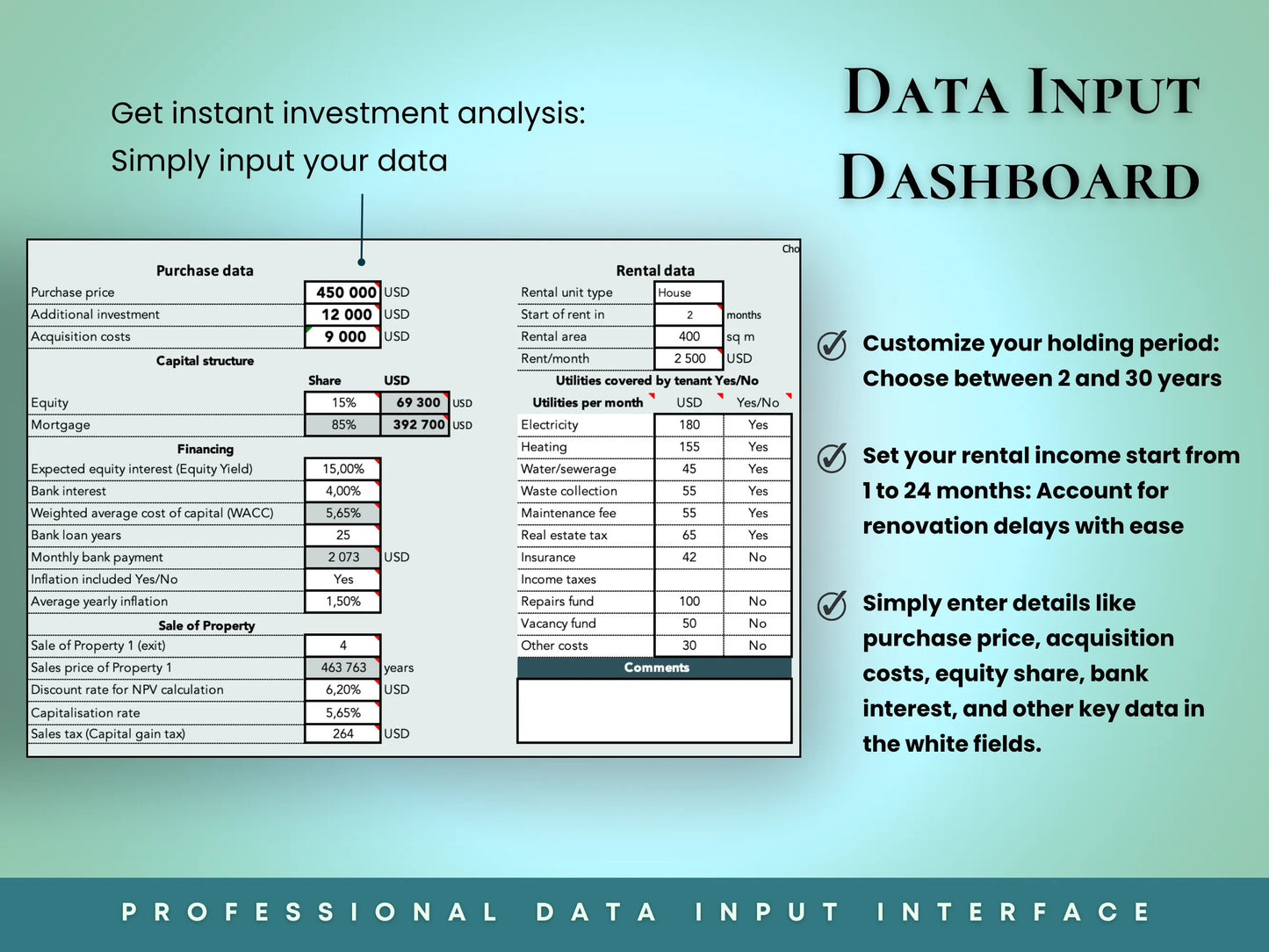

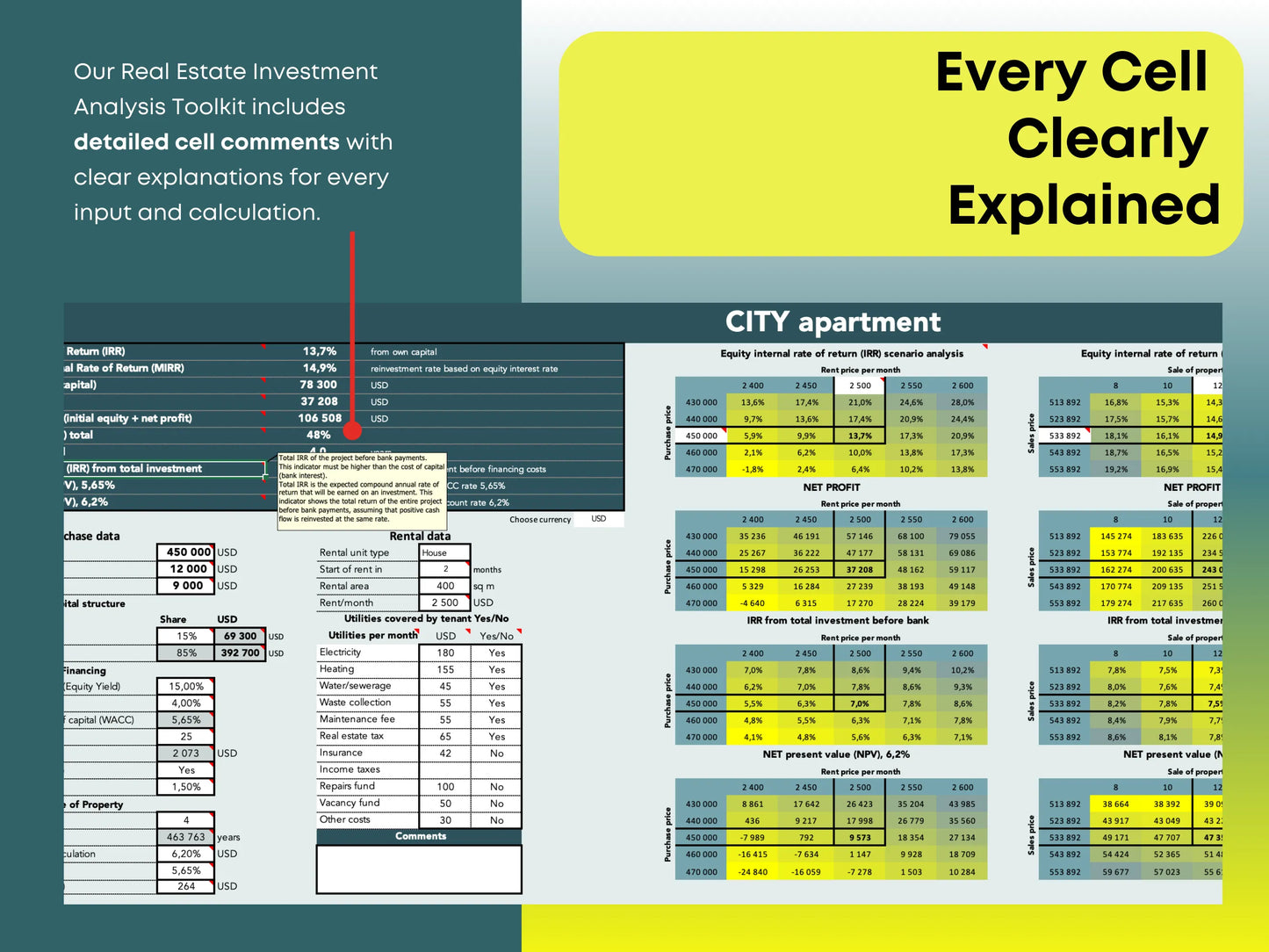

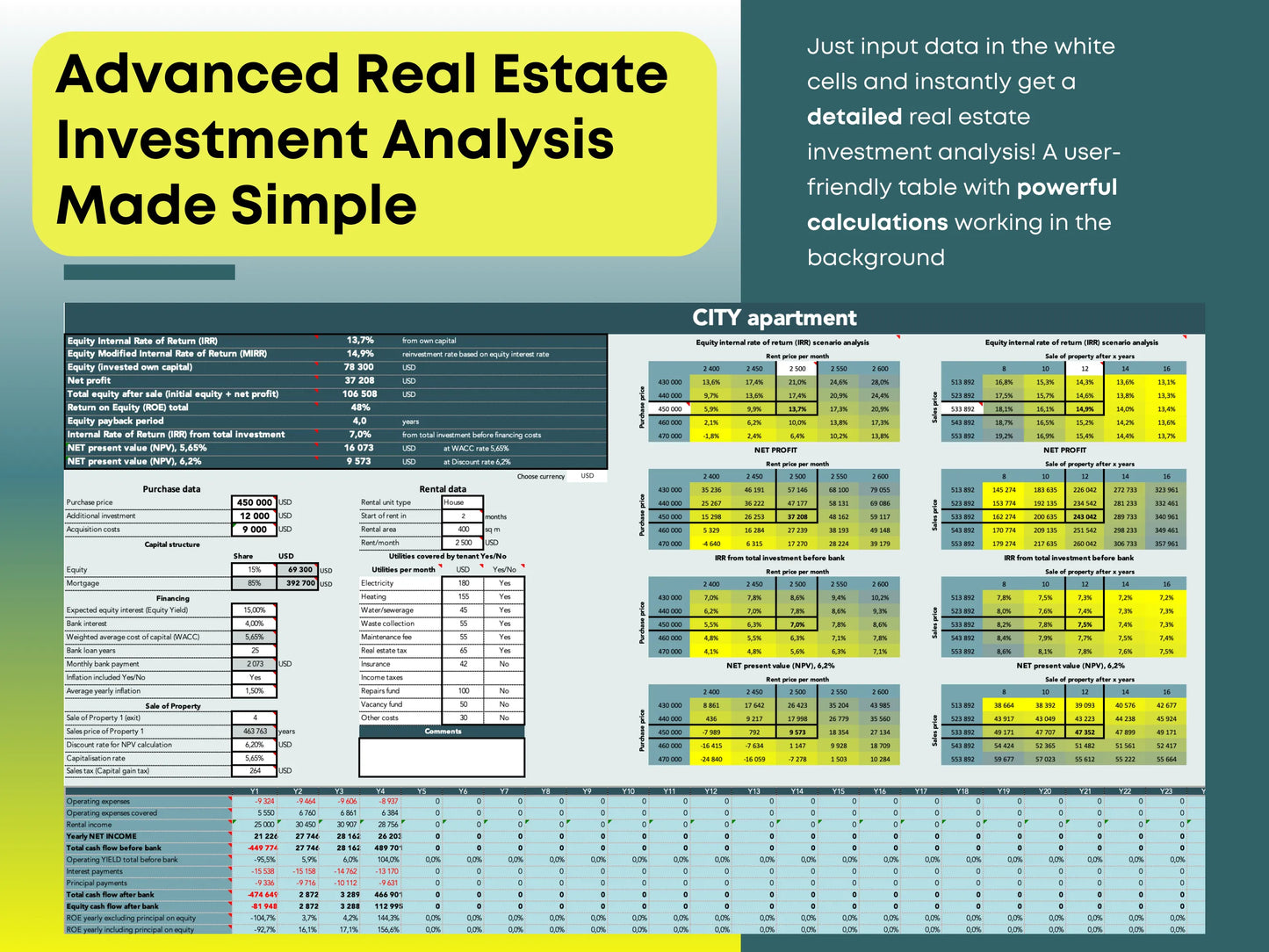

This process, known as sensitivity analysis, helps you understand potential risks and prepare for volatility. (Tip: Our Excel real estate tools include built-in sensitivity analysis for rental income, appreciation, interest rates, and exit values.)

Plan Exit Strategies

The holding period—5, 7, or 10 years—can dramatically change returns. NPV shows whether projected cash flows over your chosen period meet your return targets.

Assess Financing Impact

By modeling debt service, interest rates, and repayment schedules, you can see how leverage affects your discounted cash flow. This allows you to make informed decisions on loan structure and equity allocation.

Common Mistakes Investors Make with NPV

-

Using the Wrong Discount Rate

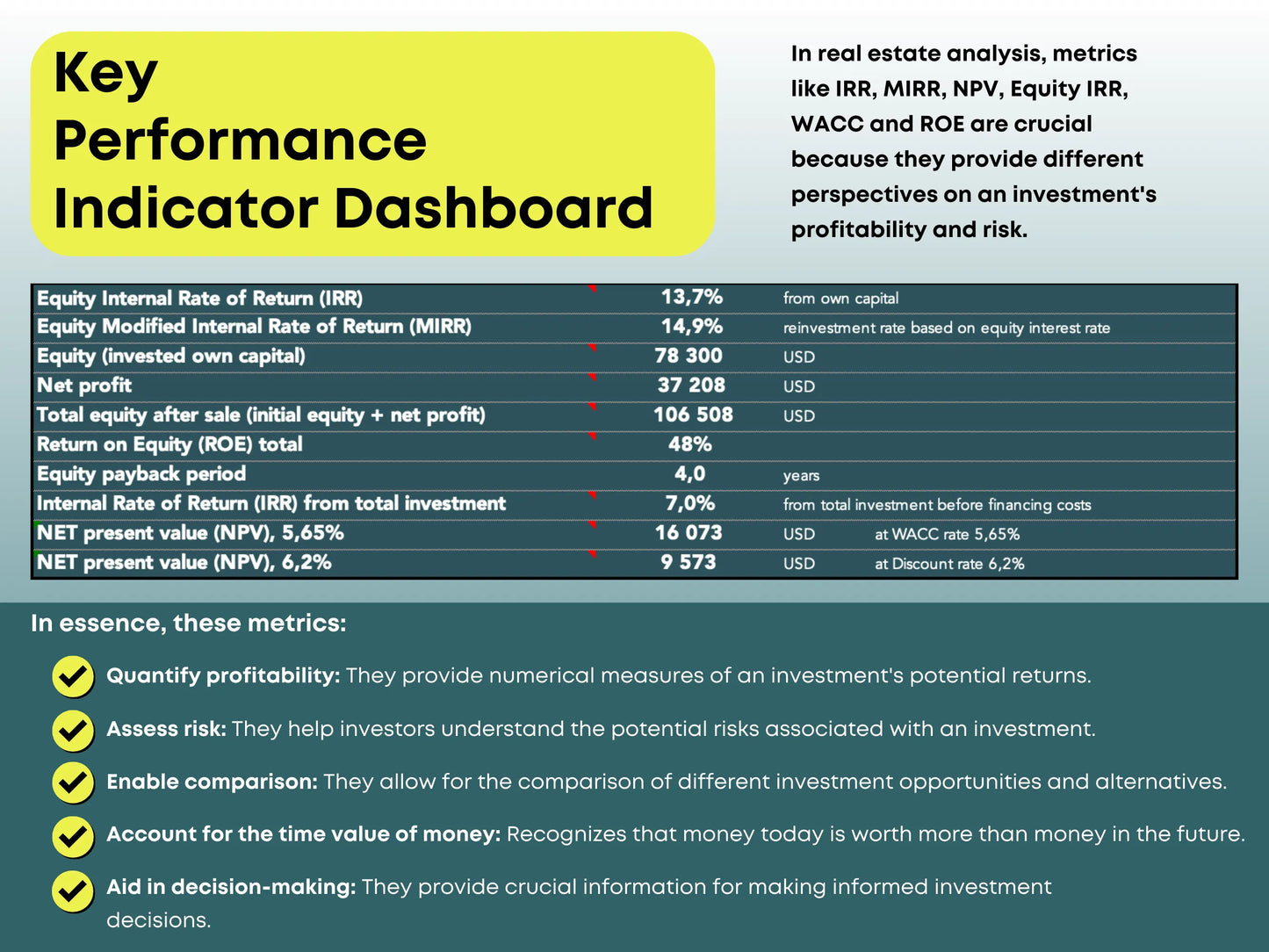

Always use your weighted average cost of capital (WACC) or target Internal Rate of Return (IRR). An incorrect rate can produce misleading results. -

Ignoring Sale Proceeds

The property exit often accounts for a large portion of total value. Leaving it out underestimates NPV. -

Using Gross Instead of Net Income

Always calculate based on net cash inflows after expenses, vacancies, and debt service. -

Not Updating Assumptions

Market conditions change. Update your projections regularly to ensure NPV remains relevant. -

Ignoring Taxes and Inflation

Failing to account for property taxes, income taxes, or inflation can distort results and lead to poor investment choices.

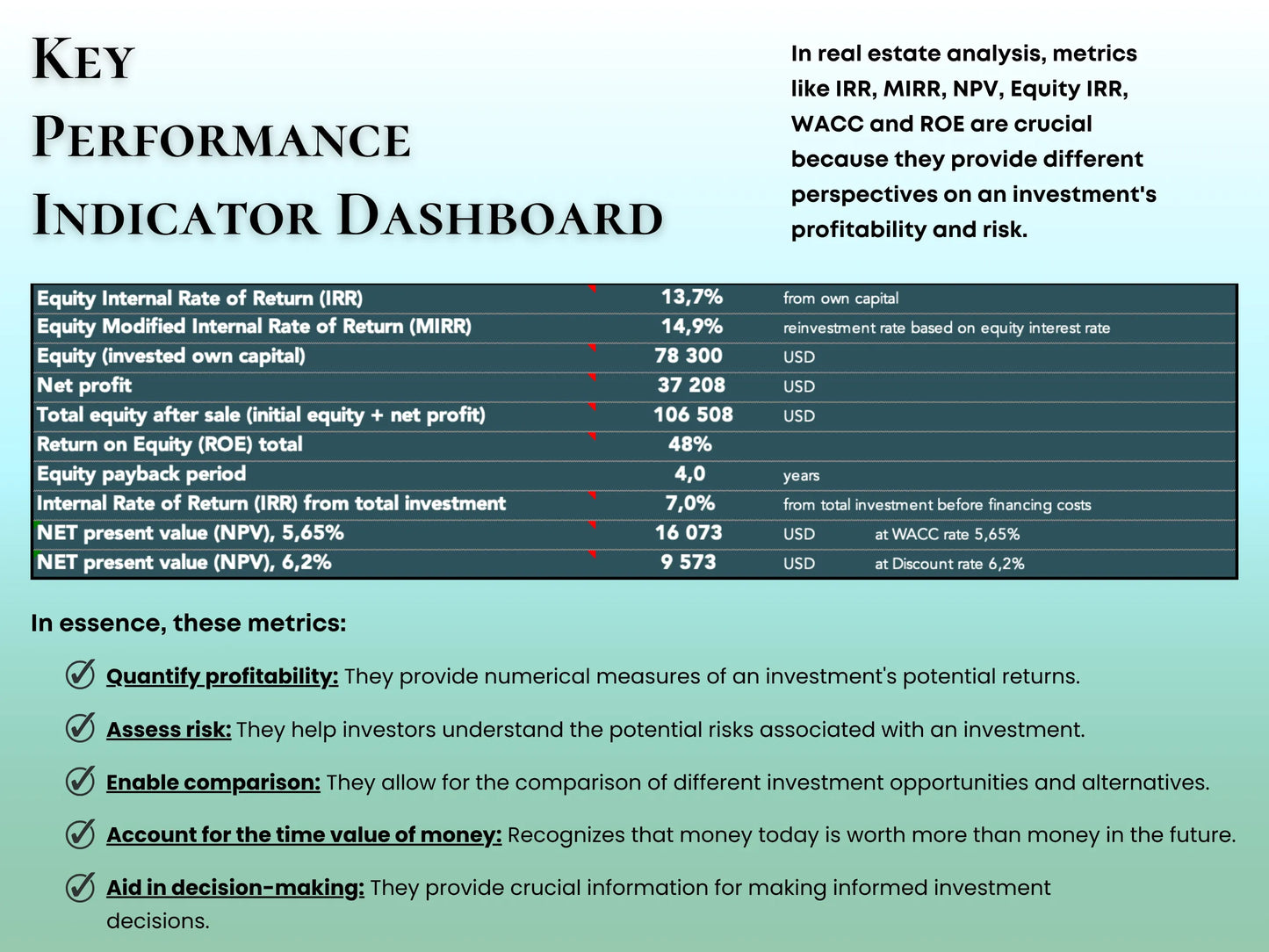

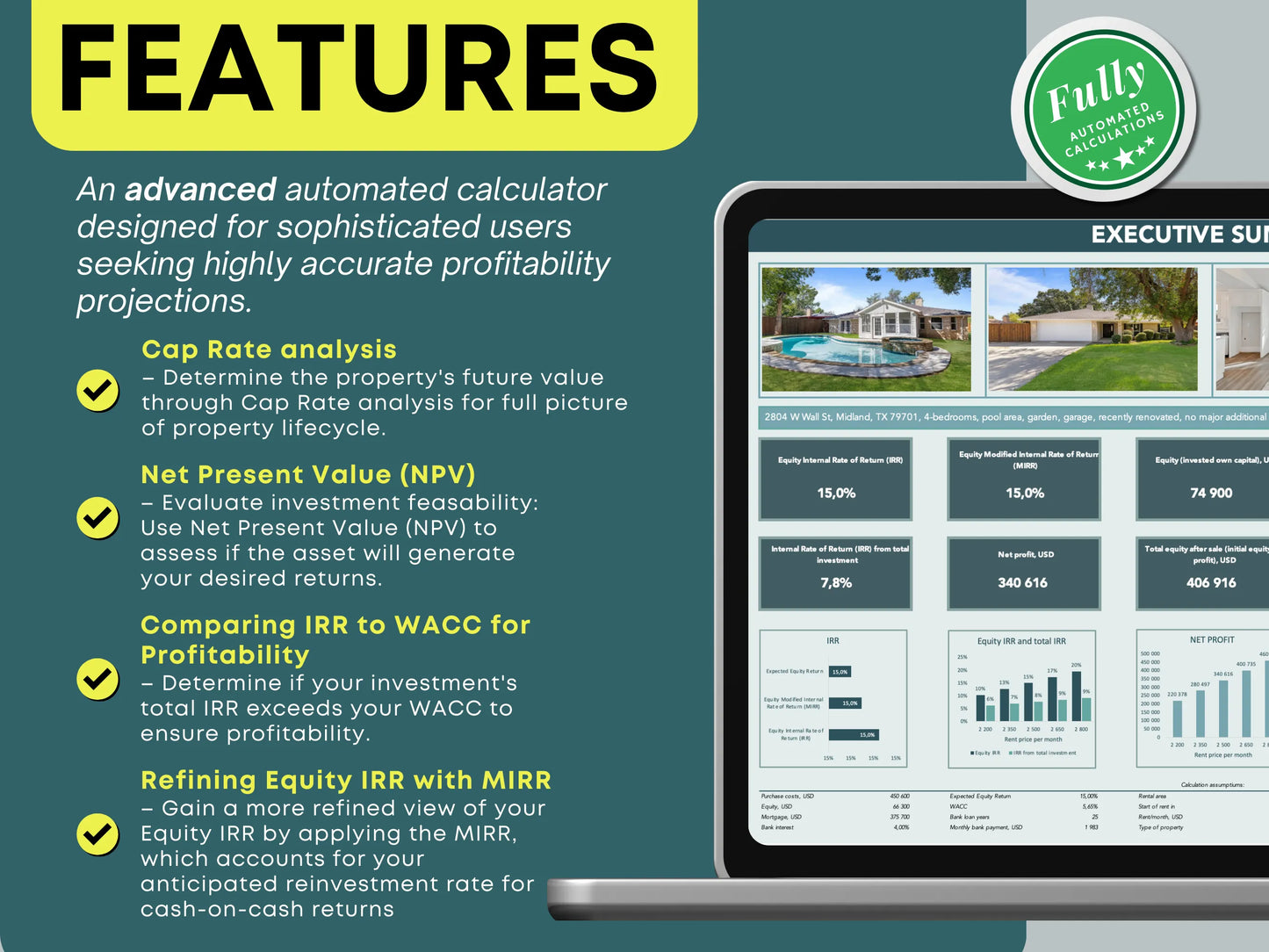

NPV vs IRR vs ROI

- ROI (Return on Investment): Shows return as a percentage of cost but ignores the time value of money.

- IRR (Internal Rate of Return): The discount rate at which NPV equals zero; indicates expected annualized return.

- NPV: Shows the actual dollar value created in today’s terms, accounting for timing of cash flows.

Smart investors use all three metrics together for a complete property evaluation.

Practical Example of Real Estate NPV

Imagine you buy a rental property with:

- $50,000 annual net cash inflows

- $300,000 sale proceeds after 10 years

- 8% discount rate

If your discounted series of cash flows totals $400,000 and your initial investment is $350,000:

- NPV = $50,000 → The deal creates $50,000 in value above your target return.

If instead, NPV is –$20,000:

- The property destroys value even if cash flow appears positive.

This example shows how NPV provides a clearer picture of investment profitability than simple cash-on-cash return or cap rate alone.

Advanced Tips for Real Estate Investors

- Model Multiple Scenarios – best case, worst case, and base case.

- Update Market Assumptions – vacancy rates, rent growth, maintenance costs.

- Include Sensitivity Analysis – see how small changes affect NPV.

- Factor in Leverage – simulate different financing options.

- Combine with Other Metrics – use ROI, IRR, and cap rate for a full perspective.

Final Thoughts: Why NPV Should Be Part of Every Investor’s Toolbox

Net Present Value (NPV) is one of the most powerful tools for real estate investors. It allows you to:

- Compare investment opportunities with accuracy

- Adjust for cash inflows and outflows over time

- Evaluate the impact of financing and interest rates

- Protect your capital and equity

By combining NPV, IRR, ROI, and discounted cash flow modeling, investors can make smarter, data-driven decisions.

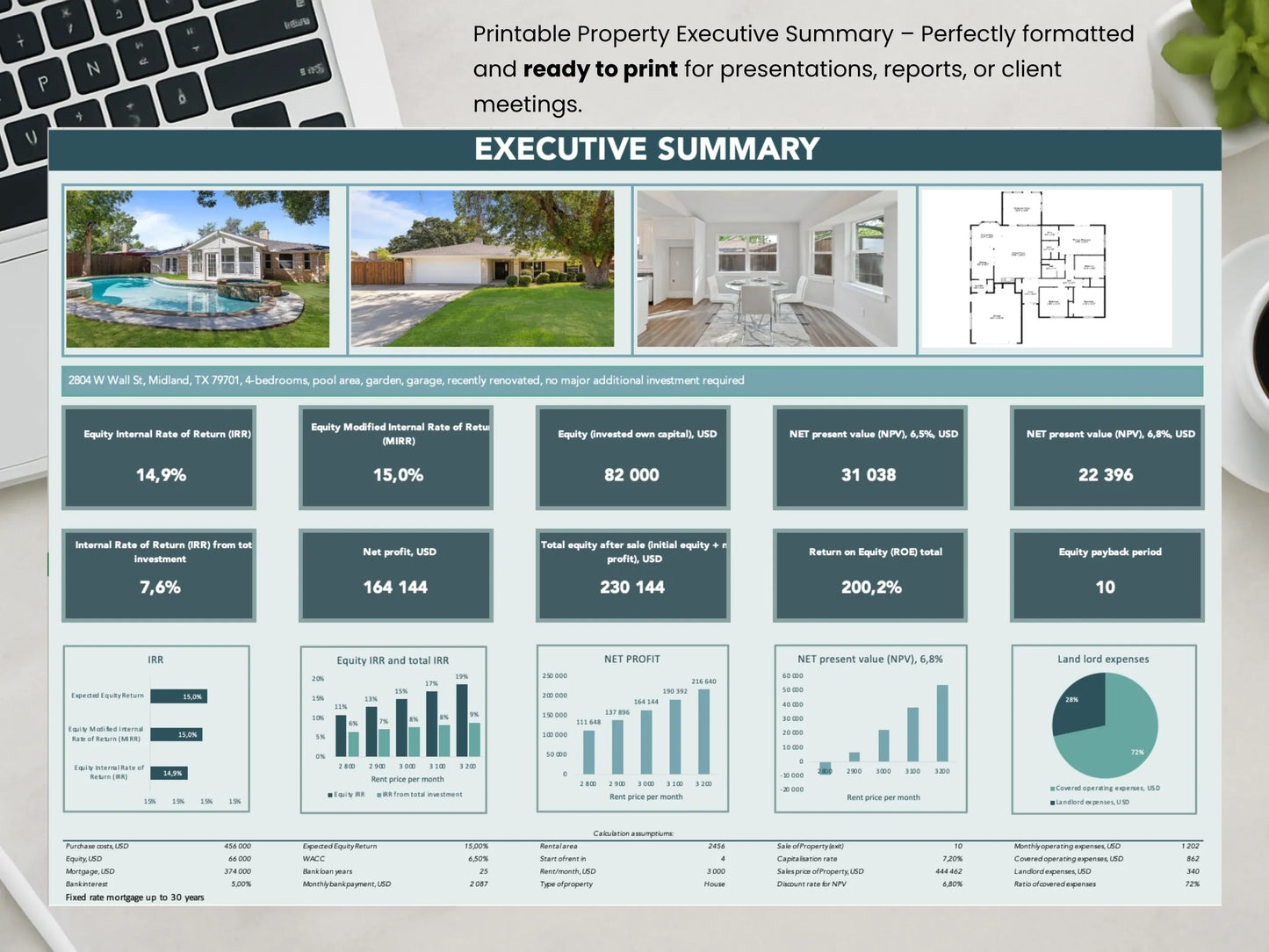

👉 Tip: Our Real Estate Investment Tools in Excel include ready-made models for NPV, IRR, ROI, sensitivity analysis, and scenario planning—helping you evaluate deals with professional-grade accuracy.